Courtesy of Dana Lyons

Stocks of “vice” industries like alcohol and tobacco are showing leadership – that hasn’t always been good news for the market.

Stocks of “vice” industries like alcohol and tobacco are showing leadership – that hasn’t always been good news for the market.

For the October equity bounce to progress to the next step, segments of the market will need to start pushing new highs again. And while there have been important price advances (see last week’s post on the Nasdaq 100), thus far there has been a dearth of major averages and sectors threatening new highs. One area that has seen its share of stocks moving to new highs already is the group affectionately known as “vice” stocks. As one might guess, vice stocks represent companies involved in, uh, less than wholesome industries like tobacco and gambling, etc. The problem is, leadership among this market segment has not always occurred at the best times in the broader market.

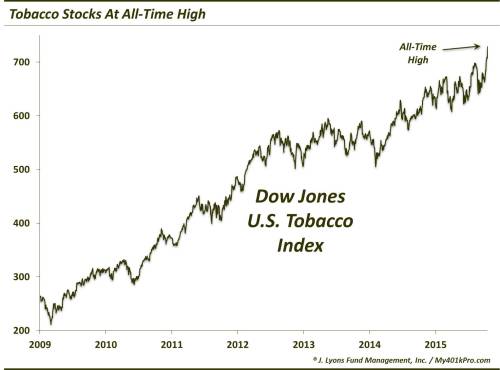

Before we touch on that, let’s take a look at some of these “vice” groups that are presently demonstrating strong performance. Several areas are at all-time highs, including tobacco stocks.

Additionally, alcoholic beverage companies have been on a tear lately. This includes the brewers, thanks in part to merger talk.

And distillers and vintners are also at all-time highs right now.

Also in the beverage arena, soft drink companies have been strong. As a group, they too currently look to be in position to make a run at all-time highs once they break out of what looks like a bull flag on the chart.

Similarly, while defense stocks are not at new highs, the group has been consolidating its sharp 2-year advance for much of the year. It too looks like it could be poised for all-time highs once the current consolidation runs its course.

Lastly, gambling stocks are nowhere near their highs. However, they do have a key dynamic working for them. After doubling from 2012 to March 2014, gambling stocks went on to relinquish the entirety of the rally. They bottomed with the rest of the market at the end of September, right near levels that marked its lows in 2011 and 2012. Additionally, that level (not surprisingly) happens to mark the 61.8% Fibonacci Retracement of the 2009-2014 rally. While this level may not hold forever, it should be substantial enough to support a further extension of the sector’s recent bounce.

So we see a number of these vice areas doing well right now. By putting them together into a composite, we can judge the performance of the category as a whole versus a broader market index like the S&P 500. So we took the 6 industries shown above and combined them into one equally weighted composite starting in 2000 (note, the defense and the distillers & vintners indices began in 2004 so they were added to the composite then.)

When we chart this VICE Composite, we notice that A) it is at a new all-time high and B) it is at an all-time high relative to the S&P 500. Furthermore, the relative VICE:S&P 500 ratio has sky-rocketed of late. That is great news for vice stocks, but perhaps not so much for the broad market in general.

From the chart, we can identify two other distinct periods in which VICE stocks far out-paced the S&P 500. Ominously, those were during the 2000-2002 and 2007-2009 cyclical bear markets. The theory goes that even during dry spells in the market or economy, folks are still going to partake in their particular “vices”, like drinking, smoking and gambling. It is a speculative theory, but it makes sense and appears to be borne out by the data.

Of course, much of the VICE Composite’s relative outperformance during those periods came as a result of the S&P 500′s exceedingly poor performance, rather than the VICE Composite’s stellar performance. However, along with the vice stocks’ relative defensive nature during the bear markets, they also did demonstrate spurts higher coinciding with the previous two cyclical market tops.

Is the current spurt higher by vice stocks another of those “last ditch” rallies prior to the market rolling over? We don’t know for sure. However, the circumstances that exist today are, in many ways, not unlike those at the prior two cyclical market peaks. Now if an investor is involved in these vice stocks, we certainly don’t see this phenomenon as a reason to dump them. However, for broad market investors, it would certainly be preferable if a different set of sectors was currently leading the way.

* * *

More from Dana Lyons, JLFMI and My401kPro.