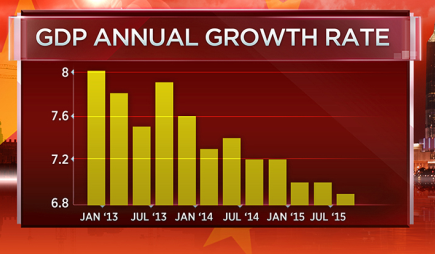

China claims their GDP is growing at 6.9%.

China claims their GDP is growing at 6.9%.

This is, of course, complete and utter BS but even if you accept this BS, it's still unsettling how fast the GDP growth has contracted over the last 18 months. Still, this is just silly because China is claiming 6.9% GROWTH when dozens of other economic indicators out of China are showing CONTRACTION.

You won't get any serious analysis of China's economy from the US Media, who are so beholden to China and Chinese companies that you may be completely unaware that the Chinese Government has recently "unleashed an extraordinary assault on basic human rights and their defenders with a ferocity unseen in recent years — issuing directives insisting on “correct” ideology among party members, university lecturers, students, researchers, and journalists." In fact, according to Human Rights Watch's 2015 Report:

China remains an authoritarian state, one that systematically curbs fundamental rights, including freedom of expression, association, assembly, and religion, when their exercise is perceived to threaten one-party rule.

Yet China's leaders were just greeted with open arms in the US and now the IPhone makers are heading off to England where, Liu Xiaoming, China’s ambassador to the UK, said British people “know how to behave” and the topic of human rights would not be raised at the dinner on Tuesday. As a Jersey boy, I also "know" mafia-style intimidation tactics when I hear them!

Yet China's leaders were just greeted with open arms in the US and now the IPhone makers are heading off to England where, Liu Xiaoming, China’s ambassador to the UK, said British people “know how to behave” and the topic of human rights would not be raised at the dinner on Tuesday. As a Jersey boy, I also "know" mafia-style intimidation tactics when I hear them!

Meanwhile, let's not get off the topic of fake, Fake, FAKE GDP numbers since we follow the market and the underlying assumption that China is growing at 6.9% is being used to justify a lot of insane corporate valuations – especially in China.

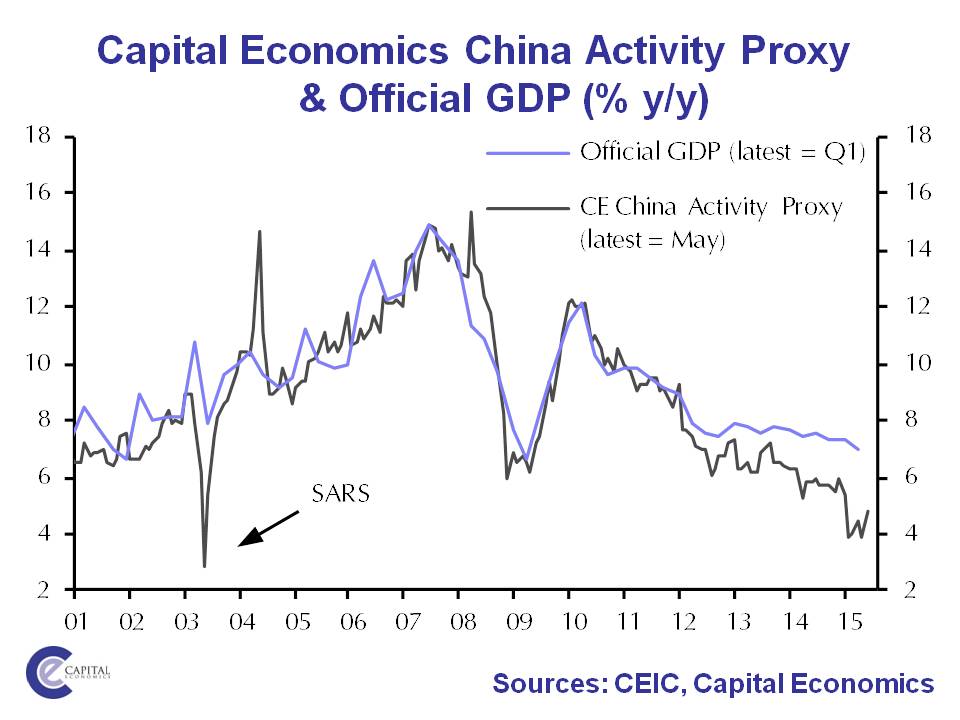

Capital Economics has a thing called the China Activity Proxy which is considered a much more realistic view of China's GDP and, as of Q1 – it was at 5%, which is it's lowest level since 2003 and much worse than the recent collapse in 2008, which helped trigger a global recession.

Capital Economics has a thing called the China Activity Proxy which is considered a much more realistic view of China's GDP and, as of Q1 – it was at 5%, which is it's lowest level since 2003 and much worse than the recent collapse in 2008, which helped trigger a global recession.

Now, I know it was a long time ago and many of you may have forgotten but, way back in August of 2015, the Shanghai composite fell 30% and, as of September 30th (the end of Q3) it was still 27% below the June 30th close – which market the end of the 2nd quarter and the beginning of the 3rd.

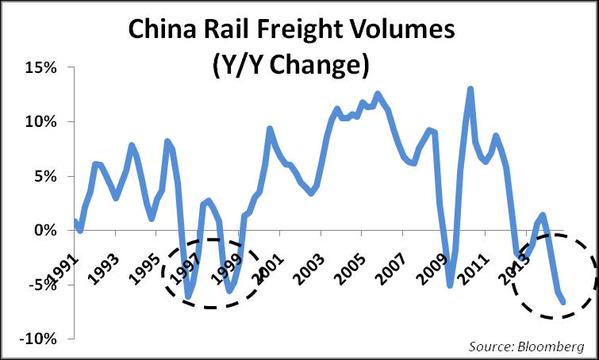

Across the board, the statistics don't look good with everything from steel to rail freight to electricity consumption showing big drops. China's manufacturing sector looks especially weak – sentiment just hit its lowest level in six years. The "flash" measure of sentiment among manufacturing purchasing managers fell to 47.1 in August, the worst figure in 77 months and a decline from the index's final reading of 47.8 in July, according to Caixin Insight and Markit Economics. Any number below 50 indicates a deceleration in the manufacturing sector. Here's a few pictures that save 1,000 words:

There are lots and lots of charts like this but you get the idea. All measurable indicators show decline yet the Government claims +7% – it's just too much of a gap in logic to accept. Another cause for doubt, according to the Financial Times, is that provincial figures and national data don’t always add up. Nor, often, do Chinese trade statistics matched against those of its trading partners. Such discrepancies are partly down to the sheer difficulty of measuring activity in such a vast country. Partly, though, they result from perverse incentives through which officials have been rewarded according to crude measures of growth.

Work by Harry Wu, an economist at The Conference Board, an independent research institute, concludes that, from 1978-2012, China grew at 7.2 per cent a year. While that is spectacularly fast, it is 2.6 percentage points below the official 9.8 per cent estimate.

Mr Wu finds that China overstates productivity growth and underestimates inflation, measured by something called the GDP deflator. If the deflator is understated, “real” growth, adjusted for inflation, will be overstated.

So, for goodness sake, do not fall for the streaming BS coming from the US Media, who are completely in bed with China and would do nothing to upset them. If everything were so great in China – then what's up with all the emergency stimulus, rate easing and market halting? Those are not the kinds of things that are usually necessary when the economy is actually growing at a 7% pace.

That brings us back to our stance, which is "Cashy and Cautious" because the US, Europe and Japan are also manipulating their economies – just a bit more subtly than China. That doesn't make it any less wrong or any less dangerous for investors and, as I noted in our October Portfolio Review this weekend, just because we keep our cash on the sideline doesn't mean we can't have fun – it's just a selective sort of fun that takes full advantage of the market manipulation – without having to commit to any particular direction.

That brings us back to our stance, which is "Cashy and Cautious" because the US, Europe and Japan are also manipulating their economies – just a bit more subtly than China. That doesn't make it any less wrong or any less dangerous for investors and, as I noted in our October Portfolio Review this weekend, just because we keep our cash on the sideline doesn't mean we can't have fun – it's just a selective sort of fun that takes full advantage of the market manipulation – without having to commit to any particular direction.

Our new Options Opportunity Portfolio begins it's 3rd month already up 16% and one of our short positions happens to be the China ETF (FXI) Nov $40/$38 bear put spread, which closed Friday at 0.75, down from the $1 we paid back on 10/12. The Nov $40 puts we are long on are still $1.60 so we will cash those in (0.60 more than we paid for the spread) and invest another $1.60 to roll to the FXI Jan $41 puts at $3.20. That will give our FXI premise more time to play out as more economic reports fail to match the GDP figures.

China has their plenary session this month and it will run through about Nov 10th after which there are HUGE expectations for lots more stimulus. Anything less than that will lead to a major sell-off (again) in the Chinese markets. Meanwhile, it's not like the data out of the US or Europe has been trilling either and this week we'll get earnings reports from 116 of the S&P 500 companies (23%) with another 160 reports next week (32%) reporting next week.

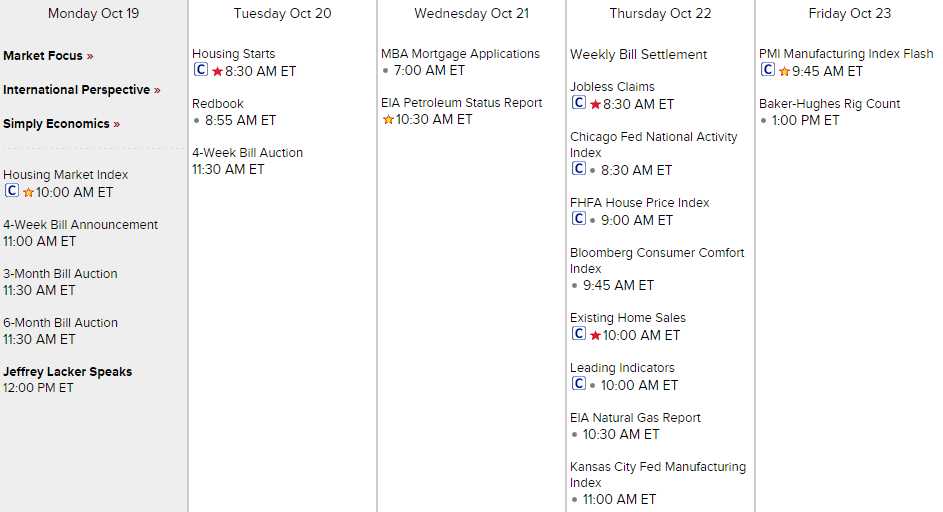

As you can see from the US calendar, there's not much in the way of economic news to distract us this week but add to this list, on Tuesday, Fed speak from Carney (BOE, actually – 6 am, EST), Dudley (9:00), Powell (9:15) and Yellen (11:00) and I tend to get very worried when the Central Banksters suddenly feel the need to spin the crap out of a morning, which leads me to think the September Housing Report is going to be a big miss (1.15M pace expected).

Canada has a Monetary Policy Report 10 am Wednesday with a rate decision and their Governor (Poloz) speaks at 11:15 and then Carney (BOE) is scheduled again at 1pm, EST. We get UK Retail Sales on Thursday morning and then the ECB rate decision at 7:45, EST and then Canadian Retail Sales at 8:30 – so a very busy morning ahead of China's sure to be negative PMI report that night (9:45). We'll close out the week on Friday with all sorts of EU manufacturing reports – the same reports that sent the Global Markets into freefall last month (in case anyone remembers that far back).

Please, be careful out there!