Not the same as last Tuesday.

Not the same as last Tuesday.

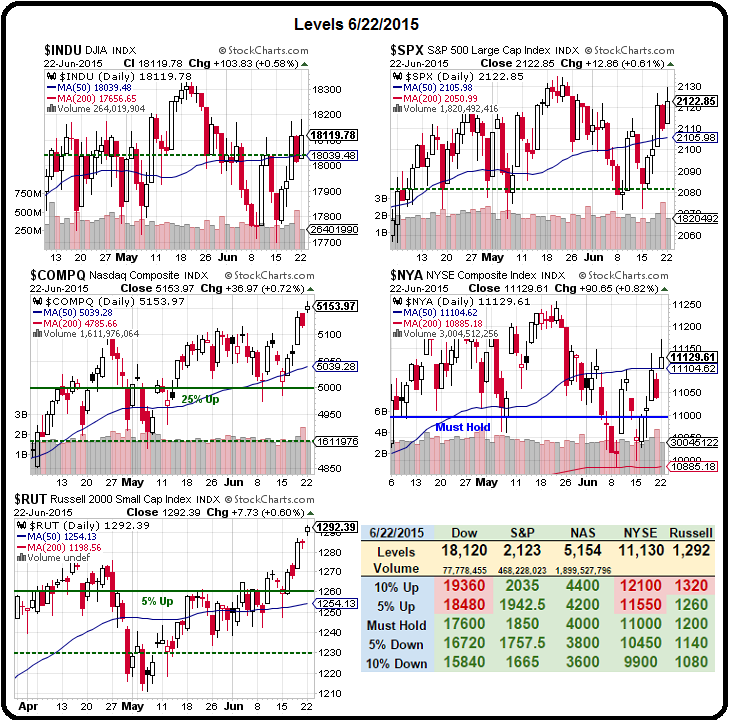

Last Tuesday we were testing our lows and we were looking to see if the indexes could bounce back and bounce back they did, past all of our Strong Bounce Lines at Dow 18,000, S&P 2,100, Nasdaq 5,050, NYSE 11,050 and Russell 1,260. We were also very concerned about Germany's DAX retaking its 11,500 line and yesterday we finished at 11,460 and today we are back over – all the way to 11,600 as Greece remains fixed for the 2nd consecutive day!

None of our underlying concerns have changed – only the immediate potential downside catalyst of a Greek default has (seemingly) been removed for the moment. We're not going to race back into the market but, on the other hand, we did plenty of bottom-fishing last week and added plenty of long trades to our portfolios (see our June Trade Review for a look at our free picks). Now we're headed back into earnings season with plenty of cash in our wallets, looking for more stocks to go on sale.

The whole market doesn't have to down for there to be bargain stocks. While the Nasdaq made a new all-time high yesterday, 40 of it's component stocks made 52-week lows. 57 new lows were made on the NYSE as well, where 1/3 of the index is within 5% of their year's lows, despite the recent round of exuberance.

For an up 1% day, yesterday was a pathetically low-volume affair – as you can see from Dave Fry's S&P ETF (SPY) chart. The index fell from 213.34 on Thursday to 210.36 on Thursday on 195M shares but all the way back to just under 212 on 65M shares. Hey, it's more than a quarter (but less than a third) – so let's not quibble over whether it's meaningless or manipulated and just sit back and enjoy the show.

For an up 1% day, yesterday was a pathetically low-volume affair – as you can see from Dave Fry's S&P ETF (SPY) chart. The index fell from 213.34 on Thursday to 210.36 on Thursday on 195M shares but all the way back to just under 212 on 65M shares. Hey, it's more than a quarter (but less than a third) – so let's not quibble over whether it's meaningless or manipulated and just sit back and enjoy the show.

You need the same sort of suspension of disbelief watching the markets as you do watching Jurassic World. Not so much that people are living with dinosaurs but that Ingen is still in business after 3 previous park disasters and this time their idea is to put much bigger dinosaurs in a new park with 100x more people! Now THAT is irrationally exuberant!

Compared to that leap of faith that everything will work out just fine, investing in the markets on the same premise seems almost rational, doesn't it? So what if we've seen this movie before? So what if we're making the same mistakes we made last time? This time we have even richer rich people and 10x more poor people for them to terrorize (economically) with only some very thin walls preventing riots and mass hysteria from breaking out. How about a picnic? Watching people who should know better ignoring risks that are all around them is what I do for my day job, so I didn't enjoy going to see Jurassic World and seeing more of the same…

More of the same is all we're seeing in the markets as we run back up to record highs in stocks while Commodities and Transports continue to be weak – indicating that now one is actually buying anything or going anywhere but that's important in the "new market paradigm," where height makes right. In fact, just yesterday I mentioned how ridiculously-priced Netflix (NFLX) was and, of course Oppenheimer's Jason Helfstein decided to raise their price target to $775 from $610 because – get this – he expects them to have 239M subscribers by 2020. That's up from 60M today, in 2015, after 8 years in business.

More of the same is all we're seeing in the markets as we run back up to record highs in stocks while Commodities and Transports continue to be weak – indicating that now one is actually buying anything or going anywhere but that's important in the "new market paradigm," where height makes right. In fact, just yesterday I mentioned how ridiculously-priced Netflix (NFLX) was and, of course Oppenheimer's Jason Helfstein decided to raise their price target to $775 from $610 because – get this – he expects them to have 239M subscribers by 2020. That's up from 60M today, in 2015, after 8 years in business.

As you can see from the chart above, we have a nationwide epidemic of post-college kids still living with their parents, so of course they are watching NFLX! If that's the Future for this planet – get me on one of those shuttles out of here… 50 to 60% of the households in those dark blue states got their kids back after college. How is that a healthy economy? Over in Europe, 45-55% of people between the ages of 25-34 live with their parents. As an investor, you can see in the short run how this benefits NFLX, Chipotle (CMG), Starbucks (SBUX), etc. and, of course, how it's detrimental for people selling houses, couches, washing machines and other durables that young people used to buy at that age.

That's why our May Durable Goods Report is down 1.8% this morning and the April Report has been revised to down 1.5% from down 1% and, if not for that huge March spike, the whole year would be negative! Keep in mind that the market is at an all-time high while this chart (of stuff we sell in the economy) has been downhill for 5 straight years.

That's why our May Durable Goods Report is down 1.8% this morning and the April Report has been revised to down 1.5% from down 1% and, if not for that huge March spike, the whole year would be negative! Keep in mind that the market is at an all-time high while this chart (of stuff we sell in the economy) has been downhill for 5 straight years.

There's that "new paradigm" we love to hear about. It doesn't matter if companies don't sell any stuff, or make any profits – that's not what the stock market is about these days. The stock market is about betting on companies' POTENTIAL to sell stuff and POTENTIAL to make a profit – whether or not they actually do it is just a distraction. That's why the chartists are in charge as they are able to make their market predictions entirely unencumbered by factual analysis – it's very liberating.

As long as the free money keeps flowing, getting a return on the money you invest doesn't matter – they'll just print some more tomorrow, won't they? Well what if they don't? What if the Fed or ANY other Central Bank decides to put the brakes on? THAT is the Fundamental we are currently concerned with and it's not even a rate rise that we are worried about – just the lack of further increases will not give us enough cash to feed the ever-growing market beast.

That's why we keep shorting the S&P here at 2,120 (and we just called for a short on Russell Futures (/TF) at 1,190 and Nikkei Futures (/NKD) at 20,900 in our Live Member Chat Room this morning). That's why we are sticking to bargain stocks – ones we won't regret owning IF things do fall apart, rather than chasing high-flyers like NFLX, AMZN, TSLA, etc. If this rally is real and sustainable, then someone, somewhere, one day will need materials.

So far, there's no sign of that – think about it…