Reminder: Sabrient is available to chat with Members, comments are found below each post.

Courtesy of Sabrient Systems and Gradient Analytics

The dark veil around China is creating a little too much uncertainty for investors, with the usual fear mongers piling on and sending the vast buy-the-dip crowd running for the sidelines until the smoke clears. Furthermore, Sabrient’s fundamentals-based SectorCast rankings have been flashing near-term defensive signals. The end result is a long overdue capitulation event that has left no market segment unscathed in its mass carnage. The historically long technical consolidation finally came to the point of having to break one way or the other, and it decided to break hard to the downside, actually testing the lows from last October! Many had predicted that the longer we go without a meaningful pullback, the harder and scarier it would be when it finally broke down. In addition, program trading kicked in to deleverage positions, with preset algorithms exacerbating the selling and volatility.

Actually, there are four main issues creating uncertainty for investors: China’s true growth outlook, commodity prices, the Federal Reserve’s plan for rate hikes, and the upcoming corporate earnings season. But all is not lost, and a capitulation event like this also provides a healthy cleansing, providing the opportunity for capital to transfer from weak to strong hands, and now there is suddenly a lot of room to the upside — if bulls can keep their composure and regain their conviction.

Actually, there are four main issues creating uncertainty for investors: China’s true growth outlook, commodity prices, the Federal Reserve’s plan for rate hikes, and the upcoming corporate earnings season. But all is not lost, and a capitulation event like this also provides a healthy cleansing, providing the opportunity for capital to transfer from weak to strong hands, and now there is suddenly a lot of room to the upside — if bulls can keep their composure and regain their conviction.

In this weekly update, I give my view of the current market environment, offer a technical analysis of the S&P 500 chart, review our weekly fundamentals-based SectorCast rankings of the ten U.S. business sectors, and then offer up some actionable trading ideas, including a sector rotation strategy using ETFs and an enhanced version using top-ranked stocks from the top-ranked sectors.

Market overview:

With signs of slowing growth reducing demand from China, coupled with further devaluation of the yuan, other exporting nations are racing to debase their currencies in order to stay competitive. But as I discussed last week, the devaluation of the yuan (which is pegged to the dollar and thus must manually adjust the valuation) pales in comparison to all the other floating currencies that have devalued much more through the machinations of the various central banks’ monetary policies. But whether a slowing in China, or a higher or lower yuan, has any meaningful impact on us is beside the point; investor perception reigns, and the perception is that a slowing in China will have broad reverberations. This is also hitting commodities markets hard, since supplies have been ramping up for some time to keep up with China’s seemingly insatiable appetite.

On Friday, the S&P 500 fell -3.2% for the day and -5.8% for the week, with mass risk-off selling across the board. No one was spared. And the market had already been showing weak breadth. Of the 502 stocks in the S&P 500, 492 fell on Friday, with 328 falling into correction territory (i.e., a 10% decline from highs), of which 147 fell into bear market territory (20% decline) — including formerly invincible juggernaut Apple (AAPL), which also succumbed to fears about declining demand in China, and its fall has dragged down its top suppliers. It was the largest correction since the US sovereign debt downgrade four years ago.

Friday also offered up the Dow’s largest one-day pullback since 2011, as well as the largest two-day decline since 2008. It was the Dow’s first 1,000-point weekly decline since October 2008. Interestingly, although the Dow got hit with its first one-day 3% decline in four years, it saw 46 such one-day declines of 3% or more in the four years prior to that. So, this long period of complacency was way overdue to end. Hard hit were some of the big winners of the past year, including biotech, semiconductors (especially those who serve Apple), and oil refiners. Still, no market segment was spared in the mass carnage (although Utilities held up better, as the most defensive of sectors).

And then on Monday, the Dow Jones Industrial Average was down nearly 1100 points at the open — and actually tested the lows from last October! — before recovering most of those losses intraday, but then falling again to close down about 585 points. Yes, it was another ugly day. On the bright side, Monday’s crazy volatility showed some capital starting to flow into higher quality names, including Sabrient favorites like NXP Semiconductor (NXPI) and Skyworks Solutions (SWKS).

The big question marks for investors involve four main issues: 1) China’s slowing growth rate and reduced consumption, 2) the global fallout of low commodity prices (especially oil), currency wars, and the associated threat of deflation, 3) the Federal Reserve’s plan for rate hikes (although I expect benign impact no matter what they do), and 4) the possibility of another disappointing corporate earnings season.

Indeed, manufacturing in China is back to the same levels they held during the financial crisis in 2009, and many commentators are calling on China to take more aggressive stimulus action, but we have to keep in mind that China is far-and-away a net exporter of goods rather than a critical buyer of other countries’ goods and services. In fact, exports to China account for less than 1% of U.S. GDP, and it’s the same for most of the EU.

While the developed economies in places like the U.S., Europe, and Japan have enjoyed improving economic growth, including retail sales, housing, and manufacturing activity, emerging market economies are suffering mightily — especially those that export commodities. Commodity-consuming nations are enjoying the fire sale prices, but commodity exporters are wondering how they can keep the lights on. For example, oil exporters like Russia and Saudi Arabia need oil prices approaching $100/bbl just to pay for all the budgetary commitments (especially entitlement programs) that depend upon their oil exports. WTI oil briefly fell below the $40 threshold on Friday before closing at $40.45/bbl. And then on Monday (today), it fell again to around $38.

Even though here at home our pocketbooks are benefiting from low oil prices, there is a downside to it. Many of the smaller companies toiling in the oil patch carry a lot of high yield debt. So far, they have been able to manage without much pain (like bankruptcy), but an important event comes in October with the semiannual bank reviews of loans and revolving lines of credit, although most experts think the bigger day of reckoning won’t happen until the April review, assuming oil prices remain depressed until then. About 40% of high yield debt in the exploration & production segment is distressed, and some of that debt is already selling for less than 40 cents on the dollar. In fact, many believe that the ready availability of private equity buying up distressed debt and keeping so many small firms drilling oil is exacerbating the problem.

In any case, the strengthening dollar, falling prices from exporters (like China) that are devaluing their currencies, and oversupply of commodities are all keeping a lid on inflation. This translates into low interest rates, as well, so any move by the Fed to raise rates will be met with more global liquidity flooding into the U.S., which will further strengthen the dollar and drive down rates and may undermine the Fed’s targets with regard to unemployment and inflation. The 10-year Treasury yield closed Friday at 2.05%, and it fell below 2.0% during Monday’s trading.

The CBOE Market Volatility Index (VIX), a.k.a. fear gauge, closed Friday at 28.03, which is suddenly well above the 20 panic threshold that had held as resistance throughout the summer. The VIX more than doubled from the prior Friday’s close of 12.83 and in the process notched a record-setting one-week jump. On then on Monday, the VIX closed at 40.41, but hit an intraday high of 53.29 — a level not seen since 2008. In an instant, the panic selling that seemed so unlikely with the prolonged period of complacency has reared its ugly head.

Still, I think it is healthy. Investors need to know how far the market will fall when real fear hits, before the bulls and the big institutions come in to support it. Corrections like this help move capital from weak to strong hands. So a solid bounce from current levels, followed perhaps by a successful retest, would provide important confidence going forward. Whether bulls can take this as an opportunity to press ahead to new highs — or instead fall into a bear market — remains to be seen. But in my view, there are still many more drivers for U.S. stocks to rise than to fall.

SPY chart review:

The SPDR S&P 500 Trust (SPY) closed Friday at 197.63 and then fell again Monday to close at 189.55. The historically long sideways consolidation has ended in spectacular fashion, and the neutral pennant formation (which I thought would break to the upside) broke hard to the downside. Of course, the longer the consolidation, the tighter the trading range, and the more explosive one would expect the breakout or breakdown. And so it was, breaking down not just through the 200-day simple moving average and the bottom of the trading channel that had been in place since February, but also through the 200 price level (corresponding to 2,000 on the S&P 500) as well as the bottom of the January trading range. Incredibly, on Monday intraday it actually tested the lows around 182 from last October! Oscillators like RSI, MACD, and Slow Stochastic are in severely oversold territory. This might be the point where selling has been exhausted, at least temporarily, and we should see a pretty solid bounce soon, perhaps eventually making its way all the way back to the 204 price level (the bottom of the prior trading range).

Latest sector rankings:

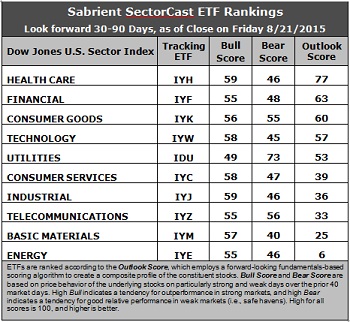

Relative sector rankings are based on our proprietary SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a forward-looking, fundamentals-based multifactor algorithm considering forward valuation, historical and projected earnings growth, the dynamics of Wall Street analysts’ consensus earnings estimates and recent revisions (up or down), quality and sustainability of reported earnings (forensic accounting), and various return ratios. It helps us predict relative performance over the next 1-3 months.

In addition, SectorCast computes a Bull Score and Bear Score for each ETF based on recent price behavior of the constituent stocks on particularly strong and weak market days. High Bull score indicates that stocks within the ETF recently have tended toward relative outperformance when the market is strong, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well (i.e., safe havens) when the market is weak.

Outlook score is forward-looking while Bull and Bear are backward-looking. As a group, these three scores can be helpful for positioning a portfolio for a given set of anticipated market conditions. Of course, each ETF holds a unique portfolio of stocks and position weights, so the sectors represented will score differently depending upon which set of ETFs is used. We use the iShares that represent the ten major U.S. business sectors: Financial (IYF), Technology (IYW), Industrial (IYJ), Healthcare (IYH), Consumer Goods (IYK), Consumer Services (IYC), Energy (IYE), Basic Materials (IYM), Telecommunications (IYZ), and Utilities (IDU). Whereas the Select Sector SPDRs only contain stocks from the S&P 500, I prefer the iShares for their larger universe and broader diversity. Fidelity also offers a group of sector ETFs with an even larger number of constituents in each.

Here are some of my observations on this week’s scores:

1. Healthcare remains in the top spot with an Outlook score of 77, primarily due to highly favorable sentiment among Wall Street analysts (net upward revisions to earnings estimates), solid return ratios, and a strong forward long-term growth rate, although its forward P/E remains on the high side. Financial moves into second place with a score of 63, but it is tightly bunched with Consumer Goods (Staples/Noncyclical), Technology, and Utilities with scores ranging from 60 to 53. Financial has a low (attractive) forward P/E but some negative sell-side analyst sentiment (net downward revisions to earnings estimates, while Consumer Goods carries the opposite, i.e., a relatively high forward P/E but solid Wall Street sentiment.

2. Energy remains at the bottom with an Outlook score of 6. Energy scores poorly in most factors of the GARP model across the board. In particular, the sector still sports a negative forward long-term growth rate and low return ratios, as well as the highest forward P/E even after such a huge price correction, while Wall Street continues to slash estimates for any firm that depends upon oil prices for revenues. (However, the refining & marketing segment is an area of strength within the sector.) Basic Materials takes the other spot in the bottom two with a 26. Even though the sector displays one of the lowest forward P/Es, Wall Street continues to slash forward earnings estimates as commodity prices fall further.

3. Looking at the Bull scores, Healthcare and Industrial display the top score of 59, followed by Technology and Consumer Services (Discretionary/Cyclical). Utilities is the lowest at 49. The top-bottom spread is only 10 points, still reflecting high sector correlations on particularly strong market days (i.e., broad risk-on buying). It is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points, which indicates that investors have clear preferences in the stocks they want to hold.

4. Looking at the Bear scores, Utilities displays by far the top score of 73, which means that stocks within this sector have been the preferred safe havens (relatively speaking) on weak market days. Basic Materials scores the lowest at 40. The top-bottom spread is a robust 33 points, which reflects extraordinarily low sector correlations on particularly weak market days, which is good. Ideally, certain sectors will hold up relatively well while others are selling off, so it is generally desirable in a healthy market to see low correlations reflected in a top-bottom spread of at least 20 points.

5. Healthcare displays the best all-around combination of Outlook/Bull/Bear scores, while Energy is the worst. Looking at just the Bull/Bear combination, Utilities scores the highest, but Consumer Goods (Staples/Noncyclical) and Telecom have the best Bull/Bear balance, indicating superior relative performance (on average) in extreme market conditions (whether bullish or bearish), while Basic Materials is the worst.

6. This week’s fundamentals-based Outlook rankings look neutral. All-weather Healthcare tops the list, with defensive sectors Utilities and Consumer Goods (Staples/Noncyclical) also in the top five. But Financial and Technology are solidly in the top five, as well, and Consumer Services (Discretionary/Cyclical) and Industrial continue to hold up pretty well. Of course, Basic Materials and Energy remain mired at the bottom due to expected persistence of low commodities prices. Keep in mind, the Outlook Rank does not include timing or momentum factors, but rather is a reflection of the fundamental expectations of individual stocks aggregated by sector.

Stock and ETF Ideas:

Our Sector Rotation model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or defensive), reflects a defensive bias and suggests holding Utilities, Consumer Goods (Staples/Noncyclical), and Healthcare, in that order. (Note: In this model, we consider the bias to be defensive from a rules-based trend-following standpoint when SPY is below both its 50-day and 200-day simple moving average.)

Other highly-ranked ETFs in SectorCast from the Utilities, Consumer Goods (Staples/Noncyclical), and Healthcare sectors include Guggenheim Invest S&P 500 Equal Weight Utilities ETF (RYU), PowerShares DWA Consumer Staples Momentum Portfolio (PSL), and SPDR S&P Health Car Services ETF (XHS).

For an enhanced sector portfolio that enlists some top-ranked stocks (instead of ETFs) from within the top-ranked sectors, some long ideas from Utilities, Consumer Goods (Staples/Noncyclical), and Healthcare sectors include Level 3 Communications (LVLT), Exelon Corp (EXC), Spectrum Brands (SPB), AMERCO (UHAL), Molina Healthcare (MOH), and Hospira (HSP). All are highly ranked in the Sabrient Ratings Algorithm.

If you prefer to bet on a reversal and take a bullish bias, the Sector Rotation model suggests holding Healthcare, Technology, and Industrial, in that order. But if you prefer a neutral stance on the market, the model suggests holding Healthcare, Financial, and Consumer Goods (Staples/Noncyclical), in that order.

Note that Fidelity offers its own line of U.S. sector ETFs that can be used for sector rotation, including Fidelity MSCI Health Care Index (FHLC), Fidelity MSCI Utilities Index (FUTY), Fidelity MSCI Financials Index (FNCL), Fidelity MSCI Information Technology Index (FTEC), Fidelity MSCI Consumer Staples Index (FSTA), and Fidelity MSCI Industrials Index (FIDU).

IMPORTANT NOTE: I post this information each week as a free look inside some of our institutional research and as a source of some trading ideas for your own further investigation. It is not intended to be traded directly as a rules-based strategy in a real money portfolio. I am simply showing what a sector rotation model might suggest if a given portfolio was due for a rebalance, and I may or may not update the information each week. There are many ways for a client to trade such a strategy, including monthly or quarterly rebalancing, perhaps with interim adjustments to the bullish/neutral/defensive bias when warranted — but not necessarily on the days that I happen to post this weekly article. The enhanced strategy seeks higher returns by employing individual stocks (or stock options) that are also highly ranked, but this introduces greater risks and volatility. I do not track performance of the ETF and stock ideas mentioned here as a managed portfolio.

Disclosure: Author has no positions in stocks or ETFs mentioned.

Disclaimer: This newsletter is published solely for informational purposes and is not to be construed as advice or a recommendation to specific individuals. Individuals should take into account their personal financial circumstances in acting on any rankings or stock selections provided by Sabrient. Sabrient makes no representations that the techniques used in its rankings or selections will result in or guarantee profits in trading. Trading involves risk, including possible loss of principal and other losses, and past performance is no indication of future results.

Pictures via Pixabay.