Investors are selling their bonds all around the World and that's forcing yields higher despite the best efforts of the Central Banksters to keep them in check. The US has $100Bn worth of TBills to sell this week and we'll see what prices we get but the real danger is, of course, Japan, where 10-year notes carry 0.461% interest and that's already up from 0.3% in April. For a country that's 250% of their GDP in debt and using 30% of their tax revenues just to service the interest on that debt – another 0.1% here or there REALLY MATTERS!

We're short on Japan, of course, I detailed those trades in last week's posts, for that simple reason – if rates simply rise to a "normal" level of 1% – the country is going to be unable to service their debt. That's a very simple premise, isn't it?

As you can see from the chart, we've been having a fantastic time since our top call on the Nikkei at 20,000 (it went a bit over, but we stuck with it) and we already tested 19,000 last week and today we're back at 19,500 (and playing long for a bounce) but, once 19,500 fails, 19,000 may not hold this time and we could be in for a wild ride down.

The root of our cautious economic outlook lies in the chart above. Even if we ignore the outlying Japan crisis, the US, UK, Germany, France, Italy and Canada are not far behind in indebtedness. Every man, woman and child in the US owes $59,000 in debt already and it's all fine as long as no one asks anyone else to pay it back but look what happened to Greece when someone did ask for their money back...

Today, at 1pm, the US Government will ask to refinance another $24Bn for 3 years through the Treasury Auction. By flooding the World with money, the Central Banks have insured that there is a ready supply of the stuff but the reality is that Japan, China, Germany, etc. (as well as our own Fed) will buy our debt and, a week later, we will buy their debt and everyone will pretend that's all fine as the total debt goes up and up.

Today, at 1pm, the US Government will ask to refinance another $24Bn for 3 years through the Treasury Auction. By flooding the World with money, the Central Banks have insured that there is a ready supply of the stuff but the reality is that Japan, China, Germany, etc. (as well as our own Fed) will buy our debt and, a week later, we will buy their debt and everyone will pretend that's all fine as the total debt goes up and up.

This economic system makes as much sense as me writing my wife a $1M check to pay off her debts and then she writes me a $1.1M check to pay off my debts plus the $1M I lent her and then I write her a $1.2M check to pay off that debt and her new debts, etc… It all looks good on paper unless some 3rd party comes along and asks where that money actually is.

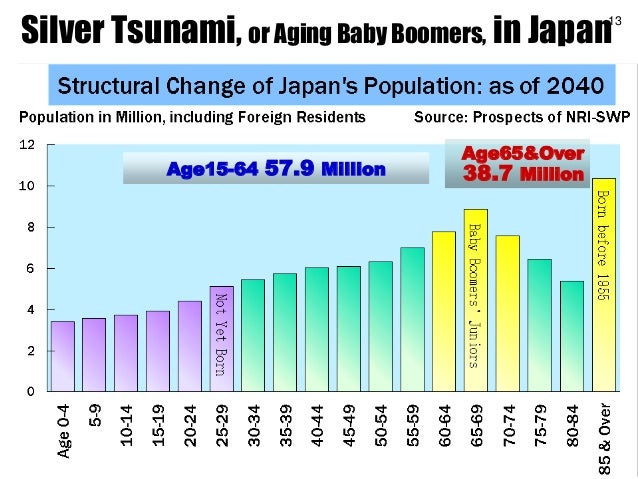

That someone is going to be the pensioners in those aging economies. Paying off Social Security, Medicaid etc. requires ACTUAL money to be distributed – but there is no actual money and, once people realize that, there is an effective run on the banks and rates will skyrocket. Skyrocketing rates will bankrupt Japan who will default on debt, which will have a domino effect on the other countries.

That someone is going to be the pensioners in those aging economies. Paying off Social Security, Medicaid etc. requires ACTUAL money to be distributed – but there is no actual money and, once people realize that, there is an effective run on the banks and rates will skyrocket. Skyrocketing rates will bankrupt Japan who will default on debt, which will have a domino effect on the other countries.

When will this happen? Not soon, but it is coming and, between now and then, we'll see a bunch of mini-crises but, as you can see on the chart for Japan above, 40% of their population will be above 65 in 2040 – clearly that's unsustainable so, somewhere between now and then – it will all hit the fan.

There are two ways to "fix" this problem Globally – default or inflation. Default is very messy and has unintended consequences, inflation is a little messy but lets everyone pretend they are paying off their debts (using worthless currency) and people maintain their faith in the system.

There are two ways to "fix" this problem Globally – default or inflation. Default is very messy and has unintended consequences, inflation is a little messy but lets everyone pretend they are paying off their debts (using worthless currency) and people maintain their faith in the system.

This is what I predicted the end game would be back in 2008. For 2015, we had our "Secret Santa's Inflation Hedges for 2015" and it's only April, so some can still be played.

The money has already been printed. So far, it's flowed into bonds and the markets and pretty much nowhere else but, as the markets top out and begging to spit back some of that cash – it may finally flow into the economy, probably starting with commodities but eventually being used to pay some workers and buy some equipment and then we can get on with the business of really improving the economy, from the ground up.

That's why we're long-term bullish on the market, inflation is the rising tide that will lift all ships but, in the short run – it's going to be a bumpy ride.