What an insane market!

What an insane market!

At 4 am, just after Europe opened, the Futures blasted off for no particular reason. It wasn't too surprising as they were the same long lines we played in yesterday's Live Futures Trading Webinar – so great money to be made by the early risers but now we're back to the lines we shorted earlier yesterday, at 11:10, when I said to our Members:

Lines of the moment are /YM 17,200 (below), /ES 2,035 (below), /NQ 4,450 (below) and /TF 1,165 (below) with /ES at 2,028.5 playable short with a stop over 2,030 (or any of the others going over) and then short the laggard if we're back at 2,035.

This morning we're right back at 17,200, 2,030, 4,445 and 1,165 so of course we're back in the saddle again – taking our short entry on the Russell as we follow our shorting rules, which are:

I do like shorting our majors this morning at 17,200, 2,035, 4,450 and 1,165 – ONLY ON CROSSES BELOW by the 3rd of 4 and out if ANY of the 3 cross back over and needing to quickly see the 4th index confirm the drop.

Follow those simple rules and, as we demonstrated in yesterday's webinar, you can limit your losses while waiting for that big victory when things break your way. We made about $200 live for our Webinar participants – who else gives a webinar where the attendees come out ahead?

.jpg)

As you can see from Declan's S&P 500 chart from PSW's Chart School, 2,050 is a major line of resistance but 2,035 (see yesterday's post) is the 5% line on our Big Chart and that has been unbreakable during the live sessions so the market manipulators are now pulling out all the stops to push us over the line in the thinly traded futures to keep the retailers thinking Everything is AWESOME – even when the data shows that it clearly is not.

We're not going to complain about the blatant market manipulation because we're part of the Top 1% that's able to profit from it. Yesterday we rode those Futures shorts down to 17,100 on /YM for a $500 per contract gain, 2,020 on /ES for a $425 per contract gain, 4,420 on /NQ for a $600 per contract gain and 1,155 on /TF for a $1,000 per contract gain. This is how the Bottom 99% of the Top 1% get their share of the FREE MONEY the Fed is giving away.

There's nothing Fundamental driving these moves, we're merely moving higher on bad economic news, like this morning's 11% decline in Japanese Imports that the MSM hasn't said a word about – instead focusing your attention on the 0.6% increase in Exports over last year that still sucks, but doesn't sound as bad. Do you know why it sucks? Because it's measured in Yen and $XJY was at 95 last October and now it's at 83.42, which is 12% lower so the same VALUE of Exports would have to be 12% higher just to be the same as last year.

Even so, leading Economorons surveyed by Bloomberg expected a 3.8% increase, which wasn't too unreasonable given the huge head start the weak Yen was giving it paired with Abe's $1Tn stimulus program BUT Noooooooooooooo!, it' failed to help. In fact, 42% of the economorons surveyed by Bloomberg now expect the BOJ to boost the stimulus further this month. Overall, Japan's Trade Deficit was 114.5Bn Yen vs "expectations" of an 87Bn Yen surplus – oops!

Even so, leading Economorons surveyed by Bloomberg expected a 3.8% increase, which wasn't too unreasonable given the huge head start the weak Yen was giving it paired with Abe's $1Tn stimulus program BUT Noooooooooooooo!, it' failed to help. In fact, 42% of the economorons surveyed by Bloomberg now expect the BOJ to boost the stimulus further this month. Overall, Japan's Trade Deficit was 114.5Bn Yen vs "expectations" of an 87Bn Yen surplus – oops!

QE policies ARE NOT WORKING people! Doing more of the same is monetary madness, we are propping up the economy by charging stock market gains to our credit cards without creating any real assets and that's a very, very stupid thing to do. We need INFRASTUCTURE projects that use those excess materials we have laying around and create some jobs and we need policies that spur REAL housing growth, not the BS multi-family housing growth that was used as an excuse for yesterday's rally (thanks Pharmboy):

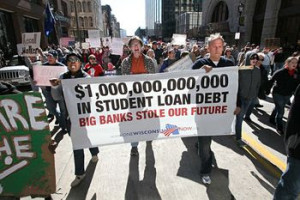

This is what our housing "recovery" looks like – less an less single-family homes being bought and more and more 5+-unit structures for our indentured servants to cower in until it's time to work again. Yes, indentured because that's what someone is when they can only get a job after the go to college and college costs $100,000 and the job pays $25,000 so even if they manage to live on $10,000 a year (half of their after-tax $20,000 take-home pay), it will still take them 15 years to pay off the loan with interest. THAT'S WHAT INDENTURED SERVITUDE IS!

And that student loan can't be discharged in bankruptcy. That's how the Banksters get their claws in your children as soon as they are old enough to vote. The credit card debt they use to get by while paying off their loans also may not be discharged in bankruptcy thanks to Bush's 2005 rule changes. That's why Bernie Sanders wants to reform Student Loans and eliminate college tuition altogether and that's why the MSM refuses to cover the man – lest you proles get any "ideas."

And that student loan can't be discharged in bankruptcy. That's how the Banksters get their claws in your children as soon as they are old enough to vote. The credit card debt they use to get by while paying off their loans also may not be discharged in bankruptcy thanks to Bush's 2005 rule changes. That's why Bernie Sanders wants to reform Student Loans and eliminate college tuition altogether and that's why the MSM refuses to cover the man – lest you proles get any "ideas."

In fact, Student Loan Balances grew another 15% this year and are now miles above Auto Loans and Credit Cards as the number one source of US debt, having grown 300% since 2004. A combination of rapidly rising college costs, parents who can't afford to help and declining wages after college means these loan balances are just growing and growing every year yet this is another thing your MSM does not want to cover because it doesn't fit the current AWESOME propaganda:

Of course, none of this affects the children of the Top 1%, their kids have fully-funded 525 plans that will pay for their college and still have some left over for graduate school. Top 1% kids won't need to take a crappy job to pay off their student loans and that will leave them free to take internships at Law Firms and other start-up positions that will lead them to the high-paying jobs that are their birthright while your children will work at Starbucks making coffee for the Top 1% as they hurry off to their important jobs.

THAT IS THE STATUS QUO – this is what you are supporting, folks – shame on you!