Wheeeee, what a ride!

Wheeeee, what a ride!

So far, the markets are doing exactly what we expected them to do all month (see previous posts) ever since, in fact, that I wrote my post on May 15th (the tippy top on these charts) titled: "All-Time Highs Prove Investors Must be Stoned." The best part of looking back on these posts is to read all the comments of people telling me how wrong I was to doubt the might of the markets at the time.

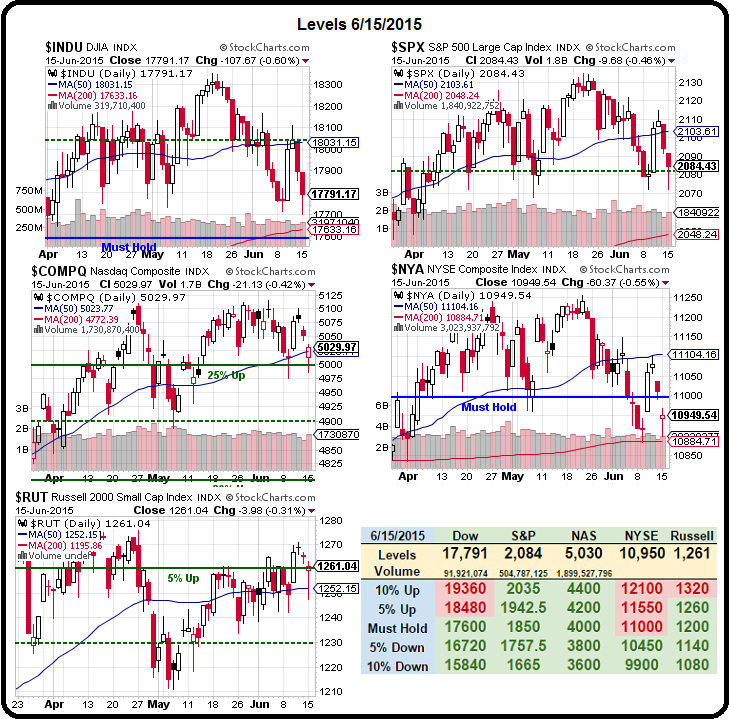

We did our mid-May Portfolio Review that day and our Short-Term Portfolio was up 119.5% at the time and fortunately, since we did call it correctly, we finished the day yesterday at +137.4%, gaining 18% as the S&P fell 2.5%. 2.5% is very significant to our 5% Rule™ so we'll be looking for a 0.5% "weak" bounce today and a 1% "strong" bounce by the end of the week.

Last Monday ("Bouncing or Bust"), we were focused on Germany's Dax Index as a leading index to the downside and on Weak Bounce Wednesday (10th) before the market opened we were already calling for a move back up. As I said at the time:

Speaking of gravity, we're looking for some weak bounces today, especially in Germany, where the DAX is completing a 10% correction (12,250 to 11,000) which is still above the 200-day moving average at 10,469, which would be another 5% drop from here. This is all perfectly normal after a 30% run from 9,500 in January, which is kind of a lot for a major market to move in 6 months.

As you can see from how well it obeys the lines Fibonacci Lines (see our primer here), the bots are firmly in control of the trading in Europe so this 50% retracement will be a huge test of sentiment over there. Of course we're going to have a "bullish" bounce off the 11,000 line – it's major support – the question is whether the bounce will be strong (40% retrace of the drop) or weak (20% retrace) and the drop was from 12,250 so 1,250 points means we're looking for a 250-point weak bounce to 11,250 this Friday and 11,500 by early next or the momentum will still be down.

Notice how well our 5% Rule™ does a lovely job of telling you exactly what is going to happen before it even happens. See the consolidation at 11,250? What that tells us is that the action was very Bot-driven (as that's what the rule looks for) and the struggle to get over 11,250 was an early indication that 11,500 was going to fail, which it did on Thursday.

That led us, in Thursday's post, to question the validity of our own strong bounce moves and we plotted out the lines for the US indexes as:

That led us, in Thursday's post, to question the validity of our own strong bounce moves and we plotted out the lines for the US indexes as:

- Dow 17,850 (weak) and 18,000 (strong) – recalculated as we never went lower to complete the bottom.

- S&P 2,090 (weak) and 2,100 (strong)

- Nasdaq 5,025 (weak) and 5,050 (strong)

- NYSE 10,970 (weak) and 11,050 (strong)

- Russell 1,250 (weak) and 1,260 (strong)

Today we'll be watching the Russell and the Nasdaq closely – they must hold up if the others are to even to get back to their weak bounce lines but it's all going to be led by the DAX, who are down 1% this morning and struggling to take back that 11,000 line, which failed as support on the 2nd attempt – the attempt the US indexes are now making on their own support levels…

As we expected, Greek PM Tsipras has paused the panic by making a speech this morning saying the negotiations will go on but that's what everyone says on the way to bankruptcy court, isn't it?

Tsipras stressed that he is not in a rush to come to an agreement with the creditors and, if need be, will not make the IMF loan payments due at the end of the month. In the discussion with Theodorakis, the PM appears confident that while the creditors seem to harden their stance towards Greece, they will ultimately cave in to avoid a Grexit.

That was all it took this morning to pull a dramatic turn-around in the EU markets, which were off more than 1% at the open. Still we're looking for those strong bounce lines by Friday or it's just another weak bounce on the way down to a proper correction of at least 5% and, don't forget, Germany is already down more than 10%, which is why it needs to retake that 11,000 line to give global investors a boost of confidence.

Speaking of confidence, German investor sentiment hit it's lowest point of the year, dropping 10.4 points since May to 31.5 vs the 37.3 predicted by leading economorons. That's down from 41.9 so pretty much a 25% drop in confidence in 30 days. "External factors are reducing the scope for further improvement of Germany's good economic situation. These include, in particular, the ongoing uncertainty over Greece's future and the restrained dynamic of the global economy," said ZEW president Clemens Fuest.

Speaking of confidence, German investor sentiment hit it's lowest point of the year, dropping 10.4 points since May to 31.5 vs the 37.3 predicted by leading economorons. That's down from 41.9 so pretty much a 25% drop in confidence in 30 days. "External factors are reducing the scope for further improvement of Germany's good economic situation. These include, in particular, the ongoing uncertainty over Greece's future and the restrained dynamic of the global economy," said ZEW president Clemens Fuest.

Don't worry though, despite the fact that it can't all be about Greece, all they have to do is "fix" Greece again and the markets will rally. Maybe it's still the "bad news is good news" meme as US New Home Construction fell 11.1% in May and our own Federal reserve will release a report tomorrow that (according to Fed whisperer, Jon Hilsenrath) downgrades its forecasts for economic growth to just 2.1% from 2.9% predicted in the March report.

The Fed begins their 2-day meeting today and will issue their statement tomorrow but these numbers indicate that there will be no reason to tighten at this point – especially with the almost non-existent outlook for inflation. Note the Fed Funds Rate Forecast has dropped dramatically and that's the best kind of market-booster as the free money express keeps on rolling. As noted by Hilsenrath:

The Fed begins their 2-day meeting today and will issue their statement tomorrow but these numbers indicate that there will be no reason to tighten at this point – especially with the almost non-existent outlook for inflation. Note the Fed Funds Rate Forecast has dropped dramatically and that's the best kind of market-booster as the free money express keeps on rolling. As noted by Hilsenrath:

Officials have conditioned the timing of a first interest rate increase on their confidence that inflation will return to their 2% objective and the job market will continue to improve. If their inflation forecasts were to come down or their unemployment forecasts deteriorate, they might consider putting off a rate increase.

Whether it's Greece being fixed, the Fed easing or some other form of good news or stimulus, we were expecting at least a weak bounce before going lower so the reason doesn't matter – what matters is whether or not we show real signs of holding the, so far, very mild 2.5% pullback lines. Based on what we've been observing overall – I don't think we're done going down until at least 5% but, in this crazy market, it doesn't pay to overdo the short betting.