Courtesy of Jean-Luc Saillard

Back in December, I wrote a post on my blog where I compared the performances of various ETFs related to the oil industry. I was looking for the best possible proxy to match the moves of oil prices if you didn’t want to play with futures. At the time, I concluded that for medium term trades, USO and the leveraged ETFs UCO and SCO were the most promising. Longer term, broader ETFs like OIH and XLE might make better investment if oil prices do recover to more profitable prices since ETF linked to futures like USO, UCO and SCO do suffer from decay. It also seemed that DIG and DUG could be promising if OIH could recover as it should with the price of oil, but that they don’t make a good proxy for the price of oil itself.

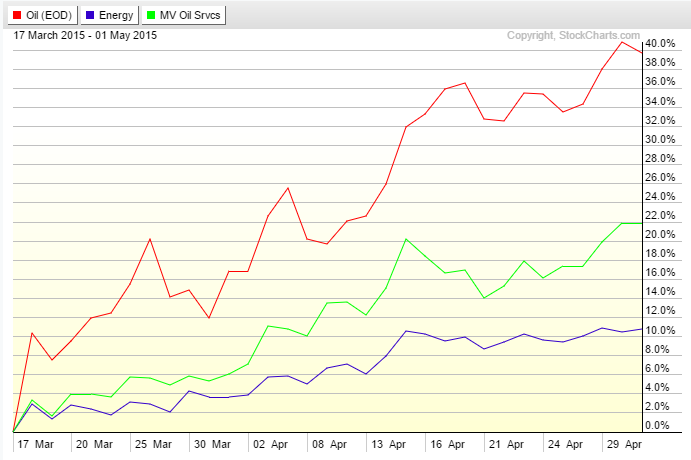

Since then, oil has hit a multi-year low at around $42.50 and is now approaching $60, still well below its highs of 2014 but probably closer to a breakeven price for American shale producers. In this post I want to see what ETF would have profited best from that rebound and also which one would have fared worse. Let’s look at a couple of performance charts. First, the standard oil proxies based on the futures:

.png)

Oil (red) is up 40% since March 17 but what is interesting is how the pure oil ETFs are tracking that move. USO (blue) which is not leveraged is not tracking very well. In fact, it’s up only about 27% or about 2/3 of the oil move. As expected, SCO (pink) is down, but clearly, the leveraging is not the 2x that you would expect as it’s only down a bit less than 40%. And UCO (green), while the clear winner here, is only up 57% which is lower than the advertised 2x leverage factor. Once again, these future based ETF are victims of some decay.

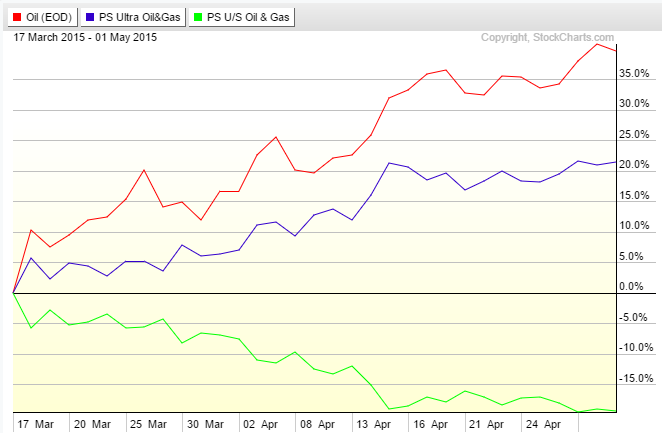

Let’s look at some ETFs not based on oil futures but who should benefit from an oil price rebound. In the next performance chart, we’ll look at OIH and XLE.

It’s not surprising that there should be a lag between the time oil prices start rising and the impact it will have in companies whose main business revolve around trading or exploring for oil. In addition, many of the components in XLE (blue) are conglomerates who benefit from lower oil prices for some of their components so might be not as impacted by higher oil prices. OIH (green) is actually pretty promising. Its performance almost matches the returns of USO with the added security of dealing with real businesses rather than a simple commodity. We have already seen that some consolidation is taking place in that sector which means that in my opinion companies might be able to absorb future price dips better or will benefit more from an increase in oil prices.

How about the leveraged ETF constructed around the oil industry – DIG and DUG. How did they fare:

Disapointigly, actually! They work quite well as a leveraged version of XLE which is not surprising since 2 of their biggest components are XOM and CVX! As expected, the short ETF (DUG) is down about 20% which matches the 2x leverage factor of XLE. And DIG is up a bit over 20% which doubles the return of XLE. So as a proxy to the energy industry, these 2 ETFs work quite well, but OIH produces the same returns with the drawback of the leveraged ETFs.

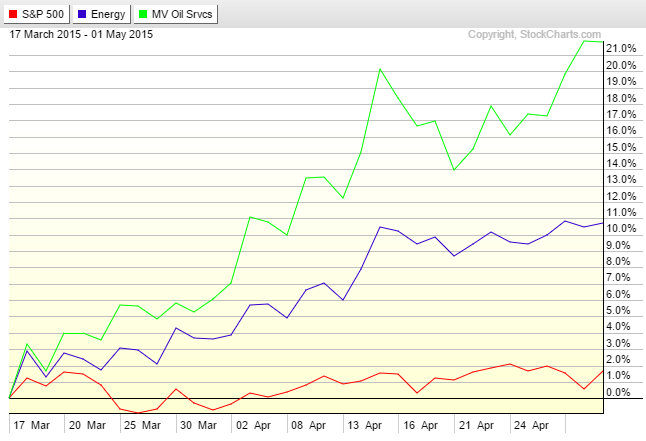

To be fair, we should compare the performance of the equity based ETF against the broader market as a rising tide lifts all boats and these 2 ETFs could benefit from a bullish environment.

Here we see that with a flat market, these 2 equity based ETFs have outperformed by a wide margin. There is no rising tide explanation, it’s all down to the price of the underlying commodity.

My conclusions from the earlier post are still valid. If you want to play a short to medium term move in oil prices, the leveraged commodity based ETFs like UCO and SCO might be your best bet. If you want to play a longer term oil price recovery, OIH in view of the current consolidation might make a more solid bet. It might not get you the quick 50% gain, but it might not also be plagued by violent moves on both sides and is not subject to the decay that is observed in the leveraged ETFs.

Overall, you still need to pay attention to the price of oil. It’s still possible that we might see further dips as the current price might be supportive of oil production in the US which is counter to what the Saudis were trying to achieve. Can they inflect the price down again? They are under a lot of pressure from other OPEC members, but giving up now would mean having absorbed a lot of pain in the past 6 months for very little gain.