Another day, another $82Bn – or maybe $164Bn.

Another day, another $82Bn – or maybe $164Bn.

That's what Chinese markets are excited about this morning as "people familiar with the matter" say China’s Ministry of Finance may set additional quota of 500Bn-1Tn Yuan for local governments to swap debt into Municipal Bonds, ie – "Project Rug Sweep." Keep in mind they JUST announced $82Bn on May 15th, just two weeks ago – AND THAT DIDN'T HELP FOR LONG, DID IT?

Since you can fool some of the people all of the time, the Shanghai Composite popped 4.7% this morning but the Hang Seng found plenty of sellers into its close and finished the day up just 0.63%, You can't look to the Nikkei to break the tie as they ended up flat but /NKD Futures are back at our shorting line (20,600) and that makes us happy (see our Live Member Chat for our other Futures plays).

Quick action was needed in China this morning as the official Chinese PMI report showed slight expansion at 50.2 but the private, HSBC PMI reading showed the 3rd consecutive month of contraction at 49.2 while both the Service Sector and Exports continue to contract at a dangerous pace, so it's lies AND manipulation keeping the Chinese markets alive this morning – not much of an investing premise, is it?

Quick action was needed in China this morning as the official Chinese PMI report showed slight expansion at 50.2 but the private, HSBC PMI reading showed the 3rd consecutive month of contraction at 49.2 while both the Service Sector and Exports continue to contract at a dangerous pace, so it's lies AND manipulation keeping the Chinese markets alive this morning – not much of an investing premise, is it?

Of course, $82Bn of additional stimulus is just a drop in the bucket compared to the $550Bn in value lost on the Shanghai Composite last Thursday alone. Certainly the Government is getting plenty of bang for it's manipulative buck but on May 30th, 2007, the Shanghai also lost 6.5% and, without stimulus, was down 15% by June 4th following a rally that had also been marked by a massive increase in new trading accounts and record margin debt.

What's different this time is that, back in 2007, the PBOC was tightening to cool off an overheating economy while now the PBOC could not be more accommodating – BUT THAT's WHAT SCARES US!!! If the PBOC is pulling out all the stops to stimulate the economy but the PMI (and other indicators we discussed last month) ARE STILL FALLING – what's going to happen when they run out of stimulus?

"Ah", say the bulls, "that's where we have you. because Central Banks will never run out of stimulus because they can just print more and more money so BUYBUYBUY the F'ing dips, drool, drool…" Well, they don't actually say "drool, drool," but that's kind of how I imagine them when they are writing to me.

"Ah", say the bulls, "that's where we have you. because Central Banks will never run out of stimulus because they can just print more and more money so BUYBUYBUY the F'ing dips, drool, drool…" Well, they don't actually say "drool, drool," but that's kind of how I imagine them when they are writing to me.

It remains to be seen whether or not the bulls will have to chew their own legs off to get out of their positions or if the Central Banksters will indeed "fix" China, Greece, etc. before they run out of printing ink.

That's right, Greece is still a thing but so, according to Shakespeare, is the play – so we're just going to let Greece play out and not make any bets on that tragedy. Each day, each hour in fact, the market runs up or down based on what any minor European or Greek official happens to say – it's completely ridiculous but not as ridiculous as the people who say a Greek default won't be a big deal. If it's not going to be a big deal, why is it such a big deal whether or not the negotiations are going well?

Even as I write this (8:30 am, EST), the markets have popped up on a rumor that progress is being made over in Europe and they'd better make a deal because EuroZone Factory Growth came in weaker than expected at 52.2, so they certainly can't afford to let Greece die over a couple of Billion Euros (payments through June) at the moment. "The rate of growth is modest rather than spectacular," said Markit's Chief Economist Chris Williamson. "There are clearly countries which continue to struggle."

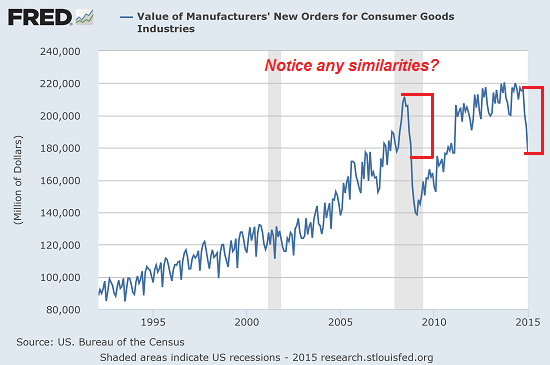

Speaking of countries that continue to struggle, this chart is a bit disturbing on New Orders for US Consumer Goods, which has fallen off 18% so far this year. In-line with that number, we just got a big, fat ZERO on Personal Spending for April after the ZERO we had in March was blamed on the weather and was supposed to rebound in April, according to leading Economorons.

Speaking of countries that continue to struggle, this chart is a bit disturbing on New Orders for US Consumer Goods, which has fallen off 18% so far this year. In-line with that number, we just got a big, fat ZERO on Personal Spending for April after the ZERO we had in March was blamed on the weather and was supposed to rebound in April, according to leading Economorons.

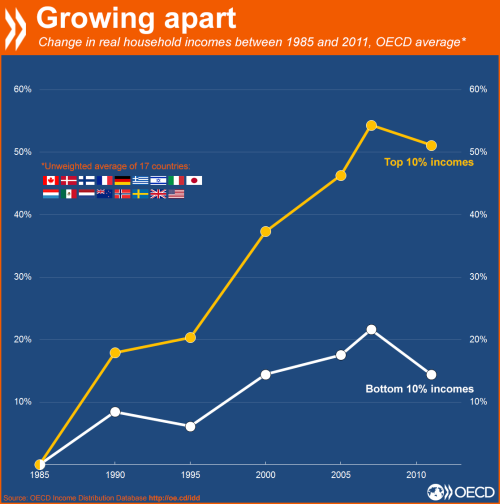

Personal Income was up 0.4% but, as I've been saying over and over again – it doesn't do any good to make the top 1% $59Bn richer in April while the bottom 99% split the other $400M. Personal Consumption actually went down $4Bn but that's less than 0.1% of the total so it rounds out to zero, though -0.1% sounds a lot worse, doesn't it? In fact, Personal Income on Assets alone was up $26.6Bn plus Transfer Receipts of $6.5Bn totaled $33.1Bn out of $59.4Bn but add in Proprietor's Income ($2.5Bn), Rental Income ($3.9Bn) and that's two-thirds of the total income right there for the investing class.

Another way you can tell how much of that personal income increase went to the top 1% is to look at the Savings Rate, which jumped $51.5Bn out of the $59.4Bn total gain (86.7%) – which class do you think it is that takes almost all of their income gains and drops it right in the bank? So, while Economorons may be baffled as to why rising income levels don't lead to more consumer spending – by simply not pretending that income is evenly distributed, we are able to get the bigger picture.

This is why Bernie Sanders is surprisingly popular as a candidate in the upcoming elections – addressing income inequality is front and center on his agenda – and about time too!

SANDERS: What is my dream? My dream is, do we live in a country where 70 percent, 80 percent, 90 percent of the people vote? Where we have serious discourse on media rather than political gossip, by the way? Where we’re debating trade policy, we’re debating foreign policy, we’re debating economic policy, where the American people actually know what’s going on in Congress?

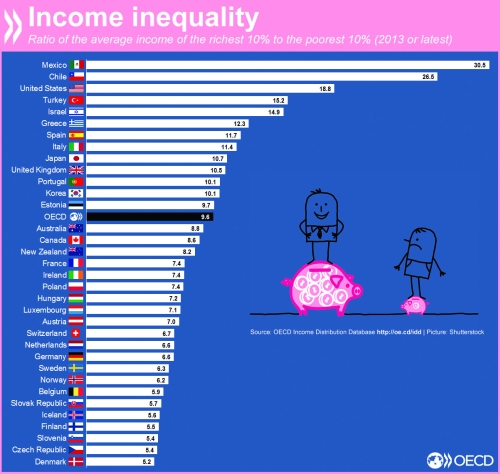

Ninety-nine percent of all new income generated today goes to the top 1 percent. Top one-tenth of 1 percent owns as much as wealth as the bottom 90 percent. Does anybody think that that is the kind of economy this country should have? Do we think it’s moral? So to my mind, if you have seen a massive transfer of wealth from the middle class to the top one-tenth of 1 percent, you know what, we’ve got to transfer that back if we’re going to have a vibrant middle class. And you do that in a lot of ways. Certainly one way is tax policy.

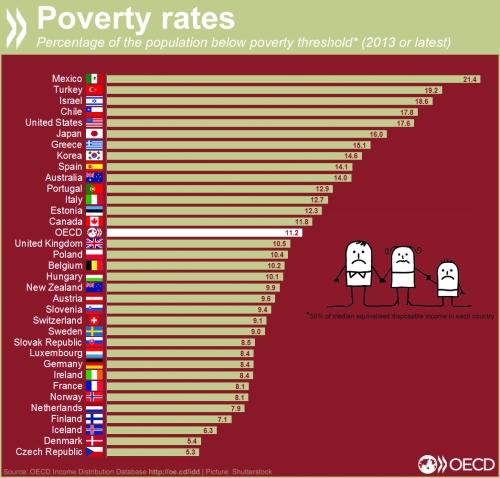

Look at US! Ranked 3rd in the World in Income Inequality, ranked 4th in allowing our citizens to fall into poverty at a rate that is DOUBLE most of Europe. IT'S SHAMEFULL – Wake up America! Income Inequality doesn't just hurt the 60M Americans (1,000 football stadiums) who live below the poverty line ($23,850 for a family of four) but, as you can see from today's data, it also hurts our economy, with all of our economic growth going straight into the bank accounts of a very select few.