Reminder: Pharmboy and Ilene are available to chat with Members, comments are found below each post.

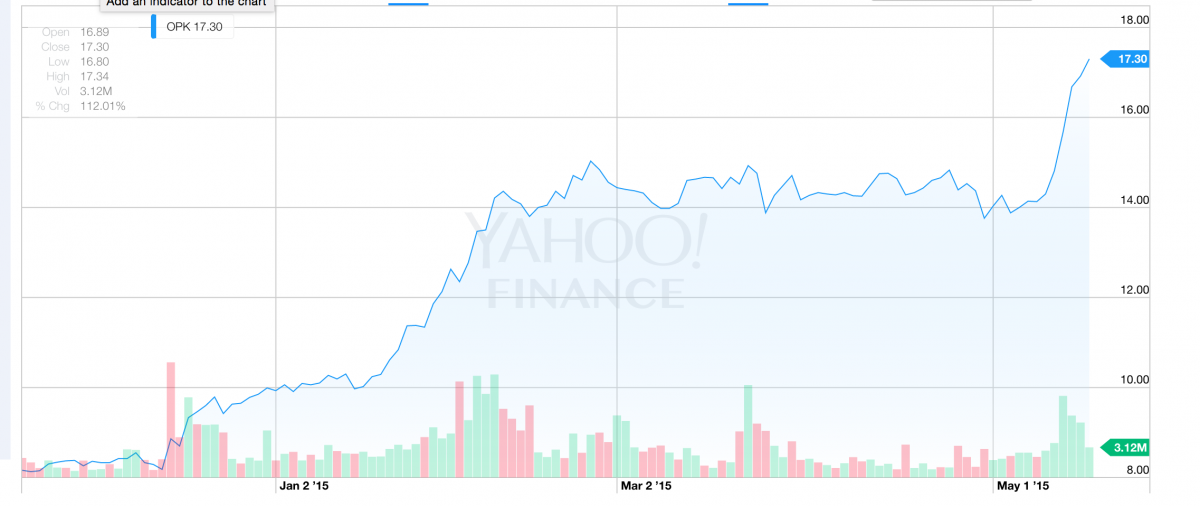

My friend Trevor at Lowenthal Capital Partners entitles his article on Opko Health (OPK) "Why Shorting Opko Health Makes No Sense After The Q1 2015 Earnings Report." So I asked him, "Why that title? Why not just say "Going Long OPK," or "OPK: Finally Earns Bubble Valuation, A Keeper!"? If you examine the key statistics, you will not fall in love with this stock. And one look at the chart explains Trevor's title. ~ Ilene

Six month chart (Yahoo)

But Trevor likes the shares, preferably a little cheaper, and explains why in his article, Why Shorting Opko Health Makes No Sense After The Q1 2015 Earnings Report.

Excerpt:

Summary

- Opko Health continues to impress on many fronts.

- The Q1 2015 earnings report confirmed key developments related to 4Kscore Test reimbursement and NDA filing for Rayaldee, and the market is taking notice.

- Management continues to buy shares on the open market. [Go to insider cow, look up OPK.]

- For these reasons, shorting Opko Health does not seem to be a viable investment strategy.

[…]

I am a buyer of Opko at current price levels, as I believe there is considerable upside ahead. It seems that Opko is entering a period in which any number of developments could create shareholder optimism and spark a rally (which we are seeing now). And given the company's long-term growth potential looks strong, I do not believe establishing a short position in Opko is a viable investment strategy. Perhaps looking for short plays elsewhere in biotech is a safer bet.

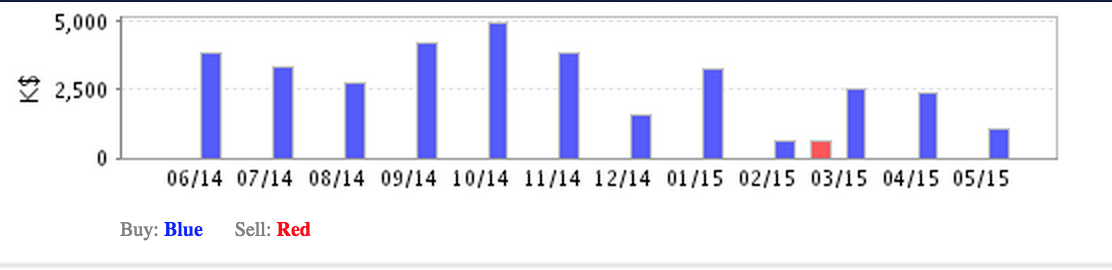

There's truly been a lot of insider buying of Opko shares by the CEO indirectly as Frost Gamma Investments Trust. The chart below is from Insider Cow, the blue bars represent insider buying.