Another day, another $50Bn.

That's how much of their own stock GE will be buying back (20% of the company) after selling most of their GE Capital Assets to Blackston (BX) and others. Keep in mind $50Bn is about what the big Central Banksters pour into the markets in a whole month and GE is now the 2nd public company to match them this week (RDS.A dropped $70Bn on the markets on Tuesday).

Though the markets are taking it as a positive (GE must be undervalued, right?), I take it as a sign that GE is worried about Commercial Real Estate again and they are cashing out while they can and, since there is nothing worth buying with $35Bn and since money is cheap, they are using the cash to fund a massive buyback to reduce the number of shares their shrinking earnings are divided by in order for the board of directors to keep their phony-baloney jobs.

After all, you don't need to pay out tens of Millions in salaries, bonuses, stock options, etc. to have Immelt and his Board preside over a liquidation sale – do you? That's why it can't LOOK like a liquidation sale – it needs to look like restructuring for the 21st Century or some such nonsense you can expect to read about in the annual report.

After all, you don't need to pay out tens of Millions in salaries, bonuses, stock options, etc. to have Immelt and his Board preside over a liquidation sale – do you? That's why it can't LOOK like a liquidation sale – it needs to look like restructuring for the 21st Century or some such nonsense you can expect to read about in the annual report.

Don't get me wrong, I love GE. We were buying it hand over fist when it was under $10 back in the crisis but, at $25+, we liquidated our positions because we (like GE, apparently) couldn't see how they could generate good returns off the current conglomerate mix they cem into 2014 with. So a radical restructuring is a good idea if they ever want to see $50 again but this isn't a restructuring, this is a retreat.

Selling $35Bn worth of assets it took decades to accumulate and borrowing another $15Bn to buy back your own stock is NOT about building for the Future – it's about propping up the present!

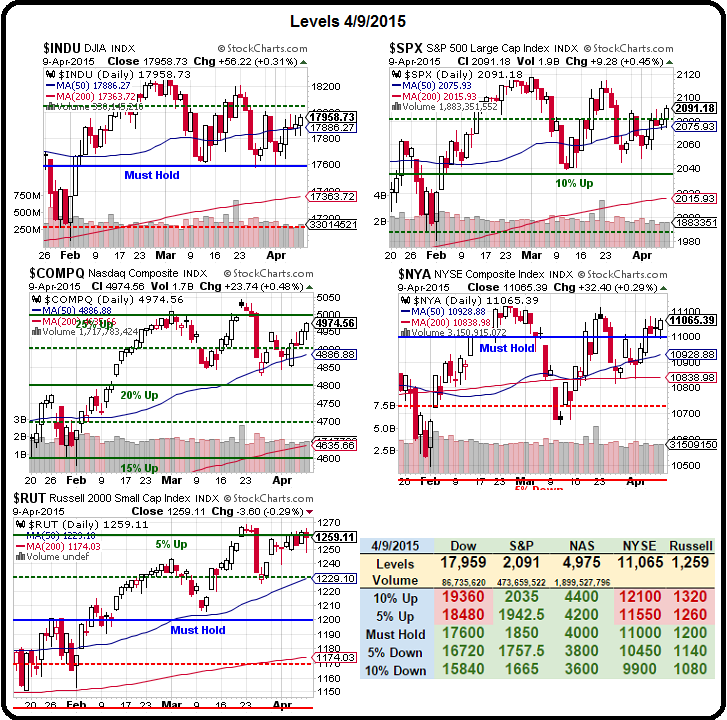

We already took adavantage of the early excitement to short the /ES (S&P) futures at 2,090 in our Live Member Chat Room. We expect a sell-off into the uncertain weekend and the strong Dollar (99.97) also argues for a pullback in our equities. Yesterday we had another $1,000 per contract winner on Gasoline Futures (/RB) – simply going long off the same $1.75 line we had identified for you last week.

We already took adavantage of the early excitement to short the /ES (S&P) futures at 2,090 in our Live Member Chat Room. We expect a sell-off into the uncertain weekend and the strong Dollar (99.97) also argues for a pullback in our equities. Yesterday we had another $1,000 per contract winner on Gasoline Futures (/RB) – simply going long off the same $1.75 line we had identified for you last week.

The Futures are a nice trading tool to help build our cash piles while we're waiting on the sidelines for re-entry points on equities. We have already picked up a few positions this week but we're still 90% in CASH!!! in our Long-Term and Short-Term Portfolios, waiting to see what earnings look like for Q1. With Futures trades, we can take advantage of the day-to-day nonsense and be back to cash by the day's end – it really helps us sleep very well each night! ![]()

We also shorted /NKD (Nikkei Futures) at the 20,000 line yesterday (and again this morning) and caught a 100-point drop that was good for $500 per contract overnight. We'll be thrilled to get another $500 today – enough to pay for a nice dinner this weekend. 1,260 will be the line to watch on the Russell today, which closed yesterday at 1,259. On the bull side, we'll be looking for 5,000 to be taken back on the Nasdaq – just 25 points away from yesterday's close (0.5%).

Another fun futures play into the weekend is oil at $50.50 as a bullish bet that the Dollar gets rejected at 100, which is below $1.06 on the Euro and $1.46 on the Pound and 120.50 on the Yen. It won't take much of a comment by someone or much an explosion somewhere to reverse those pairs so it's a fun gamble (or you can use the UCO trade ideas we've featured previously).

Next week earnings begin in earnest and we'll have our special earnings trade ideas as well as our usual nonsense for you.

Have a great weekend,

– Phil