Arrest them! Arrest them, arrest them –

That was the word from the Communist Party last night as they halted one half the market and made it illegal to short the other half while the PBOC, the brokers, the banks and even Goldman Sachs went all in to pump up the markets for the Top 1% over in the "People's" Republic of China.

Poor Mao must be rolling over in his grave to see the shenanigans going on in China this week as the Chinese Governments goes to EXTREME measures to prop up the markets and rescue the speculators who have helped to destroy the agrarian economy the Chairman built the country around.

Poor Mao must be rolling over in his grave to see the shenanigans going on in China this week as the Chinese Governments goes to EXTREME measures to prop up the markets and rescue the speculators who have helped to destroy the agrarian economy the Chairman built the country around.

Aside from shutting down half the market (still not trading), banning short selling and pumping Billions into the market through various mechanisms (all since yesterday's open), China has also banned "major stockholders" from selling stakes in public companies. This is not just insiders, this includes funds and money managers as well! “It suggests desperation,” Mark Mobius, chairman of Templeton Emerging Markets Group, said by phone. “It actually creates more fear because it shows that they’ve lost control.”

The China Securities Regulatory Commission said Wednesday that investors with holdings exceeding 5 percent as well as corporate executives and directors are prohibited from selling stakes for six months. They even got their buddies at Goldman Sachs to put out a statement saying "There is no China Stock Bubble – in fact, we see a rally ahead."

The rule is intended to stabilize capital markets amid an “unreasonable plunge” in share prices, the CSRC said. While China has already ordered government-owned institutions to maintain or increase stock holdings, the CSRC directive expands the sales ban to non-state companies and potentially foreign investors who own major stakes in mainland businesses.

While the authorities should “pull out stops” as much as they can during a crisis, China’s actions may backfire by scaring away investors, said Burton Malkiel, author of the investment classic “A Random Walk Down Wall Street” and an economics professor at Princeton University. “I am not sure this is going to work,” Malkiel said by phone. “When the government does this, it might be a sign that ‘Oh my God, the government is panicked and we ought to get out even sooner.’’

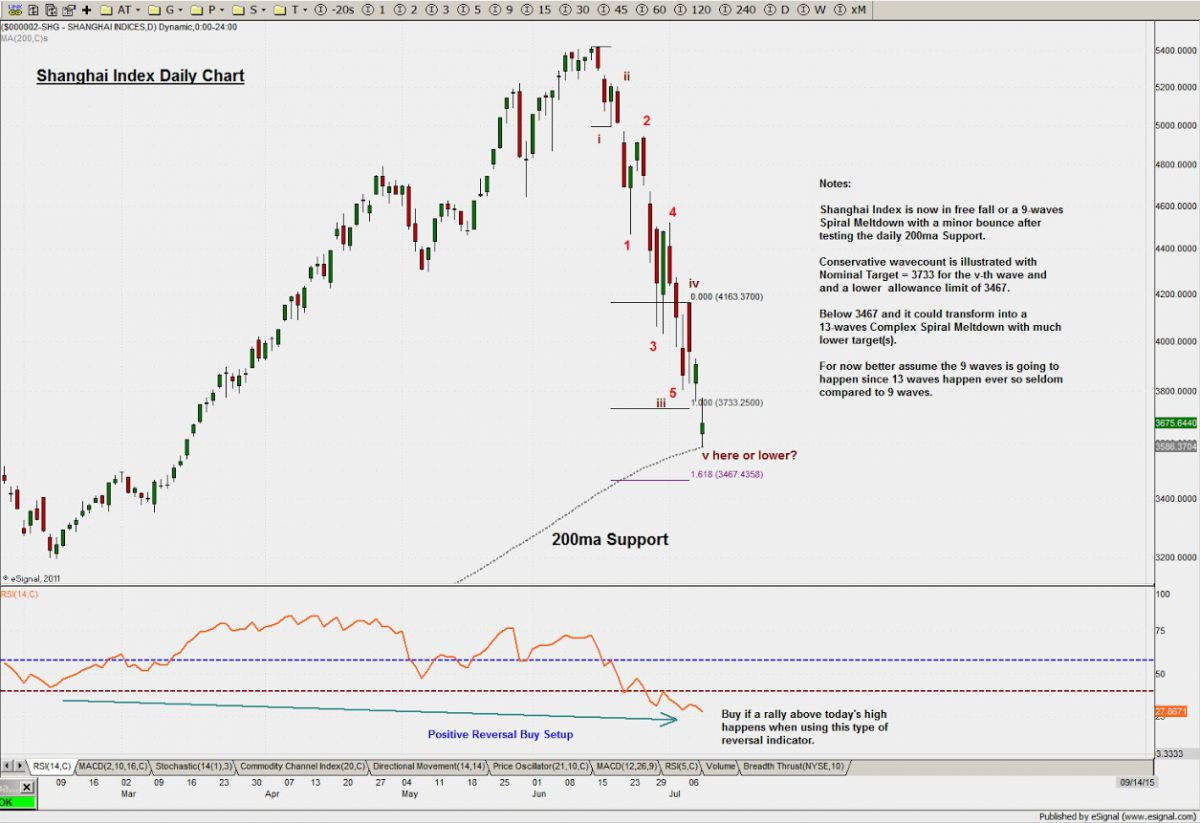

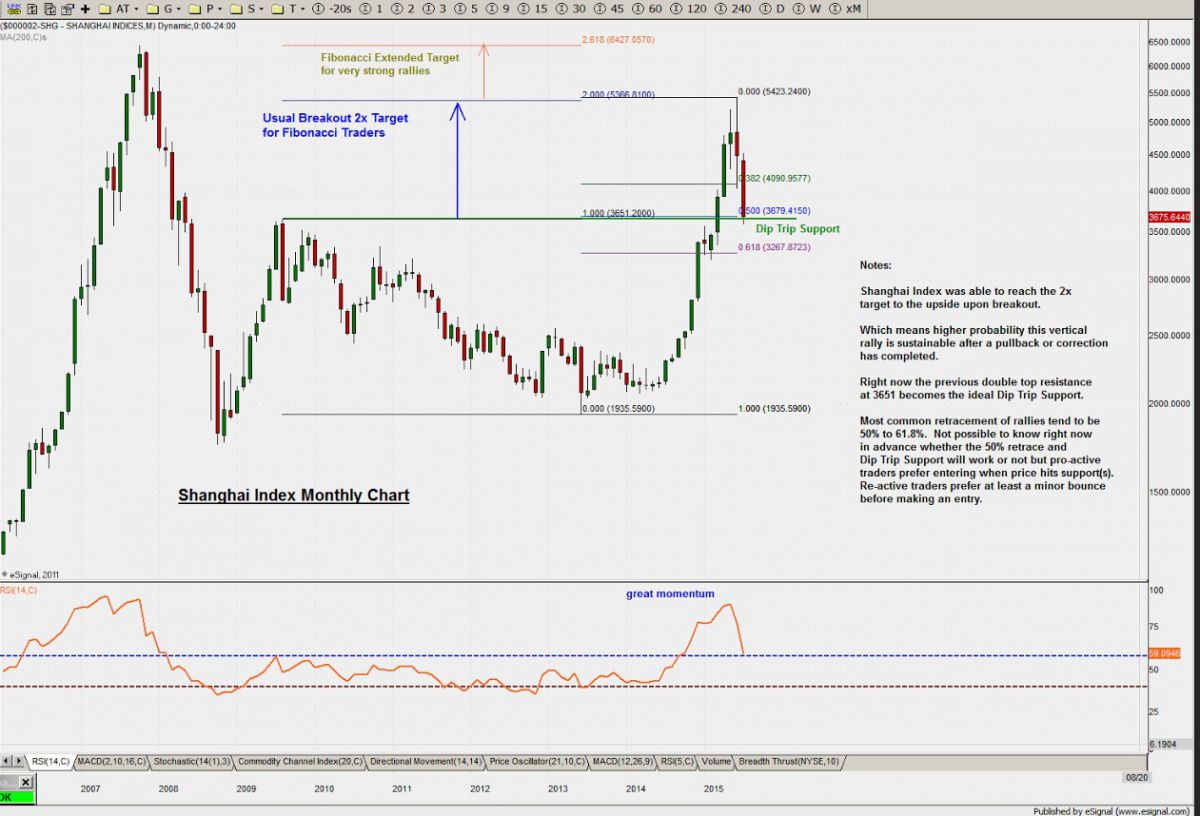

As you can see from Aarc's charts above, both GS and the PBOC know that hitting the 200-day moving average is an excellent time to jump in and "take measures" or predict a turnaround as that's pretty much what happens at 200-day moving averages. If you don't get a bounce off that line – WATCH OUT BELOW!

Our fabulous 5% Rule™ tells us that a drop from 5,400 to 3,250 is 40% and, from that line we expect an 8% weak bounce back to 3,500 (where the markets held yesterday) and a 16% strong bounce back to 3,750, which is right about where we finished the session (3,709).

So there's nothing at all unexpected about this rebound in the Shanghai except that none of it is real since, aside from the stimulus, half the market is shut down and no one is allowed to short. Given those conditions, we should be bouncing 1,500 points – not 500!

Still, the beautiful sheeple in the US and EU markets are loving it (and maybe Greece will be "fixed" on Sunday, of course) and they are pouring back into the markets this morning and erasing most of yesterday's losses which is great with us as we called a bottom yesterday at 3pm in our Live Member Chat Room, where I said:

I like /TF for a gamble on a bounce into the close off the 1,220 line with VERY TIGHT stops below.

TNA July $86.50s at $2 were in the money this morning.

As you can see, we NAILED IT and already this morning those /TF longs are already testing 1,240 for a $2,000 per contract profit in just over 12 hours (you're welcome!). I'd take the money and run on those as well as TNA at the open – that was easy money and I'm not sure how long this prop job will last.

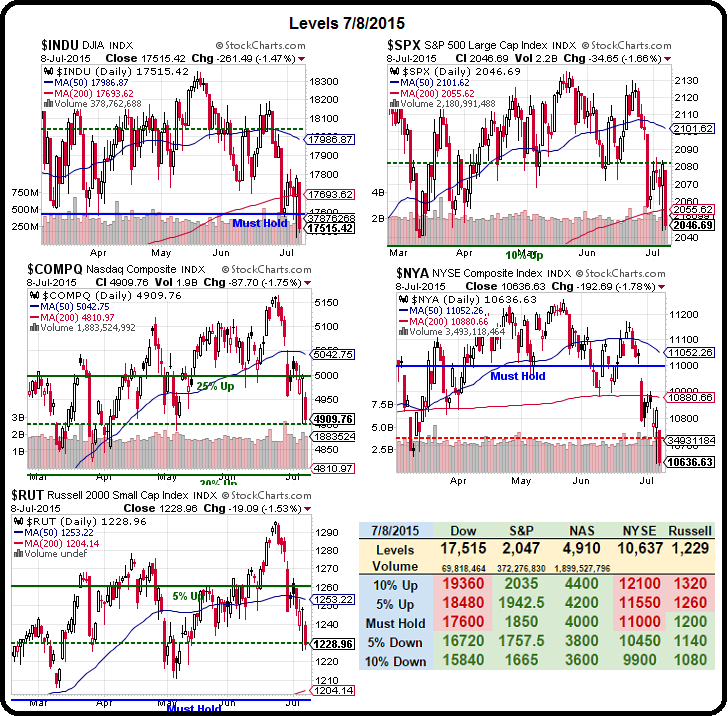

Of course we still have our own weak and strong predictions to look for (from Tuesday morning's post)

Of course we still have our own weak and strong predictions to look for (from Tuesday morning's post)

- Dow 17,725 (weak) and 17,850 (strong) closed at 17,515

- S&P 2,075 (weak) and 2,090 (strong) closed at 2,047

- Nasdaq 5,025 (weak) and 5,075 (strong) closed at 4,910

- NYSE 10,850 (weak) and 10,950 (strong) closed at 10,637

- Russell 1,255 (weak) and 1,270 (strong) closed at 1,229

We needed to see STRONG bounce lines by tomorrow's close to get more bullish – today we're still waiting to see if they can take back the weak ones. Speaking of weak, the Chinese index plays I mentioned the other day were:

- FXI short at $42, now $38.95 – up 7.3%

- CHAU short at $28.39, now $21.26 – up 25%

- FXP long at $37.37, now $41.93 – up 12.2%

If you got your profits off the table on our reverse call yesterday, you may want to consider getting back in when the positions reverse begins to reverse again – we'll be keeping an eye on things but, like the US Index Futures – we're back to looking for shorting opportunities at Dow 17,700 (/YM), S&P 2,070 (/ES), Nasdaq 4,410 (/NQ) and Russell 1,240 (/TF) because nothing is fixed – just more cups and balls…

Be careful out there!