Reminder: Sabrient is available to chat with Members, comments are found below each post.

Courtesy of Sabrient Systems and Gradient Analytics

.png) Of course, all eyes have been on Greece in an ongoing saga that, although critical to the Greeks, is mostly just an annoying distraction for global investors — partly because it has been going on for so many years, with the proverbial can of inevitability continually being kicked down the road, and partly because there can be no winners in this intractable situation. Predictably, the electorate chose to follow the advice of the communists that they elected and reject the rigid bailout offer, calling the bluff of the IMF, ECB, and Eurozone and betting they will do whatever it takes to avoid losing one of its members. These are uncharted waters, and with the resultant shadow of uncertainty hanging over the markets, traders fled to the safety of cash, and the S&P 500 has relied upon support from its 200-day simple moving average to kick in (both last Monday and again today). But the technical picture may be firming up for the bulls. Moreover,, I would characterize the resulting market action as an orderly retreat rather than panic selling as traders appear to be simply taking risk off the table while preparing for a buying opportunity.

Of course, all eyes have been on Greece in an ongoing saga that, although critical to the Greeks, is mostly just an annoying distraction for global investors — partly because it has been going on for so many years, with the proverbial can of inevitability continually being kicked down the road, and partly because there can be no winners in this intractable situation. Predictably, the electorate chose to follow the advice of the communists that they elected and reject the rigid bailout offer, calling the bluff of the IMF, ECB, and Eurozone and betting they will do whatever it takes to avoid losing one of its members. These are uncharted waters, and with the resultant shadow of uncertainty hanging over the markets, traders fled to the safety of cash, and the S&P 500 has relied upon support from its 200-day simple moving average to kick in (both last Monday and again today). But the technical picture may be firming up for the bulls. Moreover,, I would characterize the resulting market action as an orderly retreat rather than panic selling as traders appear to be simply taking risk off the table while preparing for a buying opportunity.

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

At the close of 1H2015, among the U.S. business sectors, top performers for the first half were Healthcare and Consumer Services (Discretionary/Cyclical), particularly the homebuilders like the SPDR S&P Homebuilders ETF (XHB), while income-oriented Utilities and REITs, as well as Energy, and Metals & Mining have been big laggards. The 10-year US Treasury yield hasn’t moved much, closing last week at 2.39%.

Although Puerto Rico has thrown itself into the mix of debt calamities, the major crisis of the moment has been Greece and the Eurozone. After all, the whole concept of a single currency shared by such diverse cultures and politics effectively set up certain countries for failure. But although Spain, Portugal, and Ireland previously demonstrated that structural reform can work, Greeks are reluctant to endure any further pain and now are appealing to the charity and humanitarian nature of their creditors. Greek polls had been showing that a large majority of Greeks want to remain in the Eurozone but trust that they can win the game of chicken and reach a deal without the tax hikes and pension reform demanded by lenders and rejected by Prime Minister Tsipras and his communist Syriza party. If a so-called Grexit is indeed in the cards, that does not (and probably will not) mean an exit from the EU, but only from the Eurozone.

Despite the ongoing Greek saga, stocks in Europe, Australasia and the Far East (aka, EFA) have continued to outperform the US and emerging markets. However, China has given back much of its huge gains — after rising as much as 110% from November to a peak on June 12, Shanghai shares have fallen around 30%, and in the process has wiped out about $3 trillion in market capitalization. It might be hard to put that amount in perspective, so for comparison, it is more than the value of Germany’s entire stock market. Nevertheless, the Shanghai index remains up +14% YTD and +80% over the past 12 months. In an effort to staunch the bleeding and continue to facilitate the conversion of huge debts into equity, China cut interest rates for the fourth time since November, lowered required reserve ratios, allowed pension funds to invest in Shanghai shares, injected massive liquidity at lower rates, loosened margin trading rules and gave margin lenders enhanced liquidity, threatened the (mostly foreign) short sellers, put a moratorium on IPOs, and bought up shares every day in late trading to prop up prices. Most global investors look at China as the biggest risk to the global economy.

The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, closed last week at 16.79 after nearly hitting 20 a couple of times earlier in the week. So, it has reflected fear but not panic. The behavior of the VIX indicates traders simply taking some risk off the table, but perhaps also preparing for a buying opportunity rather than hibernating with the bears.

By the way, I have been on the road quite a bit lately, supporting the rollout of our mid-year Growth at a Reasonable Price (aka, GARP) top picks portfolio, which First Trust Portfolios licenses and packages as the Sabrient Forward Looking Value Portfolio, a unit investment trust. It employs the same selection process as our annual Baker’s Dozen portfolio, but with 35 names instead of 13 so as to maximize the risk-adjust return and limit single-stock risk.

Over the past several weeks, my colleagues and I have spread out across the country, from Fort Lauderdale to Seattle, from New Orleans to Milwaukee, from Boston to San Diego. We speak with groups of financial advisors, describing our disciplined stock selection process and promoting the portfolios, and the reception from these audiences has been overwhelming. Many of the advisors are subscribers to this newsletter, so I would just like to say that the confidence you have placed in David Brown, me, and the rest of the Sabrient team is humbling, and we are dedicated to the task of maintaining your trust and respect.

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed last week at 207.31, after getting a solid bounce last Monday at the important 200-day simple moving average. Oscillators RSI, MACD, and Slow Stochastic all emerged from oversold territory and seem poised to rise higher — with of course some inevitable news-driven bumps along the way. Although the large bullish ascending triangle that had been forming (resistance at 212 and rising support line from the long-standing uptrend line) has broken to the downside, strong support was nearby and could serve as a new launch point. Some technicians are saying that the uptrend line could now serve as prior support-turned-resistance, but I think bulls will be eager to retake that line if the global news allows it. Minor resistance at the moment is the 208 level of prior failed support. Next major support remains the critical 200-day SMA (approaching 206), followed by earlier-in-year support at 204, then round-number support at the 200 price level.

Latest sector rankings:

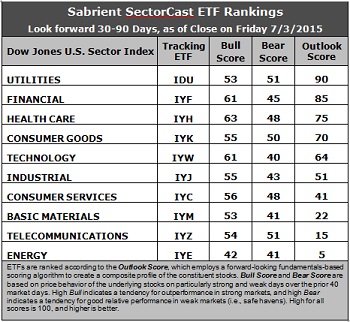

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Utilities takes first place with a strong Outlook score of 90, primarily due to its low (best) forward P/E, relatively solid Wall Street analyst support (net upward revisions to earnings estimates), and reasonable insider sentiment. Financial takes second with a score of 85 and displays the next lowest forward P/E, as well as reasonably good sentiment among both Wall Street analysts (upward revisions to earnings estimates) and insiders (buying activity). Healthcare takes third place with a score of 75, followed by Consumer Goods (Staples/Noncyclical) and then Technology.

2. Energy is in the cellar with an Outlook score of 5, while Telecom takes the second spot in the bottom two with a 15. Both sectors score poorly in most factors of the GARP model across the board.

3. Looking at the Bull scores, Healthcare displays the top score of 63, followed by Technology and Financial as the only other sectors above 60. Energy has the lowest Bull score of 42 and is the only one below 50. The top-bottom spread is 21 points, reflecting low sector correlations on particularly strong market days. It is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold.

4. Looking at the Bear scores, Utilities and Telecom display the top score of 51, followed by Consumer Goods (Staples/Noncyclical) at 50, which means that stocks within these sectors have been the preferred safe havens (relatively speaking) on weak market days. Technology scores the lowest at 40. The top-bottom spread is 11 points, which reflects high sector correlations on particularly weak market days. Ideally, certain sectors will hold up relatively well while others are selling off, so it is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Utilities displays the best all-around combination of Outlook/Bull/Bear scores, while Energy is clearly the worst. Looking at just the Bull/Bear combination, Healthcare is the best, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Energy by far the worst.

6. Overall, this week’s fundamentals-based Outlook rankings have taken a defensive turn with Utilities at the top and Consumer Goods (Staples/Noncyclical) in the top four, ahead of Technology, Industrial, Consumer Services (Discretionary/Cyclical), and Basic Materials. Keep in mind, the Outlook Rank does not include timing or momentum factors, but rather is a reflection of the fundamental expectations of individual stocks aggregated by sector.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), now reflects a neutral bias and suggests holding Utilities, Financial, and Healthcare, in that order. (Note: In this model, we consider the bias to be neutral from a rules-based trend-following standpoint when SPY is below its 50-day but still above its 200-day simple moving average.)

Other highly-ranked ETFs in SectorCast from the Utilities, Financial, and Healthcare sectors include Utilities Select Sector SPDR Fund (XLU), iShares US Broker-Dealers ETF (IAI), and Market Vectors Biotech ETF (BBH).

For an enhanced sector portfolio that enlists some top-ranked stocks (instead of ETFs) from within the top-ranked sectors, some long ideas from Utilities, Financial, and Healthcare sectors include SCANA Corp (SCG), The AES Corp (AES), Cowen Group (COWN), Raymond James Financial (RJF), Receptos (RCPT), and Regeneron Pharmaceuticals (REGN). All are highly ranked in the Sabrient Ratings Algorithm.

If you prefer to play a bounce and maintain a bullish bias, the Sector Rotation model suggests holding Healthcare, Financial, and Technology, in that order. But if you prefer a defensive stance on the market, the model suggests holding Utilities, Consumer Goods (Staples/Noncyclical), and Healthcare, in that order