When the flood comes

Courtesy of Joshua M Brown

Courtesy of Joshua M Brown

. . . on that day all the fountains of the great deep were broken up, and the windows of heaven were opened. And the rain was on the earth forty days and forty nights…

All flesh that moved on the earth perished, birds and cattle and beasts and every swarming thing that swarms upon the earth, and all mankind; of all that was on the dry land, all in whose nostrils was the breath of the spirit of life, died. – Genesis

When the flood comes, all of the bullshit arguments among the financial commentariat will come to an end.

This will be my third time through. Believe me. We will not be arguing about how many basis points an advisor charges versus another advisor or a software program.

The people who are there for their clients and keep a cool head in public will come through okay. More than okay – they’ll actually raise assets from new and existing households who realize what a mistake they’ve made with their previous advisor or solution.

The automated services will see that “clients” are reacting to market volatility by logging back in and lowering their risk tolerance settings, thus throwing off long-term returns because they can’t take the short-term any more. Inbound flows will dry up as unsophisticated savers tweak their settings. “I’m not throwing any more good money after bad,” they’ll say. “Better wait til the coast is clear before investing any more.” Behavioral sabotage, impossible to control without a human voice and eye contact.

The people having knock-down, drag-out fights about whether “tax loss harvesting” adds 25 or 50 basis points in annual performance will be washed out to sea on a tide of their own obstreperousness.

The active fund managers who’ve been so utterly beaten by the index debate will stop obsessing over cash drag and remember what it means to manage assets again.

And the Passive Taliban will also be silenced, at least temporarily. You’ll hear much less along the lines of:

“I’m so passive, I don’t make a single trade all year.”

“Oh yeah? Well I’m so passive I dropped the login password for my accounts into a river.”

“Oh yeah? Well I’m so passive, I don’t even get out of bed during market hours.”

“Well take this – I’m so passive I don’t cast a shadow.”

“I’m so passive I don’t even f***ing breathe.”

The wake-up bell about smart beta will ring throughout the land – the reckoning will come that factor tilts do not lower volatility or protect your downside in a correction and may even exacerbate short-term drawdowns. Deep value becomes even deeper value and small caps get even smaller before the waves die down. Are they prepared to explain this? Are you prepared to accept it?

A new crop of devils who “saw it coming” will replace the old crop who have, by now, squandered all of the good will they’d accrued from the 2007-2011 period of prognostications. True, this will be a whole new ream of bullshit being unspooled, but at least the Augean Stables will have been thoroughly hosed out.

When the flood comes, the stupidity of our current nickel-and-dime bickering and ideological bitchfights will be laid bare for all to see. And when the waters subside, there will be real investors and advisors standing; bruised and battered, but still standing nonetheless. And stretched before them in the dawning light, miles of theoreticians and algorithmists face-down in the soaking sand.

***

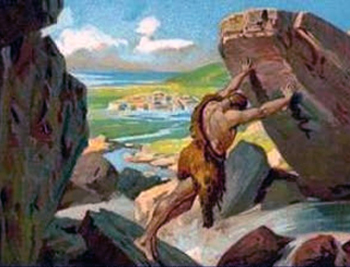

Hercules reroutes a river to clean the Augean Stables

This post was originally published here on May 22nd 2015.

Top picture via Pixabay.