The S&P has gone nowhere since our last review.

The S&P has gone nowhere since our last review.

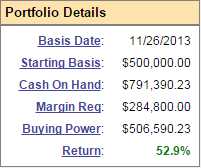

An neither have our portfolios! Actually, we did gain another $8,092 (1%) in our Long-Term Portfolio, which is very good for two weeks and exremely good considering we're over 100% in CASH!!!

How are we over 100% in cash? Because we are BEING THE HOUSE - Not the Gambler™ and we are operating our Stock Market Casino and selling risk premium to others. That is how we can reliably get these great returns. We are NOT gambling, we are running a statistically beneficial model that allows us to collect risk premiums from people who are gambling on the direction of the stocks we own.

The actual net value of the positions we hold is -$26,825, because we kept our losers back on March 24th, when we went to mainly cash ahead of this choppy earnings period - but our CASH!!! pile has greatly increased. The S&P was at 2,104 then, it's at 2,122 now but our Long-Term Portfolio is up 12.1% since then and, depsite going to mainly cash, we have added 12 new positions in two months.

The key is that we have much less at risk now and we're simply grinding out those montly gains that we can count on by SELLING risk to others, not gambling ourselves on which way the market might go. Meanwhile, just yesterday we found two new trade ideas for the LTP - even in a rally, there are bargains to be had if you are PATIENT! As I said back in March:

While it is our INTENTION in the LTP to hold our positions over time, when we get a ridiculous run in the market like the one we've had for the past year, it is simply foolish not to take advantage of it.