And the wild ride continues.

And the wild ride continues.

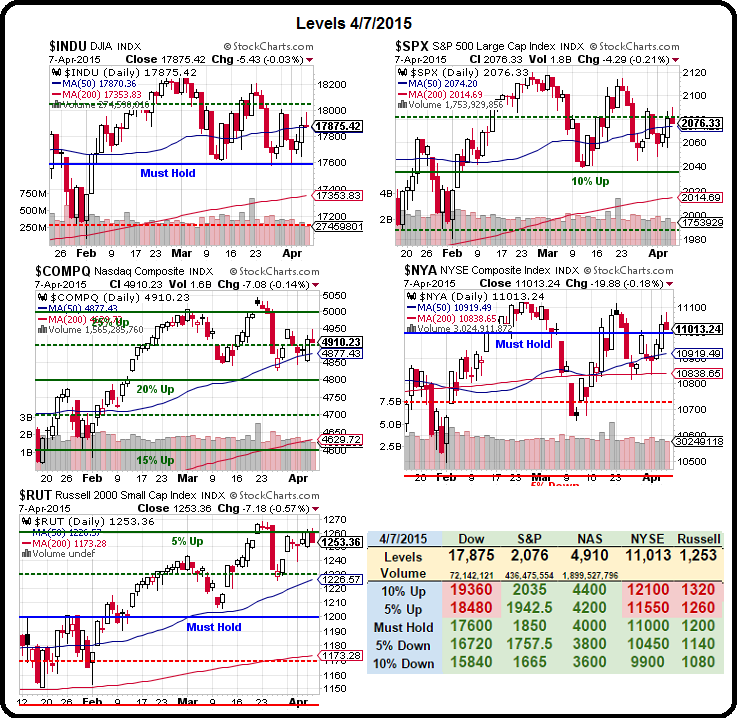

As you can see from our Big Chart, we're testing the 50-Day Moving Averages on the Dow (17,870), S&P (2,074) and Nasdaq (4,877) while, as usual, the Russell and NYSE are leading us higher. The NYSE has finally popped back over it's Must Hold line at 11,000 and that MUST HOLD for us to get bullish but we already added a bank play in yesterday's Live Member Chat Room (also sent out as a Top Trade Alert) as we have plenty of sidelined cash to deploy.

We're certainly not ready to throw in the towel on our bearish bets yet (and you can still pick up those TZA plays super-cheap from Thursday's post if you want some great hedges) – all the problems we've been discussing are still out there but we have certainly learned that you can't fight the Fed(s) and the Feds are not done pushing us higher – not by a long-shot.

Yesterday morning, we got a goose from Minneapolis Fed President Kocherlakota who said: "In light of the outlook for unduly low employment and unduly low inflation, the [Fed] can be both late and slow in reducing the level of monetary accommodation," which was enough to push the markets higher but, as you can see from Dave Fry's SPY chart – the rest of the day was all downhill from there.

Yesterday morning, we got a goose from Minneapolis Fed President Kocherlakota who said: "In light of the outlook for unduly low employment and unduly low inflation, the [Fed] can be both late and slow in reducing the level of monetary accommodation," which was enough to push the markets higher but, as you can see from Dave Fry's SPY chart – the rest of the day was all downhill from there.

And that was despite the fact that Kocherlakota also said: "There is even a theoretical argument to be made for making asset purchases now if the economy faltered.” That would be, if you are keeping track, QE4 – or QE Infinity + 1, since the last program still hasn't even begun to unwind and continues to pump $80Bn a month into the US economy as the Fed rolls over their $4.5Bn balance sheet.

We certainly need SOMETHING to goose this economy as Revolving Consumer Credit (charge cards) fell $3.7Bn for the 4th drop in 5 months while Auto Loans (mostly sub-prime) and Student Loans (see Monday's rant) move up to record levels.

We certainly need SOMETHING to goose this economy as Revolving Consumer Credit (charge cards) fell $3.7Bn for the 4th drop in 5 months while Auto Loans (mostly sub-prime) and Student Loans (see Monday's rant) move up to record levels.

So consumers are going deeper and deeper into long-term debt while continuing to cut back on day-to-day spending – that's NOT good for the economy. It's certainly not good for Retail but don't tell that to XRT, which is still over $100 as we head into earnings (and we're short).

In fact, the XRT May $100 puts at $1.69 are a fun way to play the possibility of disappointing retail earnings reports for the next week or two.

Another fun short position that hasn't worked yet is FXI, the ETF for China, which has popped 10% in two weeks and will be up another 5% today as the Hang Seng popped 961 points overnight. As noted by Bloomberg, this morning, the dot-com bubble was NOTHING compared to China's prices today as the AVERAGE valuation in their $6.9Tn market is 220 time earnings. Compare that to 156 times earnings before the Nasdaq bubble popped.

“Chinese technology stocks do resemble the dot-com bubble,” Vincent Chan, the Hong Kong-based head of China research at Credit Suisse Group AG, Switzerland’s second-biggest bank, said in an interview on April 2. “Given stocks fell 50 to 70 percent when that bubble burst in 2000, these small-cap Chinese shares may face big corrections when this one deflates.”

The use of margin debt to trade mainland shares has climbed to all-time highs, while investors are opening stock accounts at a record pace. More than two-thirds of new investors have never attended or graduated from high school, according to a survey by China’s Southwestern University of Finance and Economics.

“Many of these technology companies have bubble-type valuations as speculators take advantage of popular concepts to ramp up shares,” said Haitong’s Chen, a strategist in Shanghai. “Only a very small group, say 5 percent or 10 percent, will make it to become larger companies.”

“Many of these technology companies have bubble-type valuations as speculators take advantage of popular concepts to ramp up shares,” said Haitong’s Chen, a strategist in Shanghai. “Only a very small group, say 5 percent or 10 percent, will make it to become larger companies.”

I'm not all gung-ho to short the markets. You can't fight the Fed(s). However, I do feel a lot more comfortable staying in CASH!!! into earnings season, so we can get an idea of who is really making money in all these cross-currents.

Shorting is very dangerous indeed when companies like RDS.A have $70Bn to throw at BG Group (today's M&A deal). That's as much money as a major Central Bank throws around (it's the monthly amount that the US Fed, the BOJ, the PBOC and the ECB EACH put into the Global Economy to keep things looking good). A deal like that will goose the whole sector and keep us strong for one more day!

Where will tomorrow's $70Bn come from?