Fitch just downgraded Brazil (EWZ) to near-junk.

Brazil's economy is the 7th largest in the world at $2.4Tn – that's above Italy, India, Russia, Canada, Australia and just under France ($2.8Tn) and the UK ($2.9Tn), yet Americans know very little about Brazil, who had their credit rating dropped to BBB- by S&P last month as well. Having one credit agency mark you down is a warning, having two mark you down triggers massive cash outflows (tune in next week!).

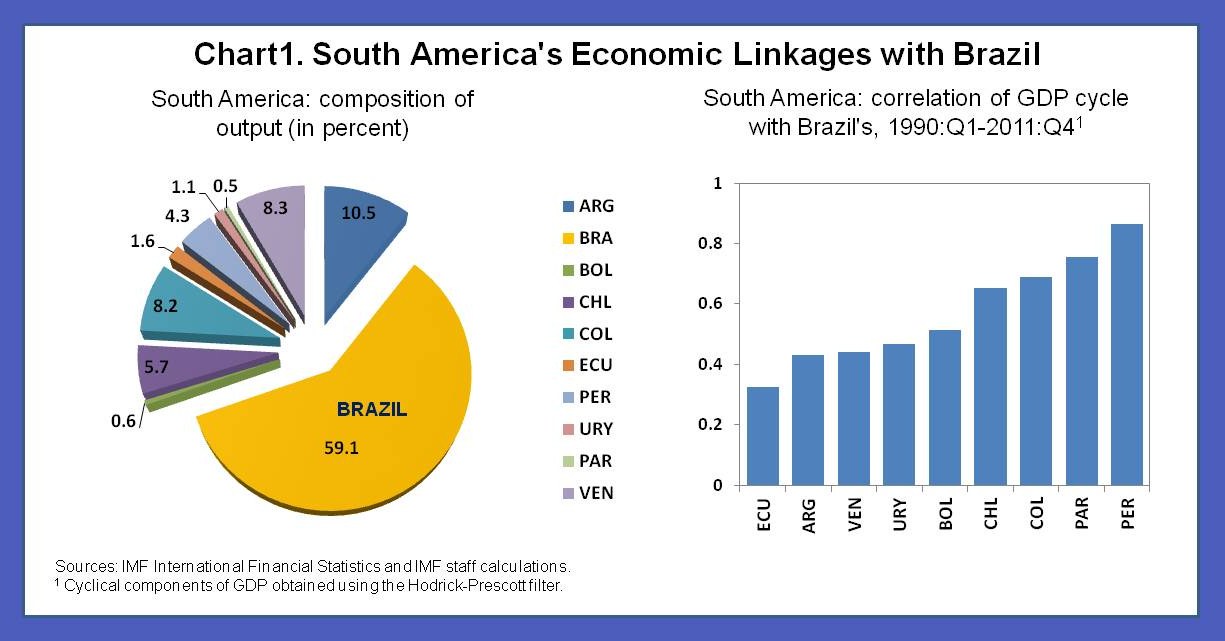

Obviously, things are pretty grim in Brazil, who's economy is close to 60% of South America's output. Is this just another thing the markets will choose to ignore as they rally back to new highs? Frankly, I don't know as this week's move is already insane – so we don't bet on irrational markets to suddenly behave rationally but TG we're in CASH!!!

Obviously, things are pretty grim in Brazil, who's economy is close to 60% of South America's output. Is this just another thing the markets will choose to ignore as they rally back to new highs? Frankly, I don't know as this week's move is already insane – so we don't bet on irrational markets to suddenly behave rationally but TG we're in CASH!!!

Cash has let us have a really fun week at PSW, playing the Futures in both directions while our portfolios were generally locked in neutral. We flipped a bit bearish overall but our Long-Term Portfolio (LTP) is still bullish (and 90% cash) and gained a whopping $3,400 this week while our paired Short-Term Portfolio (STP) lost $3,200 so, all in all – a week we could have just taken off.

But we didn't and, as I noted, we had a great time playing the Futures with all our sidelined cash and, as I detailed for you in yesterday morning's post, we shorted the Russell Futures at 1,150 (1,145 if you got started in the morning) and rode that down to 1,130 for a $1,500 per contract gain and we flipped long again at 1,130 in our Live Member Chat Room (as planned in the morning post) and caught the run all the way to 1,160 for a $3,000 per contract gain, where we're now short again.

You don't have to hold a lot of stocks to make really good money in your portfolio – just a couple of well-timed Futures contracts can make enough to satisfy all but the greediest investor. People think Futures trading is complicated but it's not – you are simply betting whether an index or a commodity will go up or down from a certain point. We will be giving a FREE Live Futures Trading Webinar next Tuesday at 1pm, EST – tune in that morning for a link.

I sent out an alert this morning updating our lines and you can see that here (3 hours later!). Keep in mind that we are in CASH!!!, so we don't give a Friday but, aside from Brazil (the World's 7th largest economy) we had TERRIBLE news out of India (the World's 9th largest economy), where both Imports and Exports are 25% BELOW LAST YEAR's LEVELS.

How many bits of bad news can we ignore? Well, the answer has to be more than that because I'm not even done with this morning's bad news yet. It seems that Japan (the World's 3rd largest economy) has had to halt trading in several Nikkei Index Funds due to liquidy concerns that are destabilizing the index. As now noted by Bloomberg:

Can the same thing happen in the U.S.? The two biggest leveraged ETFs in the U.S., according to XTF data, are: the $2.7 billion ProShares Ultrashort Barclays 20+ Year Treasury (TBT), which aims to double the inverse of a long-dated government bond index; and the $1.8 billion ProShares Ultrashort S&P 500 (SDS), which doubles the inverse of the S&P 500.

We are long SDS, it's one of our primary hedges in our Short-Term portfolio and obviously we're not alone in our grave concerns over the sustainability of the valuations in the S&P 500 as we barrel headlong into the thick of earnings season next week. So far, the early earnings season action has been back and forth but back and forth doesn't cut it when your index is trading at record highs!

We are long SDS, it's one of our primary hedges in our Short-Term portfolio and obviously we're not alone in our grave concerns over the sustainability of the valuations in the S&P 500 as we barrel headlong into the thick of earnings season next week. So far, the early earnings season action has been back and forth but back and forth doesn't cut it when your index is trading at record highs!

Have I mentioned how much I like CASH!!! lately?

This morning we're waiting for a terrible Industrial Production Report at 9:15 but, as noted above, we already placed our bets on that one. Expectations are for a 0.2% decline but I think worse and the worst part is the Capacity Utilization Number, which was just 77.6% in August, where 82.5% is healthy. If you think about it, imagine owning an office or a manufacturing plant where 22.4% of your space is just equipment gathering dust and no employees. That's not a good thing, is it? THAT is the current state of our economy!

Of course, they don't teach basic economics in school anymore, lest people realize that Republican economic policies are just bat-shit crazy… Instead we extend and pretend and we are taught to believe in a higher power (the Fed) who, in their infinite wisdom shall call forth money from heaven.

Yesterday it was the Fed's Bill Dudley and Loretta Mester's turn to conduct the Sermon of the Dove, assuring the faithful that:

"At the end of the day people are exaggerating" the divisions, Dudley said in response to a question after a panel presentation in Washington on Thursday. "We are all pretty much on the same page."

"We try to be as clear as possible about the rationale behind our decisions," Mester told a New York University audience on Thursday, calling Fed communications "a journey." "Given the cross currents in the economy, different people can have different views … which is really reflective of what the committee's decision-making is."

Jesus then said to them, "Truly, truly, I say to you, it is not Moses who has given you the bread out of heaven, but it is My Father who gives you the true bread out of heaven. For the bread of God is that which comes down out of heaven, and gives life to the world." Then they said to Him, "Lord, ALWAYS give us this bread." — John 6:32-35

Don't forget to say your prayers!

Have a great weekend,

– Phil