Wheeee, what a ride!

Wheeee, what a ride!

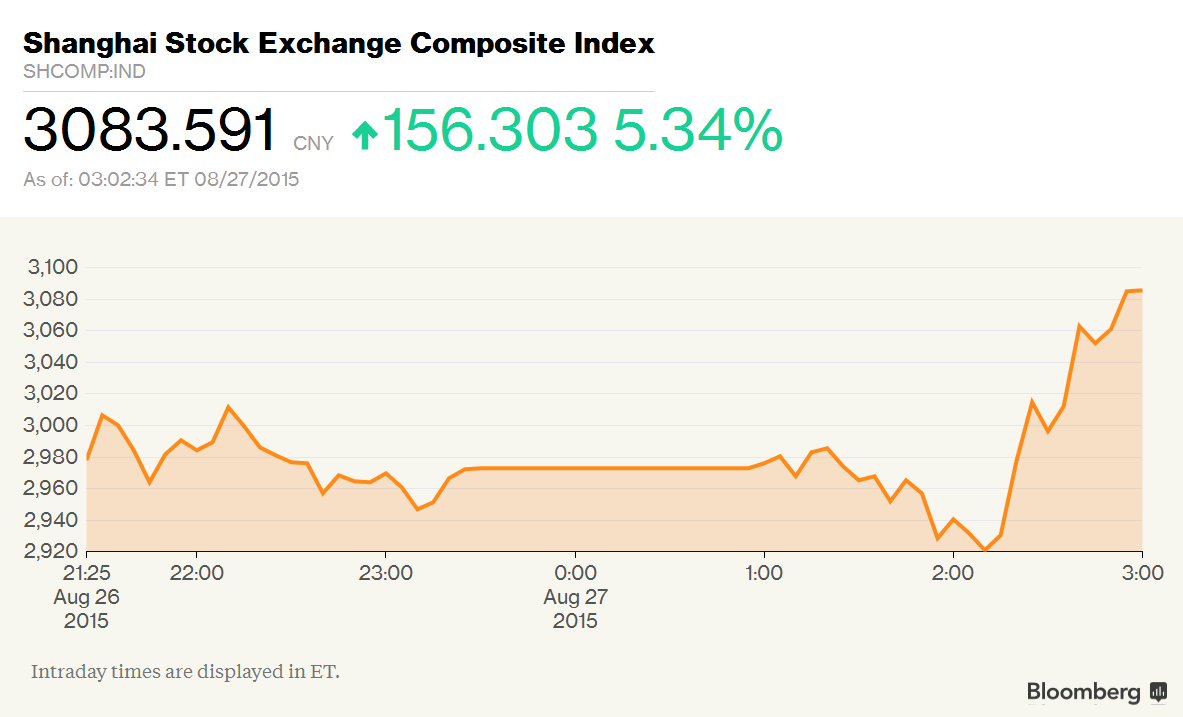

From a new low at 2,920 (down 42%) all the way back to 3,083 in 45 minutes was the close of the Shanghai Composite this morning as China’s government resumed its intervention in the stock market this morning. China had halted its stock-market intervention in the first two days of this week as policy makers debated the merits of an unprecedented rescue, according to people familiar with the situation.

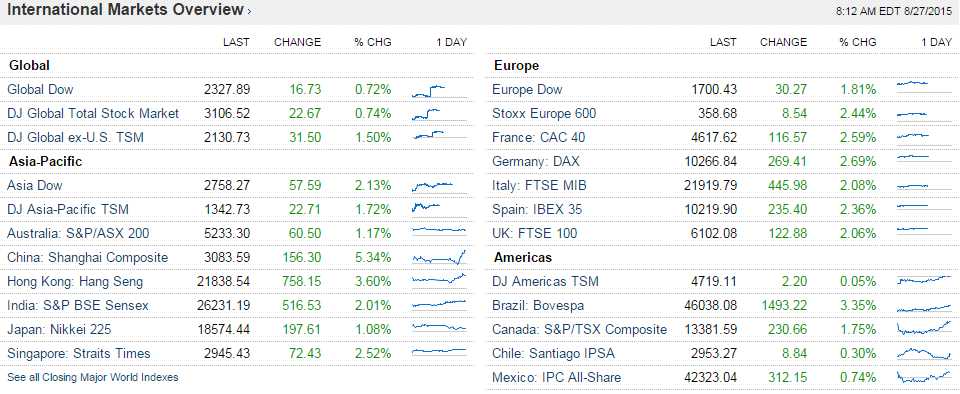

Even though the move was clearly fake, Fake, FAKE, it was still enough to excite investors as Asian and European markets followed China's lead higher and now EVERYTHING IS AWESOME again and the US Futures are up another 1% on top of yesterday's spectacular move.

While we were looking for a bounce off Tuesday's drop back to test 1,950 on the S&P 500, this is not the way we like to make our Strong Bounce lines (faked with stimulus and loose money talk). Still, fake or not, we'll take it as it only enhances our performance. In yesterday's post, we had long trade ideas for Apple (AAPL), which popped 5.75%, Baker Hughes (BHI), which popped 3% and Sotheby's (BID), which gained 1%.

We discussed our 5% Rule and our bounce lines yesterday on BNN's Money Talk and it's a real black swan event for me to spend 10 minutes talking technicals, so you might want to watch it. Meanwhile, the Russell hit our weak bounce line EXACTLY and the Nasdaq hit our strong bounce line EXACTLY with the Dow and the S&P in between and the NYSE woefully short – indicating this rally hasn't been to broad-based.

We discussed our 5% Rule and our bounce lines yesterday on BNN's Money Talk and it's a real black swan event for me to spend 10 minutes talking technicals, so you might want to watch it. Meanwhile, the Russell hit our weak bounce line EXACTLY and the Nasdaq hit our strong bounce line EXACTLY with the Dow and the S&P in between and the NYSE woefully short – indicating this rally hasn't been to broad-based.

- Dow 16,200 (weak) and 16,650 (strong)

- S&P 1,900 (weak) and 1,950 (strong)

- Nasdaq 4,550 (weak) and 4,700 (strong)

- NYSE 10,050 (weak) and 10,300 (strong)

- Russell 1,130 (weak) and 1,160 (strong).

As I noted during the show, the S&P has to be over 1,950 today but we're not going to have any real bullish confidence until and unless the NYSE clears that 10,050 mark, which shouldn't be a problem given the current 1% pop in the Futures (more than 100 NYSE points). This IS the bounce we've been playing for and, in our 5% Portfolio, some of our bullish trade ideas during the crash were:

- Buy 10 China ETF (FXI) Oct $36 calls at $1.50 ($1,500)

- Sell 10 China ETF (FXI) Oct $38.50 calls for 0.92 ($920)

-

That trade idea was net 0.58 or $580 for 10 contracts and today's pop will put FXI back at $37, where it's already $1,000 in the money (up 72% on the recovery).

- Buy 20 Dow ETF (DIA) Sept $155 calls at $8.62 ($17,240)

- Sell 20 Dow ETF (DIA) Sept $159 calls at $7.15 ($14,300)

-

DIA already popped back over $159 yesterday and this morning it looks like $165. If that trade finishes in the money, we will turn $2,940 into $8,000 in less than 30 days for a $5,060 profit (172%) in less than 30 days. That's a lot better than 5%, right?

All in all, we made more bullish trades in the last few days than we made all the rest of the month because we EXPECTED a 10% correction and, when we got it, we played for the bounce we also expected. That's all there is to it but, despite the focus on Technicals on TV, it was and is all about the FUNDAMENTALS we track – the same ones that kept us from being bullish when the market was toppy.

Of course we were also long on Oil Futures (/CL) and Gasoline Futures (/RB) and, as you can see, we took the money and ran off this morning's 5% run-up, pre-market but now we're back in 3 long over the $1.30 line (with tight stops below) in anticipation of a move higher ($1.40-$1.45) into the holiday weekend next week. At this moment (9:05), the contracts are being held down by a stronger Dollar (95.80, up 0.7%) but we don't think 96 will pop and that will allow the /RB contracts to make a little progress into the weekend.

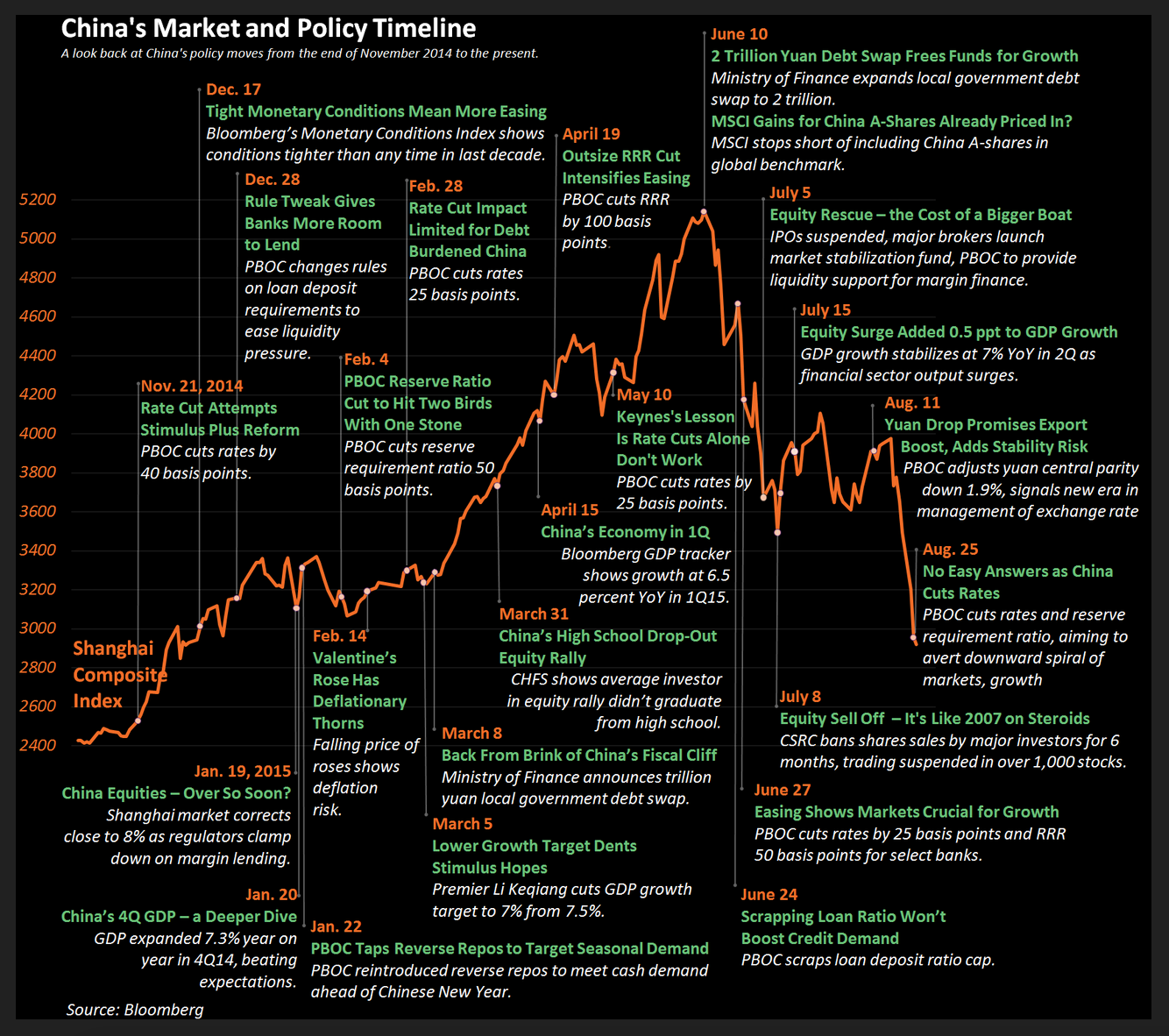

Meanwhile, we remain skeptical and those strong bounce lines MUST HOLD into tomorrow's close or we will be shifting back to bearish into the weekend (now neutral overall, with equal(ish) amounts of bullish and bearish positions). This is not the first time China has stepped in to prop up the markets and it won't be the last but previous efforts have yielded mixed results, at best:

Our Q2 GDP report has been upgraded to 3.7% growth so there is NO EXCUSE WHATSOEVER for our indexes not to move higher. If they don't, things may not be as awesome as they seem…