Courtesy of Dana Lyons

Participation among all stocks in the recent stock rally, as measured by an equal-weight index, has been relatively weak – as it has been since last spring.

In several posts last week, we looked at the developing weakness among “equal-weight” indexes versus their comparable cap-weighted versions. As the name implies, an equal-weight index applies an equal weighting to all of the components in the index, regardless of price or market cap. Taking this more democratic view of the index makes it easier to assess how strong the broader group of stocks really is, as opposed to a weighted index which may be supported by a relatively small number of its biggest constituents. This weakening among the equal-weight indexes showed marked acceleration over the past few weeks. But is it possible that the cap-weighted indexes were merely catching up to their equal-weight counterparts?

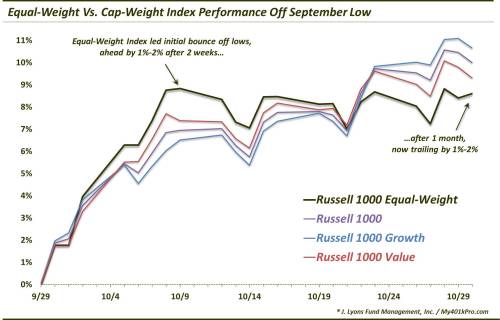

We offer as evidence of this variant view, the performance of the Equal-Weight Russell 1000 Large-Cap Index versus the traditional, cap-weighted Russell 1000 as the market was emerging from its late September lows. As this chart shows, in the initial rally off the lows, the Equal-Weight Russell 1000 handily beat its cap-weighted counterpart, as well as both the Russell 1000 Growth and Russell 1000 Value. This demonstrates that it was not just the style of stocks accounting for the leadership, it was the breadth of stocks. The equal weighting of the smaller components in the index allowed for the out-performance of the cap-weighted Russell 1000 Index.

On October 9, following the first 2 weeks of the bounce, the Equal-Weight Russell 1000 was between 1% and 2% ahead of each of the other indexes. At that point the other indexes certainly had some “catching up” to do.

From October 9 to October 21, that’s exactly what the other indexes did. During that period, the Equal-Weight Russell 1000 drifted slightly lower as the others drifted slightly higher. As of October 21, each of the indexes’ bounce gains were within 0.2% of +7%. Thus, the other indexes had caught up to the Equal-Weight. At that point, a reasonable argument could have been made for the “catch-up” hypothesis. In other words, the under-performance of the Equal-Weight Index was simple mean-reversion versus its initial out-performance.

However, the continued relative under-performance since October 21 undercuts that argument. Since the other Russell 1000 Indexes caught up to the Equal-Weight Index, they have continued to drift higher. Meanwhile, the Equal-Weight Russell 1000 has continued to drift sideways. As of Friday, October 30, about 1 month following the September market low, the other Russell 1000 Indexes had garnered a bounce advantage of between 1% and 2%. The tables have been turned.

Zooming out a bit, we find probably a more compelling case against the “catch-up” argument. See, this under-performance by various equal-weight indexes (i.e., the broad market) goes back further than a few weeks. As we touched on in last week’s posts, among the consumer discretionary and energy sectors, the ratio between the equal-weight and cap-weight indexes has fallen to 2009 levels. And even among the S&P 500 stocks, the equal-weight index is at relative 3-year lows versus the cap-weighted index. This is not just a recent phenomenon.

We can see this in the Russell 1000 Equal-Weight Index as well. Looking back to the Index’s top in May (which was the top in many other indexes as well), it has clearly been under-performing its cap-weighted peers for 5 months now.

Thus, the under-performance of the Equal-weight Russell 1000 is not just a phenomenon of the post-September rally. It has been underway for many months now. Therefore, the out-performance by cap-weighted indexes over the past few weeks can hardly be considered a mean-reversion following the initial relative leadership by the equal-weight indexes directly off of the lows. If anything, the strong equal-weight bounce off the lows was the mean-reversion.

The larger point is that this relative under-performance of equal-weight indexes is a trend we observe across numerous sectors and market segments, not just the Russell 1000. And we have observed it for 5 months now. Therefore, in our view, this issue should not simply be viewed in the context of judging the quality of the bounce off of the September lows. It should be viewed as a larger, more significant challenge to the longer-term sustainability of the stock market rally.

For, even as the major average are once again approaching their former highs, they are doing so on the backs of a diminishing number of stocks.

* * *

More from Dana Lyons, JLFMI and My401kPro.