How many times have I told you so?

How many times have I told you so?

- Monday Market Manipulation: China's Third Attempt (May 11th)

- Japan GDP Not Strong Enough – Now What? (May 20th)

- China Stocks Drop 6.5% Yet The MSM Is Silent? (May 28th)

- Let's Ignore China (Again) (June 26th)

- China Is Down 5% – Why Are You Looking At Greece? (July 8th)

- China Arrests The Short Sellers – All Is Well? (July 9th)

- China, Greece, Japan – Oh My! (July 15th)

- China Meltdown Part II: Now Are You Paying Attention? (July 27th)

- Wednesday – Shanghai Surprise (Manipulation) Ahead of the Fed (July 29th)

- Monday Mourning – The Mandarin Meltdown Continues (Aug 3rd)

- Technically F’d Tuesday – Death Crosses Hit Dow and NYSE Today! (Aug 11th)

- Monday Markdown – Morgan’s Fragile Five becomes the Troubled Ten (Monday)

- If China Drops 6% and no One Reports it, Does it Matter? (Tuesday)

- Whipsaw Wednesday – Monday Market Gains Gone in a Flash (Crash?) (Wednesday)

Remember, I can only tell you what is going to happen and how to make money trading it – that is the extent of my powers. Yes, if you make me dictator for life, heads will roll (literally) and I could get this mess straightened out but, if you continue to elect the idiots you've been electing – all we can do is sit on the sidelines and make money trading against their incompentency.

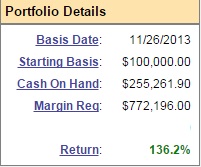

Our bearish Short-Term Portfolio, for example, was up 124.5% at 1pm, when we reviewed it in our Live Member Chat Room (you can join the fun right here) but finished the day up 136.2%?, gaining $12,000 in just 3 hours as the market continued to fall! Why were we so bearish that a stock market crash gives us one of our best days of the year? Because we pay attention to the stuff I wrote about above!

Our bearish Short-Term Portfolio, for example, was up 124.5% at 1pm, when we reviewed it in our Live Member Chat Room (you can join the fun right here) but finished the day up 136.2%?, gaining $12,000 in just 3 hours as the market continued to fall! Why were we so bearish that a stock market crash gives us one of our best days of the year? Because we pay attention to the stuff I wrote about above!

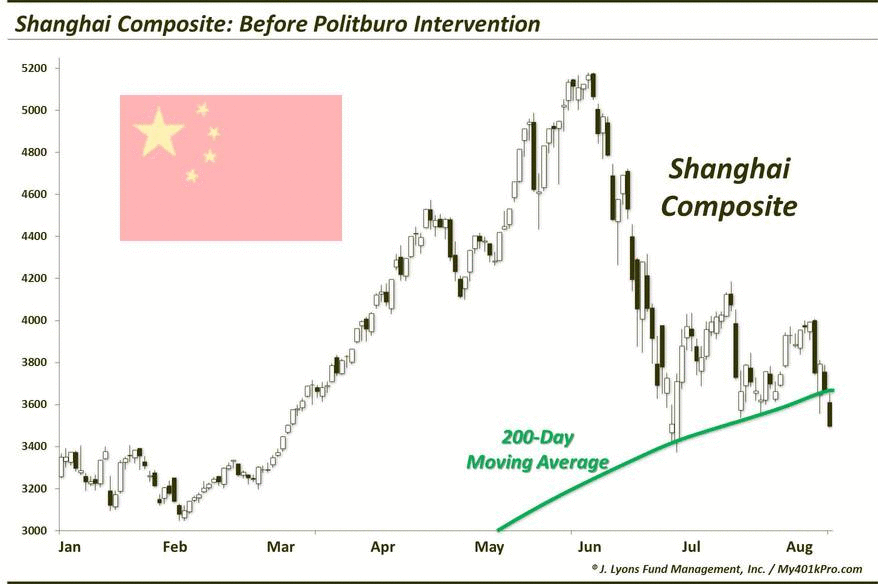

Yes, as fundamental investors we are often a bit too far ahead of the curve and we failed to participate in the last legs of the great China rally because we already decided it was too expensive as it crossed over 3,500 in March. The Shanghai Composite continued to climb all the way to 5,000 in May but by then I was banging the table on how ridiculously overbought and manipulated the market was and we were able to make the easier money shorting China on the way down, rather than buying already overbought stocks on the way up.

We employed similar logic on Wednesday Morning, when I was being interviewed on Benzinga's pre-market show and I called for a 10% correction in the market. It was the same call I made Tuesday afternoon, at 1pm, during our Live Trading Webinar, at which time we shorted the Dow Futures at 17,477 (now 16,841 on contacts that pay $5 per point!). I also called for a long on Lumber Liquidators (LL), which popped 9% yesterday (one of the only winners) and for a short on NFLX, which fell 12% in the 48 hours since (and should be down 20% before it's done correcting).

I don't say these things to brag, I say these things because reviewing what we got right and wrong is the key to making better decisions in the future. In fact, the whole reason I began keeping a trading blog in 2006 was to keep track of what I was thinking when I entered and exited a trade – how was I to know that people would find the stuff in my head to be interesting?

Also, knowing that we made a correct, but early call on China might help you decide whether I may be right about my current call to go long on gasoline (/RB) into the holiday weekend (we are long /RBU5, the October Futures, at $1.37, now $1.36) as well as a long on China (FXI) at $37, as we expect the PBOC to step in and do SOMETHING over the weekend to defend that 3,500 line on the Shanghai Composite. As a trade we'll be liking for following for our 5% Portfolio at Seeking Alpha:

Also, knowing that we made a correct, but early call on China might help you decide whether I may be right about my current call to go long on gasoline (/RB) into the holiday weekend (we are long /RBU5, the October Futures, at $1.37, now $1.36) as well as a long on China (FXI) at $37, as we expect the PBOC to step in and do SOMETHING over the weekend to defend that 3,500 line on the Shanghai Composite. As a trade we'll be liking for following for our 5% Portfolio at Seeking Alpha:

- Buy 10 FXI Sept $37 calls for $1.50 ($1,500)

- Sell 10 FXI Sept $38.50 calls for 0.85 ($850)

That's net $650 on a potential $1,500 spread (if FXI is over $38.50), so you can make $850 in 30 days (130%) and simply stop out if it fails to hold $500 for a $150 risk. I'm already surprised nothing has been done into the weekend but I can't believe the Chinese Government is going to blow their credibility (they just said the markets were "safe" at this level a month ago) so quickly – any adviser worth a damn will tell them that not stepping in now can lead to years of people staying away from investing in China (something I've already been advocating for years).

Our generally bearish outlook on the markets has kept us "Cashy and Cautious" all summer long and, as I noted on the radio on Wednesday morning, we're looking for a 10% correction and this is only 5% (on the S&P), so far. Still, there are now 200 S&P stocks that have already corrected 20% or more and we are licking our chops for a chance to go bargain-hunting very soon.

Our generally bearish outlook on the markets has kept us "Cashy and Cautious" all summer long and, as I noted on the radio on Wednesday morning, we're looking for a 10% correction and this is only 5% (on the S&P), so far. Still, there are now 200 S&P stocks that have already corrected 20% or more and we are licking our chops for a chance to go bargain-hunting very soon.

Fear of the Fed will keep things down for a while but the sooner they get over the hump of a rate increase the better – as it's really not going to be a big deal in the end. The best thing to do for now is watch and wait as things are getting cheaper every day, so there's no need for us to catch a falling knife.

Back in 2008, I often had to repeat this mantra for our Members who were anxious to jump in and buy stocks that were 20% off, then 30% off, then 40% off. Each time they would ask me if it was time to buy I would tell them to repeat 10 times "It is not my job to save the markets." You rarely miss anything by waiting for a real bottom to form and, the lower we go, the more time you have to participate in a recovery. We've been recovering for 6 years – maybe it is time for a healthy break(down)!

Have a great weekend,

– Phil