$1,000 per contract!

$1,000 per contract!

That's how much our /NKD short idea from yesterday's post made as of this morning. Not bad for 24 hours "work." Our short position on the Dow (/YM Futures) only made $500 per contract, as did the S&P Futures shorts (/ES) as that index retested $2,100. The Nasdaq hit 4,485 and that was good for another $1,100 from our 4,540 short entry – all in all, it has been a good morning for the bears!

Oil was even better, spiking right back to our $61.30 shorting target on yesterday's oil inventories before collapsing back to $59.30, that one was good for a $2,000 gain and we called the dead bottom on oil in our Live Member Chat Room at 2:00 pm, saying: "Oil is fun for a long off the $59.50 line for a bounce into the close (/CL)." That flip flop was good enough to catch a quick $250 on the bounce as well:

We were sure enough about oil failing on inventories that we added an options trade for those Members who weren't able to trade Futures at 10:22, just ahead of the 10:30 report:

For those of you who are Futures impaired, the XOM July $82.50 puts are just 0.65 with a delta of 0.24 so a $1 drop in XOM pays 33% – it's a fun trade to play oil selling off into OPEC.

That trade finished at 3:50 on this note:

That trade finished at 3:50 on this note:

Mission accomplished on XOM July $82.50 puts – now 0.88 (up 35%). Good example of how you can make substitutions for Futures trades (see 10:22 entry).

Having cash on the sidelines doesn't mean we can't make PLENTY of money day-trading in and out of positions while we wait for better opportunities. On Tuesday morning we featured a bullish idea on LL right in our morning post and, in our Member Chat Room, we added a long on IRBT at $32 (using an options spread for leverage, of course) and a Butterfly Spread (neutral) on TXN at $55.

On Monday we picked up AWAY for our Long-Term Portfolio at $29 (also a leverage spread) and that's already at $30.68 so even a boring old stock trader is up over 5% on that one in three days. ARO fared even better, added to the LTP at $1.77 and already $1.95 for a 10% gain in 3 days. We caught the dead bottom on that one and our option spread is designed to return 528% at $3, so we're well on track there.

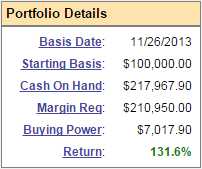

Keep that in mind when we talk about being "Cashy and Cautious" as we've moved $34,000 (5%) into positions since May 16th in the LTP so, although we are still using just 18% of our margin allocation, we have been putting our cash to work as we find bargains along the way.

Keep that in mind when we talk about being "Cashy and Cautious" as we've moved $34,000 (5%) into positions since May 16th in the LTP so, although we are still using just 18% of our margin allocation, we have been putting our cash to work as we find bargains along the way.

Meanwhile, our Short-Term Portfolio is using as much margin as the Long-Term Portfolio and is hedged fairly bearish to protect our Long-Term positions while BEING THE HOUSE and selling a lot of premium to take advantage of the market swings to keep generating a good income (up $12,077 (11%) since our 5/16 review).

Today, for example, there's a nice opportunity to go long on gold at $1,175 (/YG Futures) and that should be good for a $5-10 move up at $32.20 per $1, per contract. If we're still low at the open, the Gold Trust ETF (GLD) June $112/113 bull call spread at 0.50 will pay back 100% if GLD holds $13.50 into expirations on the 19th. So, if we want to make $2,500 in two weeks, we add 50 of those contracts for $2,500 to our Short-Term Portfolio (and 10 to our $25,000 Portfolio for $500) and then sit back and watch the fun.

So you don't need to put a lot of cash to work to have great returns in an options portfolio. In fact, having a lot of CASH!!! allows you to take advantage of these opportunities as they pop up. If Greece falls apart, gold should really pop but, even if they "fix" Greece again, there's still China, Japan, Ukraine, Russia, OPEC Nations and our own crappy data (Q1 Productivity was down 3.1% and Unit Labor Costs were up 6.7%) that can chase people back to gold.

Let's be careful out there!