China continues to fall apart.

China continues to fall apart.

Despite 4 rate cuts since November and much looser restrictions on bank lending and a very aggressive stimulus package, this weekend the PBOC admitted what we already know – that China's economy is still slowing and there will be no quick turnaround. Even worse, they aknowledged that the 2Tn Yuan ($322Bn) that they set aside for local Government bond swaps would be inadequate to cover the problems in that sector – indicating the extent of local Government defaults is far greater than China has previously admitted (something we warned you about in June).

PBOC Director Sheng Songcheng says he expected second-quarter net profit growth for banks to fall, adding that banks' exposure to risk "has become clearer" but he said the real-estate market could rebound in the second half and provide support for the economy. Other analysts say that view is unduly optimistic, pointing to huge inventories of unsold homes and high local government debt which is curbing their ability to spend on infrastructure projects.

That means we'll have to keep a close eye on China's property market to see if it really is stabilizing. This weekend we got another poor reading (47.8) on China's PMI, down from 48.2 last month and again, I cannot stress enough that this is despite MASSIVE stimulus. There have also been a lot of major property sales in China as the Top 1% have been dumping their holdings on speculators betting on a turnaround – not really a good sign or, as Zero Hedge puts it:

That means we'll have to keep a close eye on China's property market to see if it really is stabilizing. This weekend we got another poor reading (47.8) on China's PMI, down from 48.2 last month and again, I cannot stress enough that this is despite MASSIVE stimulus. There have also been a lot of major property sales in China as the Top 1% have been dumping their holdings on speculators betting on a turnaround – not really a good sign or, as Zero Hedge puts it:

To sum up: misrepresentations about local government debt, lies about bad debt levels, and now, the wealthiest locals are quietly, slowly getting out of Dodge, er, China. We can only hope that China's desperate attempt to hold up its stock market, the final frontier before all confidence in China crumbles alongside, lasts a few months longer, or the great Chinese hard landing that has been discussed for years, and always delayed in the last moment, is now virtually inevitable.

Looking at the PMI numbers, the hard landing is already in progress as this (Aug, not on chart) marks the 6th consecutive month of contraction. Lack of Chinese Manufacturing has sent Commodity prices down to 13-year lows as the slowdown in China has not been offset by a pickup in activity anywhere else in the World and, even as I write this, it feels like a paper analyzing the cause of the Great Depression of 2015 that someone will be writing 20 years from now with perfect hind-sight.

Looking at the PMI numbers, the hard landing is already in progress as this (Aug, not on chart) marks the 6th consecutive month of contraction. Lack of Chinese Manufacturing has sent Commodity prices down to 13-year lows as the slowdown in China has not been offset by a pickup in activity anywhere else in the World and, even as I write this, it feels like a paper analyzing the cause of the Great Depression of 2015 that someone will be writing 20 years from now with perfect hind-sight.

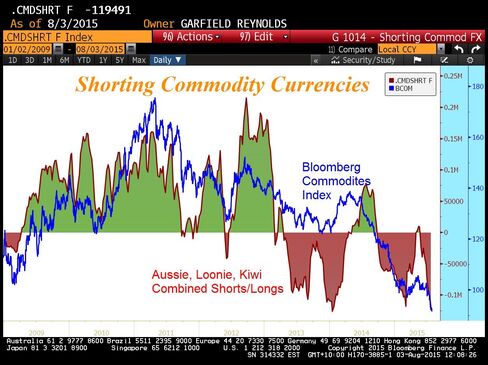

The commodity rout is having a cascading effect on export currencies, like the Australia, New Zealand and Canada and their currencies are collapsing due to low demand for their resources and the Aussie Dollars, Kiwis and Loonies (don't name your currency the Loonie if you want respect!) and then the inevitable layoffs, the mine closures and loan defaults don't help much either.

According to Bloomberg: Canada’s dollar sank to its weakest since 2004 as plunging oil prices shrank the economy and prompted Prime Minister Stephen Harper to call an early election. The Australian and New Zealand dollars were within one cent of six-year lows this morning amid signs of a slowdown in China, the world’s biggest consumer of raw materials. All three currencies have fallen more than 10% this year against their U.S. peer, the first time that’s happened since 2008, spurring hedge funds to turn the most bearish on them since the start of 2014.

“Commodity prices have shown a clear and broad-based falling trend in recent months, and that’s being reflected clearly in the currencies of commodity-exporting nations,” said Greg Gibbs, a strategist at Royal Bank of Scotland Group Plc in Singapore. “The Canadian dollar looks particularly vulnerable with five months of consecutive declines in GDP and an uncertain election called over the weekend.”

What's stunning here is the extent to which this is being ignored by our own markets – as if things that are happening in Canada, Mexico, Brazil, Venezuela, OPEC Nations, Russia, Australia and New Zealand to wreck their economies have no effect on us whatsoever. For example, Canada’s economy sank further into contraction in May, with a 5th monthly decline in gross domestic product marking the longest slump since a 2008/9 Recession.

What's stunning here is the extent to which this is being ignored by our own markets – as if things that are happening in Canada, Mexico, Brazil, Venezuela, OPEC Nations, Russia, Australia and New Zealand to wreck their economies have no effect on us whatsoever. For example, Canada’s economy sank further into contraction in May, with a 5th monthly decline in gross domestic product marking the longest slump since a 2008/9 Recession.

How many times will we have to point out something is the worst since 2008/9 before it becomes a real concern? Correct me if I'm wrong but 2008/9 were pretty bad – made even all the more so because, in 2006/7, we ignored all the obvious signs in the Global Economy that things were weakening!

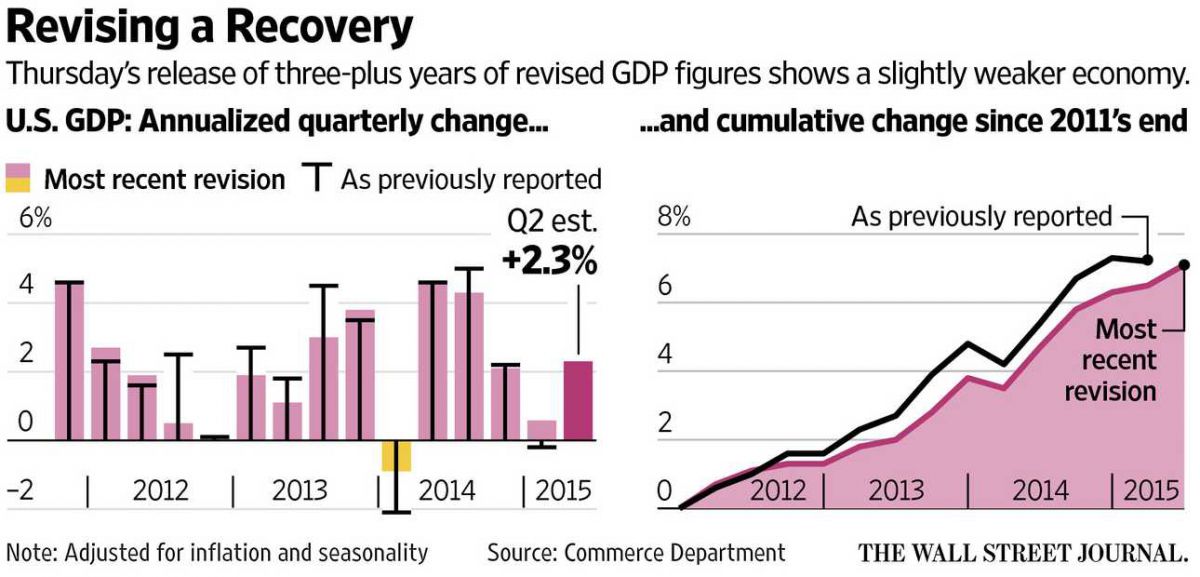

Our 6-year recovery has been, to date, a fairly weak one by historical standards and let's not forget that, other than the Great Depression, we've never put SO MUCH EFFORT into propping up the economy than we have over the past 6 years. We've increased our National Debt by 33%, from $12Tn to $18Tn and the Fed has kicked in another $4Tn, that ultimately gets added to our national debt as well. $10Tn is over 10% of our GDP coming from stimulus since 2009 and this is all we have to show for it:

While the first half’s growth rate of 1.5% was better than expected thanks to the first-quarter revision, economic growth so far this year has been even slower than during last year’s tepid first half and well below the pace of the overall recovery. Still, the modest growth figures are likely strong enough to keep the Fed on track to begin raising short-term interest rates as early as September for the first time in nearly a decade.

Our economy has been growing slower than previously reported since 2012 (per last week's revisions) but that has barely given the market pause as we party like it's early 2015 in China on the "infinite" streams of FREE MONEY flowing out of our own Central Bank. Like China, our US Retail Investors think this party is never going to stop and certainly there will be no consequences.

Companies with earnings beats last month averaged 5.3% gains the next day – as if the already high-flyers were drastically underpriced. Those gains were offset by punishments taken by the losers and the S&P finished the month up just 1% and 65 of the Nasdaq 100 have already reported – and that's where most of the positive reactions came from. The last time we had such big gains from earnings winners was, you guessed it – 1998!

“It’s getting tougher to find a lot of earnings growth in a somewhat-rich market,” Daniel Morris, global investment strategist at TIAA-CREF Asset Management in New York, said by phone. His firm oversees about $869 billion. “You’re looking for those stocks that hopefully are going to surprise positively. Everyone will be chasing these stocks.”

Or, as the Artist formerly known as Prince would say: