Not much reaction to China's rate cut on Friday:

Up 0.5% after a surprise rate cut on Friday when we're still 35% off the highs is NOT what you want to see in an "improving market" – especially one that is "growing at a 6.9% annual pace." Oh sorry – I had to take a break to fall off my chair laughing… That's right – there are STILL people out there who believe China's GDP numbers are real. Personally, I'm bored discussing them so let's leave them to their delusions and take advantage of our chance to short China's ETF (FXI) as it retests $40.

Our own markets have been much more exciting anyway, with the S&P blasting up 200 points (10.6%) in just 4 days last week. This is, of course, perfectly normal in an $18.5Tn index. After all, according to the Money Flow index, a whole net $73Bn flowed into the S&P last week, so doesn't it make perfect sense for the index to gain $1,800Bn in value?

Our own markets have been much more exciting anyway, with the S&P blasting up 200 points (10.6%) in just 4 days last week. This is, of course, perfectly normal in an $18.5Tn index. After all, according to the Money Flow index, a whole net $73Bn flowed into the S&P last week, so doesn't it make perfect sense for the index to gain $1,800Bn in value?

ALL it's going to take is another 24 weeks like that and the flow of money in will catch up to the implied gain in value – that should be no problem, right? I know I have at least $10Bn laying around somewhere to throw into the pot, chasing after all these overpriced stocks – how about you?

As I noted on Friday, Google (GOOG), Microsoft (MSFT) and Amazon (AMZN) alone added $100Bn (5%) of the S&P's market cap gains and the rest was pretty much other stocks following their lead. As you can see from the performance chart, Healthcare and Basic Materials got left behind but it was a huge week for Industrials and Technology and even Consumer Goods, Financials and Services joined the party.

As nicely summed up by Dave Fry:

The ECB is rumored, due to little bond supply to buy stocks with their QE program. Doing so would copy Japan’s BOJ who make no secret of buying stocks to support markets. Now China’s PBOC and acknowledging a weak economy, cut interest rates. And, after outlawing shorting, and even conventional selling, now markets are no legitimate two-way trading affair.

It doesn’t matter that an overwhelming majority of pundits claim the U.S. central bank dare not raise interest rates. They’ve been saying they will do so, and do so this year. Isn’t their credibility is at stake?

Bottom line, central banks are in charge and want markets higher period.

This week many market sectors have heeded central bank’s not so subtle mandates leading to almost panic buying for stocks. Many sectors have moved into green for the year.

It’s been quite a spectacle as overall earnings and ongoing economic data have been weak and are cast aside.

As I and many others have asserted, the stock market is not the economy and this has never been truer than now.

There are only two indexes we're watching this week and that is, of course, the Nasdaq at 5,000 and we're back to 11,000 on the DAX, which was the line that gave us an early failure warning back in August. Getting back over that line would be a huge victory for the bulls while failing at that line would be a huge "I told you so" for the bears.

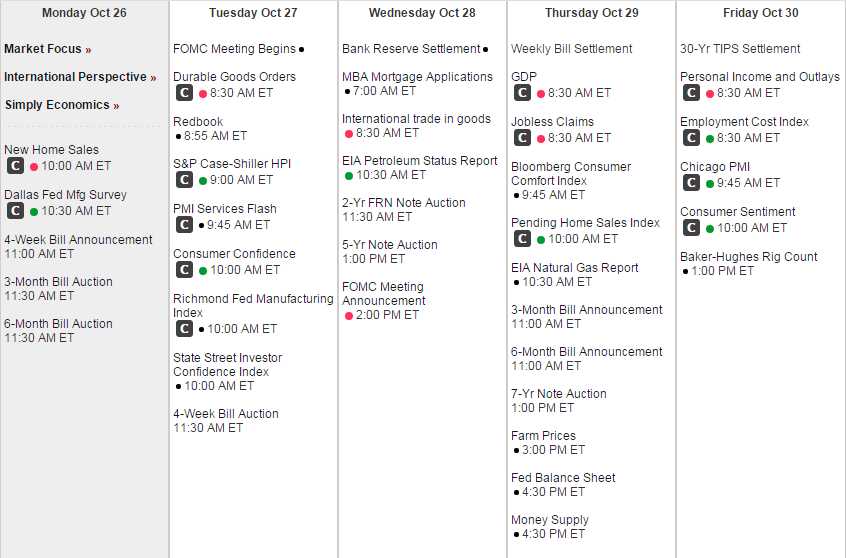

This being Monday, we're already planning on not caring what happens today. It's going to be a very busy data week with a Fed Rate Decision on Wednesday, where I am now the only analyst on the planet expecting a 0.25% rate increase. Durable Goods are a big deal tomorrow and they will suck but Consumer Confidence will be very interesting as the last Michigan Survey showed weakness but expectations for Consumer Confidence are still very high (103) and we get the Final Michigan numbers on Friday.

If we survive the Fed on Wednesday, then we have to survive Q3 GDP on Thursday. Expectations are for a 3.2% reading but I've done the math and I can't see how over 2.5% is going to happen and I'd lean lower than that. Will that bad news be good news for the markets or will it be the straw that breaks the rally's back? No help from Personal Income/Spending on Friday – not if you believe the Michigan Sentiment and Chicago PMI has been a serial disappointer this decade.

Of course, that's just one of those pesky facts we like to ignore while singing "Everything is AWESOME" and buying more overpriced stocks. This is our 2nd busiest earnings week and, so far, they've been a little disappointing but not a train wreck… This week is heavy with Health Care and Technology names and we will be looking for tech stocks to short as last week's run has over-inflated expectations on many of them.

So far, a lot of companies are getting away with "the Dollar ate our profits" as an excuse for poor performance in foreign markets. Yes, the Dollar is up 17% from last October but doesn't that lower their labor expenses and commodity costs? You don't hear any companies saying "well our earnings really would have sucked if oil wasn't 50% cheaper than last year" do you?

"The dollar is an easy crutch," said Scott Wren, a senior global equity strategist in St. Louis at Wells Fargo Investment Institute. "We haven’t had a great earnings season and we probably won’t. Operating earnings are probably going to remain flat — or down a little or up a little — so you look for those scapegoats."

Exxon (XOM) and Chevron (CVX) both report Friday morning and XOM is expected to earn just 0.89 in Q3, down 53% from $1.89 last year and CVX is projected to squeeze out just 0.76 vs $2.95 last year (down 74%) so either CVX is being overly pessimistic or XOM will likely disappoint and I think Friday, pre-market, will be a fun time to short the Dow Futures (/YM). Perhaps, if the madness continues and the Dow takes a crack at the 18,000 line this week (now 17,646), we'll grab some DIA puts (now $176, should be $180) to join in on the fun.

As we discussed last week, today kicks off China's Plenary Planning Session for the next 5 years that may or may not conclude on Friday with long-range plans regarding trade, pollution, population control (too many men at the moment), energy, infrastructure and, of particular concern to investors – GDP. If China sets their GDP target lower than 6.5% for the next 5 years, it will send red flags flying all over the Global Markets.

Of course, I see plenty of red flags already – that's why we are staying "Cashy and Cautious into the Plenary. Here's some China numbers that don't quite add up to the 6.9% GDP growth they've been reporting. The discussion in the Plenary has to be "can we keep faking our data for 5 more years or do we have to put out a more realistic number":

- China export trade: -8.8% year to date

- China import trade: -17.6% year to date

- China imports from Australia: -27.3% year over year

- Industrial output crude steel: -3% year to date

- Cement output: -3.2% year over year

- Industrial output electricity: -3.1% year over year

- China Manufacturing Purchasing Managers Index: 49.8 (below 50 is contractionary)

- China Services Purchasing Managers Index: 50.5 (below 50 is contractionary)

- Railway freight volume: -17.34% year over year

- Electricity total energy consumption: -.20% year over year

- Consumer price index (CPI): +1.6% year over year

- Producer price index (PPI): -5.9% year over year, 43 consecutive months of declines

- China hot rolled steel price index: -35.5% year to date

- Fixed asset investment: +10.3% (averaged +23% 2009-2014)

- Retail sales: +10.9% the slowest growth in 11 years

- Shanghai Stock Exchange Composite Index: -30% since June

It's going to be a very interesting week – stay tuned!