4,016!

4,016!

That's what the Shanghai blasted up to at the open, though we pulled back to 3,957 by the close as some people decided that a 100% run in 6 months called for a little profit-taking. Don't worry, it's all part of the "new normal" for equities and nothing bad can possibly happen – it's just that, 6 months ago, traders didn't know value when they saw it but NOW we are much smarter and these prices are here to stay, right? According to UBS:

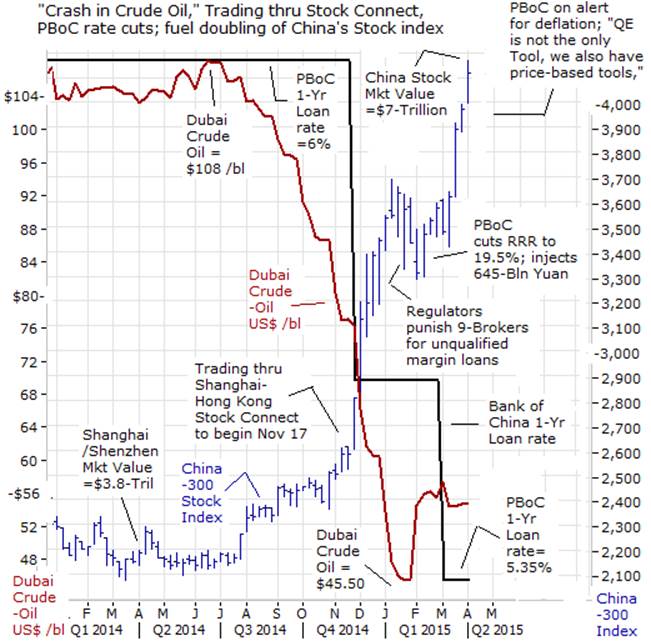

With no significant change in China's macro or corporate fundamentals, the visible rebound in China's A-share market since November appears to have been largely liquidity driven. We think this, in turn, may have been fuelled by a number of factors including:

- New funds flowing into the stock market from household saving, real estate, commodities and trust markets;

- Banks' bridge loans provided to investors who lost access to other high-yield shadow banking products as the result of tighter regulation;

- The PBC's easing of liquidity conditions via a variety of "targeted easing" tools (e.g. MSL, PSL, etc.);

- The official launch of Mutual Market Access (MMA) between the Hong Kong and Shanghai exchanges;

- Long-term expectations for SOE reform and A-shares entering the MSCI index next June;

- Increased use of leverage by retail investors via margin trading; and

- Market sentiment being boosted by expectations for further policy easing.

This has been a "New Deal" for Chinese stocks as the Government attempts to paper over a slowing economy by giving the people record market highs to "prove" how well things are going. Now, BNP is out with a note calling China’s equity bubble “a microcosm for the overall economy: unsustainable growth in leverage masking ever-deteriorating fundamentals and increasing future downside risks.”

This has been a "New Deal" for Chinese stocks as the Government attempts to paper over a slowing economy by giving the people record market highs to "prove" how well things are going. Now, BNP is out with a note calling China’s equity bubble “a microcosm for the overall economy: unsustainable growth in leverage masking ever-deteriorating fundamentals and increasing future downside risks.”

We mentioned shorting FXI (China ETF) in yesterday's post but we couldn't give a specific option play because we were waiting for that 4,000 mark in Shanghai. It turns out $50 is the magic number on FXI and we like that line for a short and we like the May $48 puts at $1 this morning – enough to go with 40 of them in our Short-Term Portfolio for $4,000. Chinese companies have earnings too – we'll see if they can live up to the hype over the next 45 days.

We're also going to be adjusting our hedges in the STP to take advantage of the recent rally. Either we fail here on earnngs and the STP makes a fortune or the market breaks higher and we quickly deploy our sidelined cash from our Long-Term Portfolio. At the moment, we're strongly leaning bearish into earnings.

We're also going to be adjusting our hedges in the STP to take advantage of the recent rally. Either we fail here on earnngs and the STP makes a fortune or the market breaks higher and we quickly deploy our sidelined cash from our Long-Term Portfolio. At the moment, we're strongly leaning bearish into earnings.

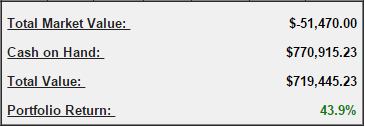

As you can see from our LTP balance, we're up $16,000 on our remaining positions over the past 10 days (see 3/30 cash out post) as we kept our losing materials positions on the premise that, if we were, in fact, missing a rally – that materials would eventually pick up. Oil has had a wild ride this week and now well off the Tuesday highs but, on the whole, $16,000 is a fantastic gain considering how small our invested position is (93% cash).

Our STP, meanwhile, has lost $8,000 (now $191,735) as it's aggressively bearish and we're not (so far) getting the drop we expected. Still, the idea of our paired portfolios is to be well-balanced and clearly at net +$8,000 in 10 days, we're on the right track. That's why we're willing and able to invest a bit more on the short side today (and free readers can still refer to last week's TZA picks for some of our great hedging ideas).

Our STP, meanwhile, has lost $8,000 (now $191,735) as it's aggressively bearish and we're not (so far) getting the drop we expected. Still, the idea of our paired portfolios is to be well-balanced and clearly at net +$8,000 in 10 days, we're on the right track. That's why we're willing and able to invest a bit more on the short side today (and free readers can still refer to last week's TZA picks for some of our great hedging ideas).

We're very worried about earnings this quarter and AA managed to beat last night but ONLY because they DOUBLDED their GAAP EPS with 0.14 in non-GAAP proforma addbacks. This is the kind of finanacial engineering we discussed in yesterday's post and now we're seeing it in action on the very first Dow component to report this quarter.

In other words, one half of Alcoa's "EPS" in the quarter was due to what management thought was another quarter of recurring "non-recurring", non-one time "one-time" charges. This has been going on consistently for the past 12 months as AA has added $740M to their GAAP earnings as they restructure.

In other words, one half of Alcoa's "EPS" in the quarter was due to what management thought was another quarter of recurring "non-recurring", non-one time "one-time" charges. This has been going on consistently for the past 12 months as AA has added $740M to their GAAP earnings as they restructure.

I'm sorry folks but I simply can't get bullish on the markets when we have TRILLIONS of Dollars of stimulus pouring in, Negative Interest Rates, Record Stock Buybacks AND Financial Shenanigans and ALL we manage to do is get back to our all-time highs. What happens if we stop firing on all cylinders? What happens if all these tricks stop working and we have to focus on the actual returns on investments our market Dollars are generating.

CASH!!! is what I like. We can invest any time. 9,000 companies are about to give us some very important data that can guide our investing for the rest of 2015 so why try to guess where to put our money when we'll be sure in a few weeks?

Let's be careful out there!