Recall back on May 8, 2015, Chris Kimble was interested in shorting the dollar if it bounced up. Phil was more bullish, suggesting there was a good chance of the dollar bouncing higher.

Here's what I wrote:

"These views are not inconsistent, actually, the dollar could bounce and drop again. We'll be watching."

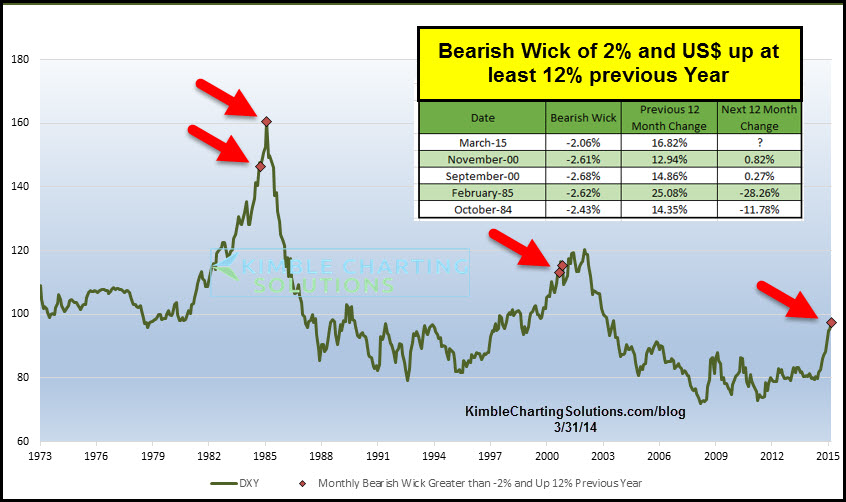

Chris's chart of the $USD from May 8, 2015:

.png)

Note that in the ensuing three weeks, there was a drift lower followed by a bounce higher along with a "kiss" at resistance.

.png)

Let's look at Phil's trade from May 8: "UNLESS that 95 line does ultimately fail (as opposed to this being bullish consolidation at the prior breakout point), then I'd prefer to sell the UUP Jan $25 puts for $0.85 and buy the Sept $24 calls for $1.05 and sell the Sept $25 calls for $0.50 for a net $0.30 credit on the $1 spread so the upside is $1.30 at $25 and worst case is owning UUP for net $24.70 (about the current price)."

Updated prices: UUP is currently trading at $25.07 (it's up about $0.37 from May 8).

Jan $25 puts sold for $0.85 are now at $0.72 ($0.13 profit).

Sept. $24 calls bought for $1.05 are now $1.17 ($0.12 profit) and Sept. $0.25 calls sold for $0.50 are now at $0.54 ($0.04 loss) for a total gain on the bull call spread of $0.08 (0.08/0.55 = 14.5% return on the bull call spread (the net cost of the bcs was $0.55).

UUP Chart (6/4/15)

Previously, the bearish wick patterns of the $USD have led either to little change during the subsequent year period, or to rather dramtatic losses.

Chris noted: "Almost 90-days ago the US Dollar was dealing with a 14-year resistance line that dated back to its all-time highs in 1985 (chart below), around the 95 level. It pushed above this resistance line and closed just above the 100 level on the week ending 3/13/15. Since then the $USD has backed off some, coming back to test the old resistance line as potential test of support for its first time in history, around the 93 level."

Since testing this support line for the first time in history, the $USD has rallied around 4%. At this time the $USD finds itself above the 93 support level and below this highs it hit at the 100 level.

The table below looks at key currency ETFs performance through the end of May.

What King Dollar does in the near future at these key support/resistance levels could have a large impact on portfolio construction going forward.

Commodities have not liked the rally of the $USD, off the 93 support level and have been pretty soft. A break below the 93 support line should be good for commodities and a break above the 100 level, could be painful for commodities.

Which way the dollar breaks out or breaks down from its 7% trading range could be a very important factor in deciding which assets to own between now and the end of the year.

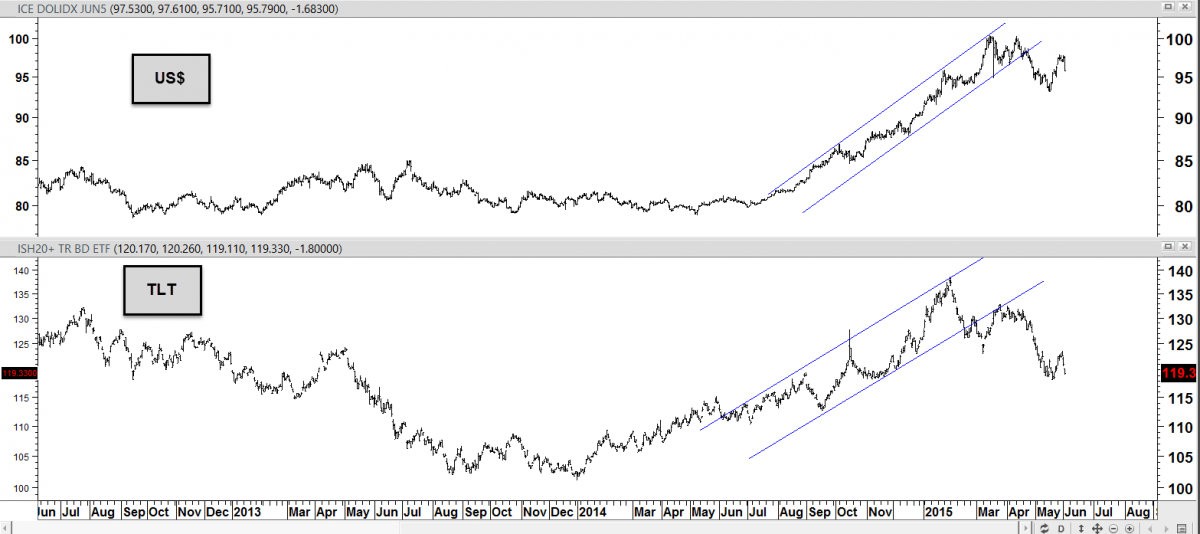

Notice the correlation relationship between the Dollar and bonds. These charts show that weakness in the dollar is likely to be associated with weakness in bond prices and higher yields.

Not surprisingly, Chris also finds support for the notion that yields will surge higher.

"From a price perspective, the yield on the 10-year note looks to be at a pretty important price point right now in the chart below."

Chris writes:

The yield on the 10-year note has remained inside of a falling channel the past two years. In February, yield hit the bottom of a falling channel and the rally since then has taken yield back to the top of this falling channel at (1).

Yields might have formed a bullish inverse head and shoulders pattern over the past 9-months, which if true, would suggest yields break resistance at (1) and move a good deal higher. If this pattern read would happen to be correct, the measured move calls for the yield on the 10-year to rally to the 3.30% level, which is nearly 50% above current yields. If rates would push that much higher, it would pretty tough on bonds.

Chris's charts are suggesting 1) weakness in the Dollar, 2) weakness in bond prices, and 3) higher yields. These are consistent with higher commodity prices.

To become a member of Kimble Charting Solutions, click here.