Told you so on Greece!

Told you so on Greece!

And Greece is only the first country to default, it won't be the last as aging populations are the proverbial bill that now has to be paid by countries who used their retirement systems as piggy banks to fund deficit spending they never should have engaged in in the first place (cough, America, cough, cough!). Greece's pension deficit is 9% of their $242Bn GDP or $24Bn – really a drop in the bucket of their $365Bn total debt, but it's the pension funds their ECB creditors insist on raiding to balance the books despite the fact that it will actually KILL PEOPLE to cut benefits further at this point.

The Banksters at the ECB and IMF don't care how many old people starve as long as they can extend and pretend on their payments for another few quarters. Of course, their actions exacerbate the problem as Greece's austerity-collapsing stock market (and low bond rates) has destroyed $28Bn of pension fund value since 2012 alone. As part of a package of savings and tax increases, Greece’s creditors are demanding the government cut pensions by the equivalent of 1% of gross domestic output, a more rapid clampdown on early retirees and for supplementary pensions to be financed by contributions, not by the state (which would effectively mean cutting them further).

Look at the spiral Greece has fallen into: 20.5% of Greece's 11M people are over 65 (and there are currently 400,000 new pension applications on hold due to Government cutbacks) while, because of the austerity measures being undertaken to pay off debts, 50% of the youths in the country (16-24) are unemployed – meaning they can't contribute to the pension system. It's not like Greek pensions are generous, either, with half of them below the poverty limit of $775/month. In fact Greece's (EL on this chart) spending per beneficiary is in the low middle of the EU pack:

The Banksters of the EU, through the IMF and ECB are pushing to purge retirees’ benefits, cut supplementary pensions horizontally across the board and raise additional revenues by squeezing a drastically depleted pool of taxpayers, which would in the short-term allow Greece to unlock the next €7bn tranche of bailout funds (more debt to pay) that it needs to carry on servicing its current debt (and not default). WHAT KIND OF IDIOCY IS THIS? Of course you will get to the point where you can't cut more or can't pile on more new debt to pay old debt – this is what I've been warning you about…

Anyway, I've made this point before and now it's reaching the end game but the real point of this rehash is to make sure you understand that this is happening in DOZENS of other countries – just at earlier stages. The reason the IMF/ECB is being insanely tough on Greece is because there are 8 other countries they have to deal with next who owe a HELL OF A LOT MORE than $360Bn!

Anyway, I've made this point before and now it's reaching the end game but the real point of this rehash is to make sure you understand that this is happening in DOZENS of other countries – just at earlier stages. The reason the IMF/ECB is being insanely tough on Greece is because there are 8 other countries they have to deal with next who owe a HELL OF A LOT MORE than $360Bn!

If you have been reading us this month, you know we're short the China ETF (FXI) and you know why, so I'm not going to rehash it all here (see: "Greece and China Race to Default" or "China Stocks Drop 6.5% Yet the MSM is Silent?"). China is only better off than Greece in that they get to print their own money and make up their own economic statistics without the fear of being audited (it was an audit of Goldman Sach's cooked books that began the Greek crisis). That means China has less chance of having their backs placed against the wall than Greece but that doesn't mean that, like fellow BRIC nations Brazil and Russia, investors won't simply lose confidence in what is more and more obviously an unsustainable system.

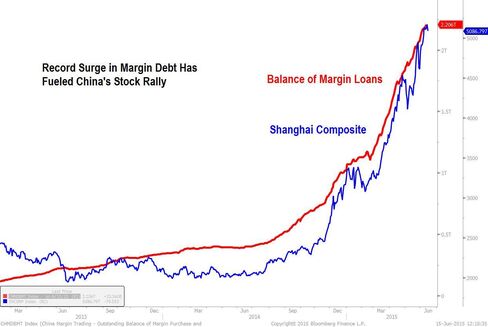

China depends on constant growth in stocks and real estate to keep their economy growing and, over the past decade, whenever the economy began to falter, the governments (national and local) stepping in with growth programs. Now the first of those 10-year bonds are starting to default and the local governments don't have access to easy capital so China changed the rules and allowed much more margin investing in their stock market. That has accomplished a 150% rise in stocks (and debt) in the past 12 months yet there are people who will tell you with a straight face that this is sustainable – it's not.

China depends on constant growth in stocks and real estate to keep their economy growing and, over the past decade, whenever the economy began to falter, the governments (national and local) stepping in with growth programs. Now the first of those 10-year bonds are starting to default and the local governments don't have access to easy capital so China changed the rules and allowed much more margin investing in their stock market. That has accomplished a 150% rise in stocks (and debt) in the past 12 months yet there are people who will tell you with a straight face that this is sustainable – it's not.

Since last June, the Chinese markets have gained $6Tn (150%) in PRICE (not value!) as margin debt climbed from $100Bn to $358Bn (250%). Meanwhile, net inflows of cash into the Chinese markets were just $200Bn. $200Bn + $358Bn is not $6,000Bn is it? Not to mention that the MAJORITY of this money is coming through via asset funds that are loaded with completely junk stocks that few self-respecting US firms would touch.

That's because the PRICE of the stock market is based on what the last person paid – not what everyone paid. Just because the last person paid $10Tn (current market cap for China) doesn't mean the next person will. In fact, now you need $150% more inflows and debt ($1.4Tn) to maintain this pace and, just to SUSTAIN the current level, you need to find another $750Bn in cash and debt because we're beginning this period at the top of the range vs $558Bn being the average of the previous range.

“There’s definitely a ceiling on margin-lending,” said Wu Kan, fund manager at Dragon Life Insurance Co., which oversees about $3.3 billion. “Once leveraged investors begin to cut their holdings, it means they’ve turned cautious on the market and that will probably spark a correction.”

“There’s definitely a ceiling on margin-lending,” said Wu Kan, fund manager at Dragon Life Insurance Co., which oversees about $3.3 billion. “Once leveraged investors begin to cut their holdings, it means they’ve turned cautious on the market and that will probably spark a correction.”

With so much borrowed money at stake, market downturns run the risk of snowballing as traders are forced to sell shares to meet margin calls. The Shanghai already dropped 6.6% in a single day on 5/28 when one brokerage upped margin requirements and 7.7% on 1/9 when regulators suspended new margin accounts (which they quickly backed off on).

The China Securities Regulatory Commission is planning to curb the amount of margin finance and short selling to no more than four times a brokerage’s net capital, according to draft rules posted on its website June 12th. There is currently no ceiling. In 2008, the Shanghai composite fell 70% in 10 months but, at the time, that "only" cost investors $1.6Tn out of $2.5Tn yet still the whole World fell apart. What happens if we drop $7Tn now?

This morning there was no additional stimulus from China (something that was expected going into the weekend) and the Chinese markets fell 2% into the close. Most notably, Hong Kong Exchanges and Clearing Ltd. lost 3 percent amid disappointment authorities didn’t make an announcement on the city’s stock link with Shenzhen as had been speculated. That has been one of the key drivers of the recent rally in mainland shares – theoretical access to International money through Hong Kong.

Will International buyers be dumb enough to push money into the Chinese markets just because the exchanges open up and even though China is clearly in a bubble. LOL – do you really have to ask?

Will International buyers be dumb enough to push money into the Chinese markets just because the exchanges open up and even though China is clearly in a bubble. LOL – do you really have to ask?

Meanwhile, in May, Chinese company insiders (senior executives or their relatives) sold a combined 1.68BN shares, tripling April's total – much more than in each of the previous months of this year, according to data compiled by Reuters. It's not just company management who are selling; major cornerstone investors, freed from mandated lock-up periods, are also reducing their stakes. Cornerstone stakeholders slashed 109Bn Yuan ($18Bn) worth of China-listed shares in May, double the amount sold during the previous month, according to data from Southwest Securities.

Rats are leaving the ship, folks – are you just watching it happen from your first-class cabin windows?