Visit Phil's Stock World for the latest market news, commentary and trade ideas.

Financial Markets and Economy

FCC Grants Approval of AT&T-DirecTV Deal With Conditions (Bloomberg)

AT&T Inc. won permission Friday to buy satellite-TV provider DirecTV after promising to spread broadband to more homes and businesses.

The $48.5 billion merger creating the largest U.S. pay-TV provider was approved by the Federal Communications Commission, according to a news release from the agency. Earlier the Justice Department said it wouldn’t challenge the deal because the transaction doesn’t pose a risk to competition.

Goldman Sachs is crushing tech deals (Business Insider)

Mobile payments startup Square reportedly filed to go public on Friday.

Now CNBC is reporting that Goldman Sachs will lead the IPO, with Morgan Stanley also hired as an advisor. Bloomberg reports that JPMorgan is also working on the deal.

The fact that Goldman scored the lead role on what could be one of the year's hottest flotations should not come as a surprise.

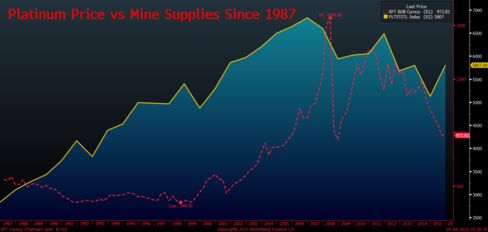

The World's Third-Biggest Platinum Miner Just Announced That It's Cutting Production (Bloomberg)

The platinum industry is seeing the first big mine closings in two years, and it may be just the beginning.

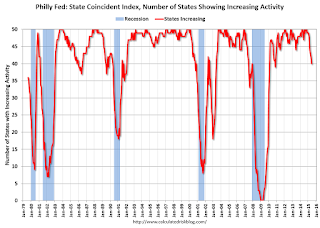

State Coincident Indexes increased in 40 states in June (Calculated Risk)

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for June 2015. In the past month, the indexes increased in 40 states, decreased in seven, and remained stable in three, for a one-month diffusion index of 66. Over the past three months, the indexes increased in 42 states, decreased in six, and remained stable in two, for a three-month diffusion index of 72.

How the commodity crisis has divided bond investors (Market Watch)

How the commodity crisis has divided bond investors (Market Watch)

The meltdown in commodity prices has divided bond investors into opposite camps.

Treasury investors are rubbing their hands with glee, because falling prices could force the Federal Reserve to delay an interest-rate increase. But high-yield bond investors fear bond selloffs and spiking yields.

The high-yield bond market consists of lower-rated corporate credits, usually at so-called junk credit quality. These risky bonds offer higher yields than safer bonds, like Treasurys and other government bonds.

A few big winners keep U.S. stock market afloat in 2015 (Business Insider)

Amazon's stock price surge into Friday made it the latest of a series of companies to boom following results, and its performance this year, along with a few others, has basically kept the S&P 500 above water.

Data from S&P Dow Jones Indices shows that the gains in Amazon <AMZN.O>, Facebook <FB.O>, Google <GOOGL.O> and Netflix <NFLX.O> account for more than 50 percent of the broad S&P 500's rise of just over 1 percent so far in 2015. Add in Apple <AAPL.O>, and those five companies account for nearly 60 percent of the year's gains, according to S&P index analyst Howard Silverblatt.

Here's Some Economic Data To Get Excited About For Next Week (Bloomberg)

Here's Some Economic Data To Get Excited About For Next Week (Bloomberg)

There's a lot of economic data coming out next week and the following week. One data point to watch is Friday's Employment Cost Index (ECI) report for the second quarter. This is a quarterly survey that looks at the total cost of labor in the U.S. and lately it's been accelerating.

Whereas normal wage growth, as measured by average hourly earnings, has been somewhat stagnant, the ECI is indicative of a tightening labor market. Ultimately it's reasonable to expect the two different measures to trend in the same direction. So if we get another strong and accelerating ECI, then watch out for more talk about rising wages, a tightening labor market and what that might mean for the Federal Reserve.

Howard Marks Interviewed: "There’s No Free Market Today" (Zero Hedge)

Howard Marks Interviewed: "There’s No Free Market Today" (Zero Hedge)

Earlier this year, Oaktree Capital Management's Howard Marks asked what is perhaps the most important question for capital markets: "What would happen if a large number of holders decided to sell a high yield bond ETF all at once?"

The answer, of course, is that fund managers would be left with a massive, non-diversifiable, unidirectional flow which would force them to either tap emergency liquidity lines with banks to meet redemptions or else risk selling the underlying bonds into an increasingly thin secondary market for corporate credit; the former option is a delay-and-pray scheme while the latter has the potential to trigger a sum-of-all-fears scenario wherein illiquidity quickly begets a fire sale.

This ominous chart pattern warns of selloff in bank stocks (Market Watch)

A bearish engulfing chart pattern is warning that the financial sector’s uptrend, that took it a multiyear high earlier this week, may have just ended.

1.5 million teens don't think they can get a job in this economy (Business Insider)

1.5 million teens don't think they can get a job in this economy (Business Insider)

One of my first paid jobs was washing dishes in the restaurant of a Holiday Inn. I was 13, and lied on the application that I was 16, the minimum age they would accept. It wasn’t a glamorous position, but it did provide a paycheck. And it came with all of the vagaries you’d expect from such a job – unpleasant working conditions, the requirement to always be on-time, shifts scheduled when I’d rather be hanging out with friends, and the proverbial bad boss.

I meandered through a number of jobs in my teen years, learning what was expected of me as an employee and how to work within corporate structures along the way.

What's Really Killing Capitalism (Bonner And Partners)

What's Really Killing Capitalism (Bonner And Partners)

New knowledge – accumulated by others – is threatening. It is what causes disruption. And what economist Joseph Schumpeter called “creative destruction.”

Cronies fear this new knowledge and try to block it from ever happening – with subsidies, licensing requirements, and other regulatory impediments.

Emerging Market Currencies Tumble to Record Low in 'Violent' Selloff (Bloomberg)

Emerging-market currencies are in free fall.

An index of the major developing-nation currencies fell to an all-time low this week, extending its drop over the past year to 19 percent, according to data compiled by Bloomberg going back to 1999. The Russian ruble, Colombia's peso and the Brazilian real have fallen more than 30 percent over the past year for some of the worst global selloffs.

Worries over slowing global growth have put this sector into correction territory (Market Watch)

Worries over slowing global growth have put this sector into correction territory (Market Watch)

It has been a rough week for commodities.

A dive in broad swathes of the metals market, as well as a fresh tumble in oil, has market participants fretting about slowing global growth.The downbeat sentiment has helped push the materials sector into correction territory, according to analysts.

Shaky results from bellwethers such as Dow component Caterpillar and metals-mining giant Freeport-McMoRan have lent credence to the market’s growth concerns, intensifying the downward pressure on materials.

How to score clients all over the globe (Business Insider)

How to score clients all over the globe (Business Insider)

Advisors are always looking for ways to add new clients. Global Wealth Management Group has seen overseas assets explode by almost 1,000% since 2010 to $325 million, and they shared some tips with Wealth Management. The firm says it's important to be able to discuss what's happening with their clients, and to do so they read overseas newspapers to stay current. While some advisors have it easy in the sense they are a foreign national or have a spouse that is, others have to start from scratch. The best way to go about it is to focus on one or two nationalities and be patient, Ozgur Karaosmanoglu told Wealth Management. Many of these potential clients have never invested in the US before, so it takes time to educate them about the culture of US investing, as well as tax laws and other intricacies.

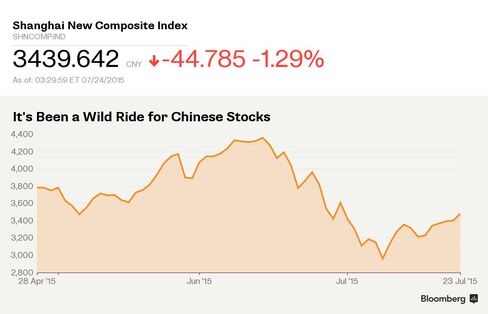

This Is What Bridgewater Said About China's Stock Market (Bloomberg)

Despite the roller-coaster ride that has been Chinese stocks in recent months, Bridgewater Associates, one of the world's largest hedge funds, had remained bullish on China's market and economy. But that appeared to change this week. In a new note released to clients on Tuesday, the hedge fund founded by Ray Dalio appeared to change its view, noting a number of growing concerns in the world's second-biggest economy.

Stocks Suffer Worst Week Of Year Amid Biotech Bloodbath, Commodity Carnage, & Bond Buying (Zero Hedge)

This seemed appropriate…

Stocks are rolling over — Dow off 160 (Business Insider)

It's starting to get ugly out there.

On Friday, stocks were lower across the board and slowly grinding to their lows of the day through the afternoon.

It’s a bad-news bear market for crude oil (Market Watch)

It’s a bad-news bear market for crude oil (Market Watch)

Oil is getting mauled. A fresh plunge in prices for West Texas Intermediate has given way to a bona fide bear market this week, and some analysts don’t think the battered commodity will be quick to rebound.

Crude-oil futures CLU5, -0.99% settled Thursday at $48.45 a barrel on the New York Mercantile Exchange, their lowest settlement since March 31. Based on that, prices were down more than 20% from their $61.43 settlement high in June—meeting the criteria for a “bear market.”

Nigeria Central Bank Holds Key Interest Rate at Record High 13% (Bloomberg)

Nigeria Central Bank Holds Key Interest Rate at Record High 13% (Bloomberg)

Nigeria’s central bank kept its key interest rate unchanged at a record high in its first policy meeting since President Muhammadu Buhari took office and after inflation broke the regulator’s target band last month.

Eight out of 12 members of the Monetary Policy Committee voted to hold the rate at 13 percent, Governor Godwin Emefiele told reporters on Friday in the capital, Abuja. That was in line with the forecasts of 21 of 23 economists surveyed by Bloomberg.

5 Things To Ponder: Shades Of Risk (Street Talk Live)

Is it just me? Last week while on vacation, the markets surged back to all-time highs as the Greek and China problems were solved. Unfortunately, as I left white, sandy beaches and clear ocean waters behind me to return to reality – so did the markets. Either it is purely coincidental or I should head back to Mexico. Personally, I am hoping for the latter.

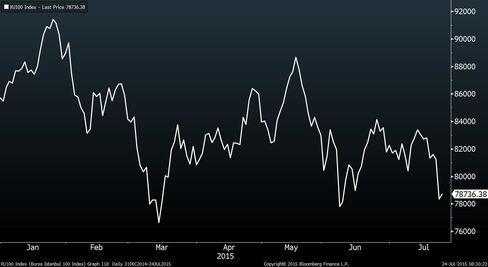

Miners walloped the FTSE 100 today (Business Insider)

Mining shares hammered down the FTSE 100 today.

JPMorgan Tells Turkey Bears Not to Run Away as BofA Touts Stocks (Bloomberg)

Many investors are fleeing Turkey as the escalating violence along its border compounds the woes of a nation that’s gone without a government for seven weeks. But many is not all.

U.S. consumer electronics firm Vizio files for IPO (Venture Beat)

U.S. consumer electronics firm Vizio files for IPO (Venture Beat)

Consumer electronics company Vizio Inc filed with U.S. regulators on Friday to raise up to $172.5 million in an initial public offering of Class A common stock.

BofA Merrill Lynch, Deutsche Bank Securities and Citigroup are among the underwriters of the IPO, Vizio told the U.S Securities and Exchange Commission in a preliminary prospectus.

New Home Sales Slump to Seven-Month Low (NY Times)

Despite two straight months of declines in new home sales, new home sales were up 18.1 percent compared to June of last year.

Why everyone blames China for slumping commodity prices (Business Insider)

The Chinese economy is in a serious slowdown. On Friday, we learned that small and medium-size manufacturing firms in China are struggling.

Growing Up With the Harvest: Oregon Pot Entrepreneur Ready for the Legal Market (Inc.)

Growing Up With the Harvest: Oregon Pot Entrepreneur Ready for the Legal Market (Inc.)

A semi-pro surfer, Randy Bilton spent the 1960s hunting big swells all over the world, but it was his hobby that resulted in a legacy his son Eli would inherit. During his travels through South Africa, Afghanistan, and Mexico, the elder Bilton gathered cannabis seeds.

Coming back home to the Emerald Triangle in Northern California, the surfer and pot activist would trade seeds with other surfers. Eventually, Randy created an unofficial seed bank. Today, with Eli joining the effort, the medical marijuana seed bank has grown to 40 different strains with names like Sour Diesel, Chem Dawg, and OG San Fernando.

Peer-to-Peer Lending Bonanza Targeted by Mortgage Bank LoanDepot (Bloomberg)

One of the biggest U.S. mortgage lenders is looking to disrupt the disruptors in the market for peer-to-peer loans.

US exports to Greece round to 0% (Business Insider)

While things are calmer in Greece for now, the future of the Greece economy still appears somewhat in doubt.

Politics

Hillary Clinton Offers Plans for Changes on Wall Street (NY Times)

Hillary Clinton Offers Plans for Changes on Wall Street (NY Times)

Hillary Rodham Clinton made a case on Friday for weaning Wall Street from an addiction to profits, calling for a change to the capital gains taxes for the highest earners and a string of measures to adjust the balance of power between corporate titans and their employees.

She also supported raising the minimum wage for fast-food workers to $15 in New York, where a wage board this week suggested such an increase, but she also insisted such a rise is not a one-size-fits-all approach for the whole country.

Ted Cruz says Republican leader McConnell told ‘flat-out lie’ (Market Watch)

Ted Cruz says Republican leader McConnell told ‘flat-out lie’ (Market Watch)

Sen. Ted Cruz, the conservative Texas firebrand and Republican presidential candidate, on Friday accused Senate Majority Leader Mitch McConnell, Republican of Kentucky, of lying to him, in an unusually personal jab for a body that holds itself to a strict standard of decorum.

“The majority leader looked me in the eye and looked 54 Republicans in the eye,” Cruz said toward the end of a nearly 20-minute speech on the Senate floor. “I cannot believe he would tell a flat-out lie, and I voted based on those assurances that he made to each and every one of us.”

Technology

These Breathalyzers Can Sniff Out If You're Carrying A Disease (Fast Company)

These Breathalyzers Can Sniff Out If You're Carrying A Disease (Fast Company)

Some day soon we may be able to tell if someone has cancer just by having them breathe into a bag

Researchers at the University of Adelaide are working on a laser system—an "optical dog's nose"—that senses for the content of breath gases. It can tell if a sample contains particular molecules by the way telltale molecules absorb light at certain frequencies. Think of it as a breathalyzer that diagnoses disease much like the breathalyzers we have for drunk drivers.

Health and Life Sciences

FDA approves new cholesterol lowering drug (CNN)

The FDA approved the new cholesterol lowering drug alirocumab, brand name Praluent, on Friday. The injectable drug, from Regeneron and Sanofi, is the first in a new class of drugs called PCSK9 inhibitors.

The drug works by making the liver more efficient at getting rid of LDL, or bad cholesterol.

Life on the Home Planet

This Company Wants To Recycle Carbon Dioxide From The Atmosphere (Forbes)

This Company Wants To Recycle Carbon Dioxide From The Atmosphere (Forbes)

We recycle cans, we recycle clothes, yes, we even recycle bras and old prosthetic limbs.

But what if you could recycle some of your fossil fuels, the carbon dioxide (CO2) that’s emitted from using coal, oil and natural gas?

Carbon Engineering in Canada is powering up a plant which promises to do just that. Their first carbon capture plant is set to start producing recycled co2 next month.

China is Building an Absolutely Massive Radio Telescope

China is Building an Absolutely Massive Radio Telescope

Construction is well underway on what will become the world’s largest radio telescope. Once complete, the half-kilometer-wide dish will explore the origins of the Universe and scour the skies for signs of extraterrestrial intelligence.

Located in southwest China’s Guizhou Province, the Five-hundred-meter Aperture Spherical Telescope—aka “FAST”—is being constructed on a naturally formed bowl-like valley. It’s far from any town or city, so it’ll be able to achieve decent levels of “radio silence.”