Now China has lowered their lending rates – again!

Now China has lowered their lending rates – again!

That's right, first thing this morning, the PBOC announced another 0.25% rate cut at 7:30 this morning along with a 50 basis point reduction in reserve requirements AND completely removed the bank deposit rate ceiling. That, of course, sent our Futures flying and, as I noted yesterday, is surely more proof that China's 6.9% GDP growth numbers are legitimate – Central Banks always panic with massive quantitative easing when their economy is growing 6.9% per year, right?

Fortunately, we had flipped long on the Russell (/TF) futures into yesterday's close at 1,155 and those punched up $1,000 per contract gains but, unfortunately, we were short on the S&P (/ES) futures at 2,050 and those are down $1,000 per contract at 2,070. So, what do we do? We take the profits from /TF and buy more /ES shorts at 2,070, of course! By the way, the replay of Tuesday's Live Futures Trading Webinar is HERE.

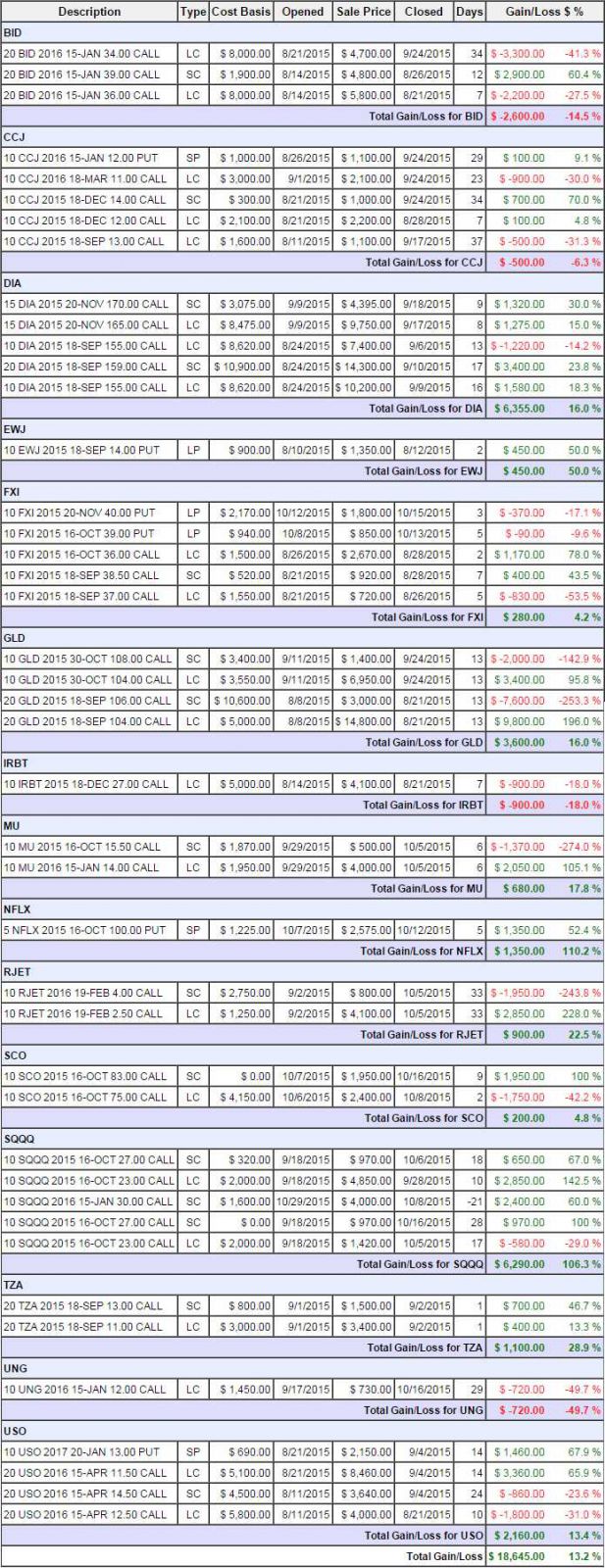

Our weekly live trading webinars are occasionally fee (Tuesday's was) but are part of the service provided to followers of our Options Opportunity Portfolio over at Seeking Alpha. Even though we got this week "wrong" by working our way into neutral (down $300 since last weekend's review) it's because we are protecting what are now $18,645 in gains (18.6%) on closed positions since our August 8th inception date:

Many of these may seem familiar to readers of our morning posts, as we often discuss similar position in our morning reports but it's inside the Member Site where we mark the actual trades, live, while the markets are open and then track them in virtual portfolios like this one. Oddly enough, the ultra-short Nasdaq ETF (SQQQ) has been one of our biggest winners but it's also our biggest current loser on the open side. We'll be repositioning those this morning on the super-spike back to 5,000 (about 4,625 on /NQ).

As you can see, our other big winner was Dow ETF (DIA) longs. We're just as happy to make money on the long side as the short. Today we just feel a lot more comfortable being short – especially coming into the weekend off another round of stimulus and back to Nasdaq 5,000, right back to where we were before we fell 800 points in mid-August.

As you can see, our other big winner was Dow ETF (DIA) longs. We're just as happy to make money on the long side as the short. Today we just feel a lot more comfortable being short – especially coming into the weekend off another round of stimulus and back to Nasdaq 5,000, right back to where we were before we fell 800 points in mid-August.

But that was so 2 months ago – this time is different, right?

You can see on this chart why we chose to go long on the Russell, it was lagging the other indexes in getting back over the 100-day moving average and, because we learned how to trade the futures – rather than sit on the wrong side of the trade AFTER hearing strong earnings from Google (GOOG), Amazon (AMZN) and Microsoft (MSFT) and missing the after-hours pop in the Nasdaq, we were still able to grab the Russell Futures (/TF) AFTER HOURS! THAT is why you should ABSOLUTELY learn how to trade the Futures – it was free money! Don't you want free money when it's being handed out?

As I said, we're short here (2,070 on /ES and 1,165 on /TF and 4,625 on /NQ) because Nasdaq 5,000 is a bit ridiculous after starting the month at 4,500. THIS IS NOT CHINA!! Our markets are supposed to be traded rationally and not subject to manipulation. Instead, we run up because the Fed chose not to tighten and we run up because economic data is so bad we assume the Fed can't tighten in October either (wrong, by the way) and run up because Draghi says Europe is doing well but needs more easing and then we run up because China says their GDP is growing 6.9% but they have to have emergency rate cuts and lower reserve requirements.

Do those things make sense to you taken together? I'm not advocting shorting the markt – that would be crazy, as you can't fight the combined efforts of the World's Central Banksters. I am advocating keeping your long positions well-hedged and, at this level, perhaps taking some of that long money off the table.

While Google Alphabet, Amazon and Microsoft all had fantastic earnings yesterday, none of them are very dependent on China – so they have nothing to do with what's affecting the other 497 S&P companies. Those 3 companies alone, since 4pm yesterday, have gained $100Bn in market cap. Now, clearly there haven't been $125Bn worth of transactions to back that up – not even $12Bn and, in an average day, those 3 stocks only trade about $12Bn worth of shares – only 10% of what they have now been marked up to.

This is why we short at times like this. Imagine a guy on the street is selling bottles of water for $2 a bottle. Usually you would pass him by but maybe it's hot and you'd rather have water now than find a store where it's $1.25. On a hot day, maybe he sells half of the 100 bottles he has on his cart but he's got a warehouse with 10,000 of them that he bought for $1 each. In general, he could tell an investor that his warehouse stock is worth $20,000 because he has a good expectation of eventually selling all 10,000 for $2 – nothing wrong with that logic – to a point.

HOWEVER, maybe on a very hot day he sells out and maybe when there's only 10 bottles left, right when he's about to close, there's a bidding war and people offer him $3 or $4 for his last bottles. Is that man now justified in telling you his entire warehouse stock of water is now worth $40,000? Just because he sold a couple of bottles at $4 during an unusual situation does not mean he should expect to sell 10,000 more at panic prices, does it?

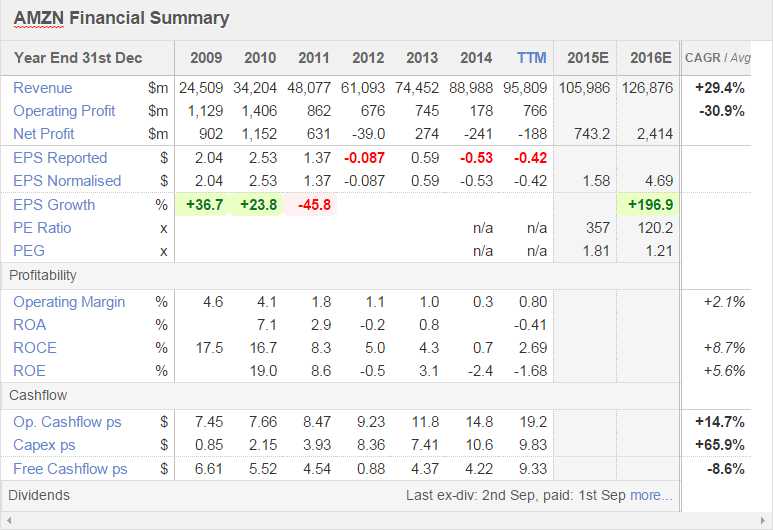

Well, that's what the the market is doing. In thin, after-hours trading, AMZN shot up 10% and GOOG shot up 12% and MSFT shot up 10% but are there really enough people to support what is now a combined $1,000,000,000,000 valuation of the three? I would say do their combined earnings support a $1Tn valuation but let's talk about the overpriced elephant in the room – Amazon (we're net short).

AMZN earned 0.17 per $564 share last night and the stock jumped $55 on that news. That's 323 TIMES the amount of earnings per share that they INCREASED above the 3,317 TIMES 0.17 they were already priced at. Now do you see why we were short and will stay short (shorter, in fact) on this news?

Let's say, for argument's sake, that AMZN can double that 0.17 profit to 0.34 per share and that they sustain it for 4 quarters. That would be $1.36 per $618 share for a p/e ratio of 454 – around 30 TIMES more than GOOG, AAPL or MSFT or any retailer or pretty much any real stock – let alone one that's been around for 21 years and, frankly, isn't growing all that fast:

AMZN LOST 0.12 in Q1 and made 0.19 in Q2 and now have made 0.17 in Q3. That's 0.24 for the year so far and last December they made 0.45 so let's assume they blast up to 0.70 (up 55%) – that's still not even $1 per $620 share! Come on people – be realistic, this is ridiculous! And this is not sour grapes because our short position on AMZN is an April spread and we'll be fine – this was ridiculous when we toot the position and only more so now.

If Google had AMZN's valuation it would be trading at $18,000 per share with their $30 in earnings. Tim Cook (pictured above)'s AAPL would $6,000 ($10/share) and MSFT ($3/share) $1,800 so either those stocks are drastically underpriced or Amazon's valuation is stupid – we report, you decide! The thing that really pisses Tim Cook off is that AAPL accounts for 10% of AMZN's sales yet AAPL (we're long) trades at less than a 12x multiple to forward earnings.

The last time we saw disparities this stupid was 1999 and there were plenty of people then who had 27 8×10 color glossy pictures with circles and arrows and a paragraph on the back of each one explaining what each one was to be used as evidence to explain to you why paying 600 times earnings for dot com stocks was a great move for your portfolio. The Nasdaq was at 5,000 then too!

Have a great weekend,

– Phil