Well, at least the expectations are low now.

Well, at least the expectations are low now.

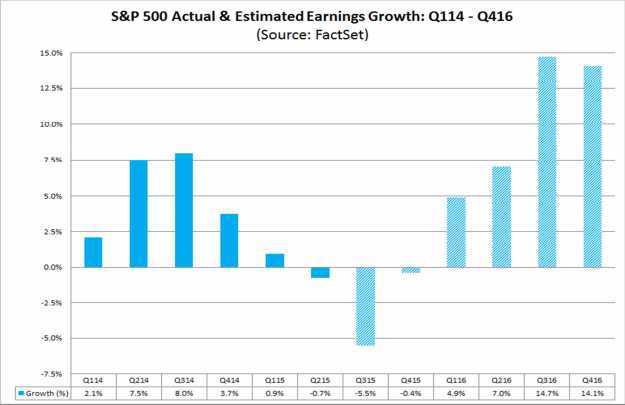

As you can see from the chart on the right, earnings have been revised down 30% in the past week (for companies that reported) and that's the worst pace since 2009 – so we've got that going for us. Meanwhile, the Fed is sending a lot of mixed messages – telling us the economy is strong but also telling us rates will have to stay low a lot longer because the economy isn't strong enough for higher rates yet.

Earnings aren't important when rates are this low. Look at Dell's purchase of EMC for $67Bn this morning. Dell went private, so they don't have to answer to anyone and now they are taking EMC private – an action that will drop $67Bn cash into the markets and take EMC out of the S&P and diminish the overall share count for the market. This is all very nice of them since EMC was priced at just $40Bn two weeks ago.

ZIRP lets companies borrow so cheaply they can do deals like this as EMC's $2.7Bn in profits fund a low-rate deal and Dell is likely to pump up the bottom line a bit and then flip EMC back out, repackaged, to the public market and suck all that money back out down the road but, for now, it's a huge amount of bonus cash coming in.

Just like in 2007, corporate buybacks are driving a massive equity rally and, as long as we keep getting deals like Dell/EMC to fuel us, this rally can keep going indefinitely. The Fed just keeps printing money and, before the ink even dries on the newly printed bills, they are traded for assets which keeps up the appearance of demand. This is why the Fed can't stop easing. There is no real demand – just this sort of financial engineering on a massive scale.

Speaking of financial engineering – you won't hear about this in the MSM because it doesn't fit the "Everything is Awesome" narrative but the Fed just revised the US's Total Debt up by $2.7Tn. Total Debt is the sum of US credit exposure as noted by the Fed here and summarized by Zero Hedge, here. The bottom line is that this little revision has driven our Consolidated Credit to GDP ratio from 330% to 350% but, because it was revised in after the fact – it has gone essentially without notice that the Fed pumped in $2.7Tn more stimulus than we thought to get us back to S&P 2,000.

"Well worth it" says the investing class as they debate how to repatriate their overseas profits without paying any of those nasty taxes that fund the ZIRP that allowed them to make those profits. Meanwhile, at this weekend's IMF meeting, the G30 (after the G8) Central Bankers warned on Saturday that "zero rates and money printing were not sufficient to revive economic growth and risked becoming semi-permanent measures." "Central banks have described their actions as 'buying time' for governments to finally resolve the crisis… But time is wearing on, and (bond) purchases have had their price," the report said. For the US, that price has been an additional $2.7Tn for starters.

The flow of easy money has inflated asset prices like stocks and housing in many countries even as they failed to stimulate economic growth. With growth estimates trending lower and easy money increasing company leverage, the specter of a debt trap is now haunting advanced economies, the Group of Thirty said.

According to an IMF report issued this week, there is "excessive" lending of $3 trillion in emerging market economies, an average of 15 percent of gross domestic product, which runs the risk of unwinding should economic conditions worsen. "Capital losses would affect many investors, including banks, and the process of extend and pretend for poor loans would have to come to a stop," the G30 report said. Even in a more benign economic outlook, central banks will have a tough time exiting easy money policies and may face demands to hold rates low. The IMF has repeatedly urged the Fed not to hike rates yet.

According to an IMF report issued this week, there is "excessive" lending of $3 trillion in emerging market economies, an average of 15 percent of gross domestic product, which runs the risk of unwinding should economic conditions worsen. "Capital losses would affect many investors, including banks, and the process of extend and pretend for poor loans would have to come to a stop," the G30 report said. Even in a more benign economic outlook, central banks will have a tough time exiting easy money policies and may face demands to hold rates low. The IMF has repeatedly urged the Fed not to hike rates yet.

It's easy to grow your GDP 7% when you are borrowing 15% of your GDP to stimulate it. In fact, those numbers indicate the true GDP is declining by 8% and they are simply buying the 7% growth number to keep up appearances. That's OK, companies do it all the time to ride out negative economic cycles (companies like Dell buying EMC to make it look like they are growing) but, eventually, they have to either put up (profits) or shut up and the shut up part can get very painful when it's a country and not a company that fails to execute on their business plan (Greece, for example).

As we begin to see Q3 earnings reports, we'll see what the Global Economy really looks like because you can pump up share prices all you want but, if sales and profits aren't there to back them up – then it's all just smoke and mirrors and it's time to get out of the Fun House. Fact Set is expecting a horrific 5.5% decline in Q3 Corporate Profits and that will make the first back-to-back decline in Corporate Profits since 2009 and it's 4.5% LOWER than the -1% projections of June 30th.

As we begin to see Q3 earnings reports, we'll see what the Global Economy really looks like because you can pump up share prices all you want but, if sales and profits aren't there to back them up – then it's all just smoke and mirrors and it's time to get out of the Fun House. Fact Set is expecting a horrific 5.5% decline in Q3 Corporate Profits and that will make the first back-to-back decline in Corporate Profits since 2009 and it's 4.5% LOWER than the -1% projections of June 30th.

So far, out of 108 companies that have reported Q3 earnings, 76 (70%) have issued negative guidance and the 12-month forward p/e ratio is now 15.9, more than 10% over the historic norm of 14 – indicating, quite simply, that stocks are priced 10% too high (essentially what I have been maintaining since we first hit 2,000). As we noted last week, of course Energy, Materials and Industrials will have terrible earnings – how could they not given the Q3 economy? What we need to see is whether Telcoms, Consumer Discretionary, Health Care and Financial stocks are able to offset that somewhat – any weakness in those sectors simply doesn't leave enough good news to balance out the bad!

Despite the indexes getting over our Strong Bounce lines last week, we still remain "Cashy and Cautious" but that certainly hasn't stopped us from making money on some bullish plays (see this weekend's "Top Trade Review"). Having a good amount of cash on the sidelines leaves us flexible enough to jump on opportunities as they present themselves and this earnings season should be FULL of opportunities.

Time to have some fun!