Market Vectors Junior Gold Miners ETF (GDXJ) is just breaking out. It's currently trading at $25.71.

Chart/bullish idea from Chris Kimble. Option trade idea by Phil Davis.

.png)

Chart by Chris Kimble

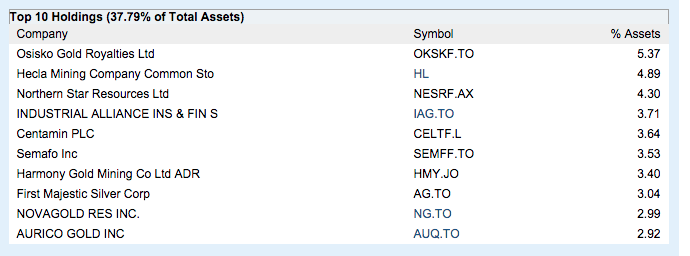

Phil writes: Of course I have an option trade! GDXJ are the Junior Gold Miners ETF and boy are there a lot of dogs in that pile!

Anyway, over 5 years, there's not much divergence between GDX and GDXJ and both are beaten up enough that I think they are worth a flyer.

GDXJ is down at $25.77 and if we assume it pops up here and strenghens into the summer, then Aug is a good target and we can pick up the Aug $23s for $4, selling the $27s for $2 for net cost of $2 on the $4 spread — that's $2.77 in the money to start. I wouldn't want to be in GDXJ if this trade goes wrong but I would want to own ABX, so I'd sell the Jan $12 puts for $1.05 to knock the net cost of the trade down to $0.95 on the $4 spread.

ABX is currently at $13 and the trade would put you in ABX at net $12.95 so let's say you REALLY wanted to own 1,000 shares of ABX for $12,950. You could then buy 10 of the spreads for net $950 (including the sold puts) and, if all goes well (i.e. GDXJ is over $27 at Aug expirations), you get back $4,000 for a $3,050 profit (320% on cash).