Wheeeeee – this is fun!

Wheeeeee – this is fun!

There's nothing like a healthy market correction – when you are prepared for it. Our Members at Philstockworld were certainly ready for this one and now we have our checkbooks ready, looking for bargains to pick up while the prices are falling. As I said yesterday, not every stock is overbought – just enough of them that we weren't happy about buying at these all-time highs.

While things were selling off yesterday morning, we added a brand new Top Trade Alert on Encana (ECA) as it tested the $12 level. During our Live Trading Webinar, we restated our long position on Gold Futures (/YG) at $1,177 and this morning we got out at just under $1,190 for a very nice $400 per contract overnight gain. That's nothing compared to the $200 per contract we made on oil futures LIVE, during the Webinar, in just 30 minutes.

Futures trading is a fun way to amuse ourselves while we're waiting for stocks to go on sale. Being a smart investor is like being a smart shopper as we hunt for bargains and walk around the mall every day in search of discounts. A lot of times we come up empty-handed but, when we finally go home with something – we feel very good about our purchases.

Futures trading is a fun way to amuse ourselves while we're waiting for stocks to go on sale. Being a smart investor is like being a smart shopper as we hunt for bargains and walk around the mall every day in search of discounts. A lot of times we come up empty-handed but, when we finally go home with something – we feel very good about our purchases.

As we expected, our bearish Short-Term Portfolio jumped up to +141.6% as the markets dipped. That's up $20,000 (20%) since our 5/29 Review and all we did last week was cash in winning Silver Wheaton (SLW) calls, add the Gold Trust (GLD) spread we featured for you in the main post on Thursday and pulled our short position on oil (one of 3 legs of the ultra-short (SCO) spread, leaving us net long).

That's the beauty of following our Balanced Portfolio Strategy – it just takes a few minor adjustments to steer ourselves more or less bullish and to take advantage of the changing conditions. All that while our Long-Term Portfolio positions continue to work for us by collecting the premiums we sold to others (mostly bulls who have no concept of gravity).

Speaking of gravity, we're looking for some weak bounces today, especially in Germany, where the DAX is completing a 10% correction (12,250 to 11,000) which is still above the 200-day moving average at 10,469, which would be another 5% drop from here. This is all perfectly normal after a 30% run from 9,500 in January, which is kind of a lot for a major market to move in 6 months.

Speaking of gravity, we're looking for some weak bounces today, especially in Germany, where the DAX is completing a 10% correction (12,250 to 11,000) which is still above the 200-day moving average at 10,469, which would be another 5% drop from here. This is all perfectly normal after a 30% run from 9,500 in January, which is kind of a lot for a major market to move in 6 months.

As you can see from how well it obeys the lines Fibonacci Lines (see our primer here), the bots are firmly in control of the trading in Europe so this 50% retracement will be a huge test of sentiment over there. Of course we're going to have a "bullish" bounce off the 11,000 line – it's major support – the question is whether the bounce will be strong (40% retrace of the drop) or weak (20% retrace) and the drop was from 12,250 so 1,250 points means we're looking for a 250-point weak bounce to 11,250 this Friday and 11,500 by early next or the momentum will still be down.

In our Live Member Chat Room this morning, we discussed the World's 3rd most important index, the Nikkei, and how this morning's bounce affects our Japan ETF (EWJ) short positions. In this case, the move down in the Nikkei is entirely attributable to Dollar weakness/Yen strength as we have further evidence of Abenomics (Japan QE) coming apart at the seams. My comment to our Members at yesterday's market open was:

In our Live Member Chat Room this morning, we discussed the World's 3rd most important index, the Nikkei, and how this morning's bounce affects our Japan ETF (EWJ) short positions. In this case, the move down in the Nikkei is entirely attributable to Dollar weakness/Yen strength as we have further evidence of Abenomics (Japan QE) coming apart at the seams. My comment to our Members at yesterday's market open was:

/NKD/Craigs – This is a bounce, the question is, how high. From 20,600 to 20,000 is 600 points so 120-points is a weak bounce (where we are now) and 240-points is a strong bounce but making a weak bounce on Day one is a good signal if they hold it. From the EWJ chart, you can see that it's not at all a bounce until we're back over that $13 line:

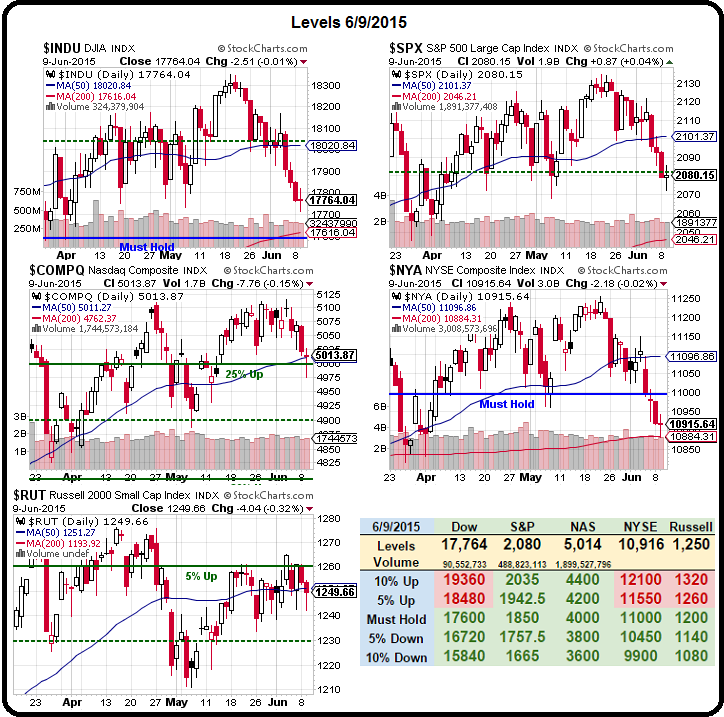

So, in addition to keeping an eye on Dax 11,000, it would be a good idea to watch Nikkei 20,000 as well as Shanghai 5,000, Nasdaq 5,000 and NYSE 11,000 – all of which are major support lines which will not bode well for the global markets if they fail. Of course, when we hit major supports like this, the Corporate Media and the Puppet Governments pull out all the stops to save the investment portfolios of their Top 1% masters – so expect something bold between now and Monday.

Per our fabulous 5% Rule™, we are going to be watching the following bounce patterns:

Per our fabulous 5% Rule™, we are going to be watching the following bounce patterns:

- Dow 18,200 to 17,600 (not there yet) is 600 points and that makes 17,720 a weak bounce – and that's about where we finished yesterday. That means if we don't see the strong bounce line at 17,850 (rounding to 50) taken back today, we're not going to be impressed at all and I very much doubt we'll pop 100 on the day – especially considering the Dollar is already testing the 95 line and not likely to fall further.

- S&P 2,080 is 12.5% over the Must Hold line (1,850) so it's the 10% line at 2,035 that needs to hold or else this market is in BIG TROUBLE. Meanwhile, 2,080 is only 50 points below the 2,130 high, so it's a 2.5% drop so far and that means 0.5% is a weak bounce (2,190) and 1% would be a strong bounce, back at 2,100. Once again, it's 2,100 or bust on the S&P.

-

Nasdaq 5,000 (4,400 on the 100) is our magical level from the dot com days. This time is a bit different as there's not as many pure BS companies out there but that just means we're only 25% overvalued rather than 200% overvalued like we were in 1999.

Nasdaq 5,000 (4,400 on the 100) is our magical level from the dot com days. This time is a bit different as there's not as many pure BS companies out there but that just means we're only 25% overvalued rather than 200% overvalued like we were in 1999.

If you were buying a car you knew was worth $50,000 and the sticker said $62,500 would you buy it just because the dealer tells you some idiot paid $62,500 for a similar car in 1999, right before the prices crashed back to $25,000? If the answer is yes, you are the perfect Nasdaq customer!

The Nasdaq topped out at 5,120 and the 120-point drop back to 5,000 is nothing (2.5% again) so forget the expected 25 and 50-point bounces – the key to the bull rally being sustained is that psychological 5,000 line not failing.

- NYSE 11,000 is our Must Hold line and that line MUST HOLD in order for us to even consider bullish bets. So far, we haven't really taken up short positions, other than our index hedges but NFLX $650 is at the top of my list. Anyway, 11,250 was a nice 2.5%(ish) move up and now back down and below at 10,900 is BIG TROUBLE if we don't get back over 11,000. Fortunately, a 350-point drop means a 70-point weak bounce to 10,970 and then a strong bounce at 12,050 (rounding to 50) would make us all feel better. Probably not going to happen, though.

- Finally, Russell has been very exciting over their Must Hold line at 1,200, topping out at 1,278 back in April (+6.5%) but now half of those gains have faded at the 1,240 line, which we hit yesterday (and a nice $1,000 win on the Futures too!) and we are calling 1,250 and 1,260 our weak and strong bounce lines as the RUT is always very hyper, so we expect more from it.

We'll be watching our bounce lines very closely today. Step one in manipulating the indexes higher would be to take the Dollar down below 95. That will not make the Nikkei happy though nor the Dax, which is why we have turned bearish – at this point, the Central Banksters are running out of room to maneuver and are not all on the same page anymore. That leads to instability and it's very easy to panic investors in these conditions – look at what's already happening in the bond market.

We'll be watching our bounce lines very closely today. Step one in manipulating the indexes higher would be to take the Dollar down below 95. That will not make the Nikkei happy though nor the Dax, which is why we have turned bearish – at this point, the Central Banksters are running out of room to maneuver and are not all on the same page anymore. That leads to instability and it's very easy to panic investors in these conditions – look at what's already happening in the bond market.

A fresh wave of selling gripped global markets on Wednesday, with yield on the 10-year German government bond yield hitting 1 percent level for the first time since September after the European Central Bank's preferred inflation expectations gauge peaked to a 3-week high. The yield has soared from a record low close of 0.073 percent in April.

Let's be careful out there!