Financial Markets and Economy

The makeup of the S&P 500 is constantly changing (Business Insider)

Time and time again, we hear that most actively-managed equity mutual funds fail to beat their benchmarks, like the S&P 500. In other words, investors who go out of their way to hand-pick stocks to buy and sell as they stray from the S&P 500 tend to lag more than lead.

U.S. Stocks Fall Amid Concerns Over Greece (Wall Street Journal)

U.S. stocks fell on Monday, weighed down by the latest setback in bailout talks between Greece and its European creditors.

Shares dropped from the opening bell, but pared much of their steepest losses by the close of trading. The Dow Jones Industrial Average lost 107.67 points, or 0.6%, to end at 17791.17, after shedding more than 200 points in intraday trade.

.png)

China Dumps Record $120 Billion In US Treasurys In Two Month Via Belgium (Zero Hedge)

Those who have been following the saga of "Belgium's" US Treasury holdings learned last month that the "mysterious buyer" behind Belgium's Euroclear was, as some speculated, China all along. Nowhere was this more evident than when showing an overlay of China and Belgium's combined TSY holdings versus China's forex reserves.

China Stocks Fall as ChiNext Posts Worst Two-Day Drop Since 2012 (Bloomberg)

China’s stocks fell, dragged down by the ChiNext index’s steepest two-day loss in three years, amid concern a flood of share sales may lure funds away from existing equities.

Technology, phone and industrial companies, the best performers this year, led declines. East Money Information Co., CRRC Corp. and ZTE Corp. slumped at least 2.6 percent. Huayi Brothers Media Corp. slid 4 percent, paring gains over the past year to 114 percent. Citic Securities Co., China’s biggest brokerage by market value, rose 2.1 percent after saying it plan to sell new additional shares in Hong Kong.

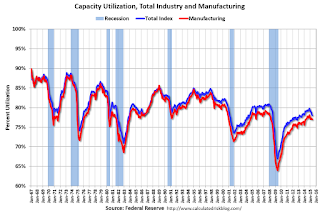

Fed: Industrial Production decreased 0.2% in May (Calculated Risk)

Industrial production decreased 0.2 percent in May after falling 0.5 percent in April. The decline in April was larger than previously reported, but the rates of change for previous months were generally revised higher, leaving the level of the index in April slightly above its initial estimate. Manufacturing output decreased 0.2 percent in May and was little changed, on net, from its level in January.

Gap plans to close stores, cut jobs (Market Watch)

Gap plans to close stores, cut jobs (Market Watch)

Gap Inc. GPS, -0.21% said Monday that it plans to close about 175 of its namesake North American stores, or about 25% of its total, over the next few years “to better reflect how customers shop.”

The retailer said about 140 closures will occur this fiscal year and won’t affect Gap Outlet and Gap Factory Stores. After the closings, there will be about 500 Gap specialty stores and 300 Gap outlets in North America. A limited number of European stores also will close.

ECRI Admits Incorrect Recession Call (Calculated Risk)

In that post, I noted that I hadn't seen ECRI admit their recent series of recession calls were incorrect. Actually they have admitted an incorrect call, and here is their recent admission (ht M): The Greater Moderation.

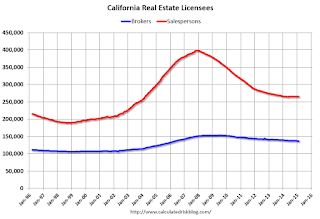

Update: Real Estate Agent Boom and Bust (Calculated Risk)

Way back in 2005, I posted a graph of the Real Estate Agent Boom. Here is another update to the graph.

Millennials' banking habits could make Wall Street obsolete (Business Insider)

Millennials' banking habits could make Wall Street obsolete (Business Insider)

Half of millenial consumers would consider swapping Google or Apple in for their current financial services provider, according to a study provided to Business Insider.

It's a trend that could crush Wall Street.

The 2015 Makovsky Wall Street Reputation Study came out this week.

Siena, Italy, Tries to Regain Financial Footing and Its Identity (NY Times)

Siena, Italy, Tries to Regain Financial Footing and Its Identity (NY Times)

Operators of kindergartens and ambulance services had to find new sources of funds. A biotech company filed for bankruptcy. The local professional soccer team slipped into the minor leagues after it could no longer afford the salaries of its top players.

And twice a year, when it is time for the Palio, Siena’s famed bareback horse race, neighborhood clans must pay for their own costumes.

Asia is about to topple North America as world’s richest region (Market Watch)

It’s been a fantastic ride in recent years for the global elite, particularly in Asia, where a scorching stock market has put the region on track to become the wealthiest in the world.

Are More Talks on the Horizon For Greece? (24/7 Wall St)

Are More Talks on the Horizon For Greece? (24/7 Wall St)

Talks with Greece fell through once again as the European Union is trying to hold itself together. This isn’t the first time that talks have fallen through and, by the looks of it, it might not be the last.

Germany, France, the International Monetary Fund (IMF), the European Union and the European Central Bank (ECB) have all tried to reach a deal with Greece in what is effectively yet another bailout with more favorable terms. The one consistent outcome is that all talks have failed at every turn. Greece’s Syriza socialist party was elected with the promise to undo many of the austerity measures and terms that had previously been agreed to.

U.S. Is Land of the Full-Time Job (Bloomberg)

When it comes to striking out on their own, workers in the famously entrepreneurial, risk-taking U.S. are extremely unlikely by international standards to…strike out on their own.

Investors Ditch Cash Market For Futures As Treasury Liquidity Evaporates (Zero Hedge)

Over the past several months we’ve spent quite a bit of time discussing liquidity (or, more appropriately, a lack thereof) in the market for US Treasurys, German Bunds, and JGBs.

Liquidity in government bond markets has become a hot-button issue in the wake of last October’s Treasury flash crash wherein the world’s deepest, most liquid market was suddenly exposed as having become nothing more than a playground for the Fed and HFTs. Six months later, the market was again forced to bear witness when German Bunds, the safe haven asset par excellence, began to trade like a penny stock as the reincarnation of 2013’s JGB VaR shock sent 10-year Bund yields on a wild ride from just 5 bps to nearly 80 bps in the space of just three weeks (the rout resumed last week, with yields rising above 1% on Wednesday).

The marginal cost of capital is rising, rising, rising.. (Trading Floor)

Our major allocation shift is working on fixed income, but commodities and gold still need the all clear regarding a Fed hike….

Trading

Being a Good Trader and a Good Asset Manager (Trader Feed)

Being a Good Trader and a Good Asset Manager (Trader Feed)

It is very important to understand the difference between trading and asset management. Trading takes advantage of short-term dislocations and seeks to make relatively quick returns. Asset management is a balanced approach to investment, in which the investor seeks long term returns from underlying factors that drive the returns across markets.

Politics

Hillary Clinton's Fainthearted Populism (Atlantic)

Hillary Clinton's Fainthearted Populism (Atlantic)

You may have heard that Hillary Clinton, in launching her campaign over the weekend, gave a speech marked by class-warfare themes. The New York Timessaid she issued “a populist promise to reverse the gaping gulf between the rich and poor.” Politico said “her economic-inequality rhetoric could have been comfortably uttered by the likes of Elizabeth Warren,” the crusading liberal senator from Massachusetts. Not (ever) to be outdone, the New York Post featured her on its cover in full Sherwood Forest drag, under the headline “RODHAM HOOD! Hillary reboots campaign with attack on rich.”

Jeb Bush's Mission (Bloomberg)

Jeb Bush's Mission (Bloomberg)

Grandson of the late Senator Prescott Sheldon Bush, son of former President George Herbert Walker Bush, brother of former President George Walker Bush and heir to the political estate known as the "Bush network" — has a fight on his hands. And anyone who cares about politics — not just Republican or presidential politics, but honest politics — has a stake in this fight.

The former governor of Florida, who previously served on the board of Bloomberg Philanthropies, had hoped to spook rivals out of the Republican presidential primary with a showing of financial and party support. He may yet produce the financial war chest, courtesy of a super-PAC that amounts to the conjoined twin of his campaign. But endorsements and votes are going to be won hard or not at all.

Technology

This new Xbox One game looks and feels just like a 1930s cartoon (Business Insider)

This new Xbox One game looks and feels just like a 1930s cartoon (Business Insider)

At its E3 press event Monday, Microsoft showed off a bunch of new indie titles coming to the Xbox One, but there was one particular standout: "Cuphead."

It has a distinct visual style inspired by 1930s cartoons, like those made famous by Max Fleisher and Walt Disney. It's colorful and beautiful and hectic, all at once.

Here’s The First Actual Gameplay Footage Of Star Wars Battlefront (Tech Crunch)

Here’s The First Actual Gameplay Footage Of Star Wars Battlefront (Tech Crunch)

I feel like I’ve been waiting years for this. The first real footage of Star Wars Battlefront — an EA-made sequel to the wonderful first person shooter of the same name that LucasArts (RIP) made back in 2004 — just dropped at E3.

Unlike previously released footage (which was made with the game’s engine but all pre-rendered) this clip is said to be ripped straight from actual gameplay running on a PS4.

I’m perhaps more excited about this than I am about The Force Awakens. Okay, probably not — but it’s close.

Health and Life Sciences

Scientists grow multiple brain structures and make connections between them (Science Daily)

Scientists grow multiple brain structures and make connections between them (Science Daily)

Human stem cells can be differentiated to produce other cell types, such as organ cells, skin cells, or brain cells. While organ cells, for example, can function in isolation, brain cells require synapses, or connectors, between cells and between regions of the brain. In a new study published in Restorative Neurology and Neuroscience, researchers report successfully growing multiple brain structures and forming connections between them in vitro, in a single culture vessel, for the first time.

Endometriosis 'risks miscarriage' (BBC)

Endometriosis 'risks miscarriage' (BBC)

It is caused by the lining of the uterus being found elsewhere in the body including the ovaries or vagina.

A study, on nearly 15,000 people in Scotland, found the condition increased the risk of miscarriage by 76%.

The team at Aberdeen Royal Infirmary said that women needed to be informed of the risk.

Life on the Home Planet

Hippos, bears and lions run wild after flood hits zoo in Georgia (New Scientist)

Hippos, bears and lions run wild after flood hits zoo in Georgia (New Scientist)

No you're not seeing things, that really is a hippo strolling down the road. After a major flood in Tbilisi, Georgia, on Sunday, which killed 12 people, several parts of the city zoo were destroyed, allowing animals to escape and take to the streets. Three zoo workers were among the dead.

The hippo was later shot with a tranquiliser dart while several other runaways were killed because of safety concerns, including six wolves, a boar, a tiger, a lion and a hyena.

A Jellyfish That Quickly Puts Itself Back Together (NY Times)

A Jellyfish That Quickly Puts Itself Back Together (NY Times)

When a juvenile moon jellyfish loses tentacles, it rapidly reorganizes its remaining limbs to maintain symmetry, a new study says.

In the lab, researchers removed the tentacles from the translucent jellyfish. “Each time, they would start reshaping and reorganizing their bodies,” said Michael Abrams, a biologist at California Institute of Technology and an author of the new study.

Study: Green space around schools may boost mental abilities (Phys)

Study: Green space around schools may boost mental abilities (Phys)

Putting more green space around an elementary school may help students develop some mental abilities, a study suggests. Researchers tested students repeatedly over the course of a year on attentiveness and working memory, which is the ability to keep something in mind temporarily for performing a task. Overall, students whose schools were surrounded by more green space improved more than pupils from schools with less green space.