One million people are marching in 500 cities tonight.

One million people are marching in 500 cities tonight.

If that is a surprise to you, you must be being held hostage but the American Mainstream Media who, for the 3rd consecutive year, seem very determined to pretend what is now a major, Global Anti-Capitalism protest gets no airtime at all. You would think it was a Bernie Sanders rally the way the MSM is ignoring this event...

That's right, the US Corporate Media has ZERO (0) mentions of this massive, world-wide event on the first page of a Google search for "Million Mask March 2015" (as of 8:12 am) and, since it begins at 1pm, EST, we've safely cleared the morning news cycle so there's little danger of anyone in the US getting any ideas about protesting Capitalism (those that haven't already had their brains beaten in during Occupy Wall Street, that is). Even my own Huffington Post only mentions it in their UK edition.

What you will hear instead today, is that Chinese markets are back in "bull market territory" because they have rallied 20% off their August lows. I told our Members we should make this a drinking game today and have a shot every time we hear someone on TV say China Bull Market to describe what is really nothing more than a dead cat bounce:

Let's have a reality check, shall we? The Shanghai was up to 5,200 and fell to 2,800, which is 46% and now, that 46% has gained 20%, which is 9% out of the 46% it lost. Saying this is a 20% rally is nothing more than a math trick, designed to lure the next round of suckers in to buy out the shares that the Media Elite and their Top 1% sponsors are still stuck with. This is not sour grapes because we are short the China ETF (FXI), this is a no BS analysis of what is happening.

It's a scam! The people on TV are lying to you. You KNOW they are covering up anti-Capitalism protests – that is very obvious – so why would you not believe they are lying to you about other things like China, Inflation, the US Economy? Once you realize the MSM is nothing more than a propaganda machine for the Top 1%, what they are doing becomes quite transparent.

It's a scam! The people on TV are lying to you. You KNOW they are covering up anti-Capitalism protests – that is very obvious – so why would you not believe they are lying to you about other things like China, Inflation, the US Economy? Once you realize the MSM is nothing more than a propaganda machine for the Top 1%, what they are doing becomes quite transparent.

China doesn't allow short-selling so the only way the Top 1% who were foolish enough to invest in China (most of them) at the top can get out at all is to drive more buyers back into the market so they can at least cash in the shares they are still stuck with. To do that, there is an all-out PR campaign being waged to convince retail investors that everything is still AWESOME in China – even though you KNOW as you read those words they simply are not true.

Bill Bonner does a nice job this mornign of summarizing the China tragedy, so I won't get into it again. I'll just point out that the Shanghai composite had a 22.5% "rally" in early July that took them back to 4,200 (less than 20% off the top) before vanishing in a puff of smoke by the end of the month and then going more than twice as low in August. This "bounce" is far weaker than that one was and, unlike June – there's no actual stimulus or policy action supporting it – just smoke being blown up the asses of retail investors by the Corporate Media – works every time!

Speaking of Chinese cover-ups. Turns out China has actually been producing one BILLION more tons of CO2 each year than previously reported. That extra Billion tons per year is the ENTIRE CO2 output of Germany. The pollution is so bad in Northern China that people there live 5 years less than the nation's average which, of course, is all dragged down by the same pollution (as is yours, but only a little).

The country has pledged to cut back emissions by 2030, and Beijing said it would end the use of coal 10 years prior to that. But the most recent data shows China has been underreporting coal pollution since 2000, reported the Times, citing statistics from the U.S. Energy Information Administration. The news comes one month ahead of December's highly anticipated climate summit in Paris.Hundreds of world leaders and scientists are expected to work out a strategy to tackle climate change, and many are looking toward big polluters including China, India, Russia and the United States.

The country has pledged to cut back emissions by 2030, and Beijing said it would end the use of coal 10 years prior to that. But the most recent data shows China has been underreporting coal pollution since 2000, reported the Times, citing statistics from the U.S. Energy Information Administration. The news comes one month ahead of December's highly anticipated climate summit in Paris.Hundreds of world leaders and scientists are expected to work out a strategy to tackle climate change, and many are looking toward big polluters including China, India, Russia and the United States.

China HAS to cut back on CO2 emissions because it is literally and undeniably killing them. That's why the slowing growth in China is not a bump in the road – it's an economic reality as the economy has outgrown the ability of the LAND to sustain the growth. By pushing the country towards rapid expansion for the past 20 years, there has been great success in growing an impressive and Globally competitive economy, but they have also accelerated all the issues we had in the 60s and 70s with pollution and environmental damage and now, like we did, they will have to slow down and fix some of those issues before they go critical (as if losing 10% of your life to pollution isn't already critical).

This is how we KNEW China could not sustain their growth in the spring and this is how we KNOW they aren't going to bounce right back now. These aren't the kind of issues that go away overnight and their Government has more to worry about than whether or not Apple hits their growth targets for iPhone sales in China next quarter.

This is why one million people or more around the World are protesting Capitalism this evening. Capitalism causes as many problems as it solves and, in the developing World, where it runs without adequate regulation (or, as the GOP calls it – their plan for the future), a LOT more problems are caused and very, very few are ever solved as nations are exploited for their resources and then left to rot by carpet-baggers from the developed World.

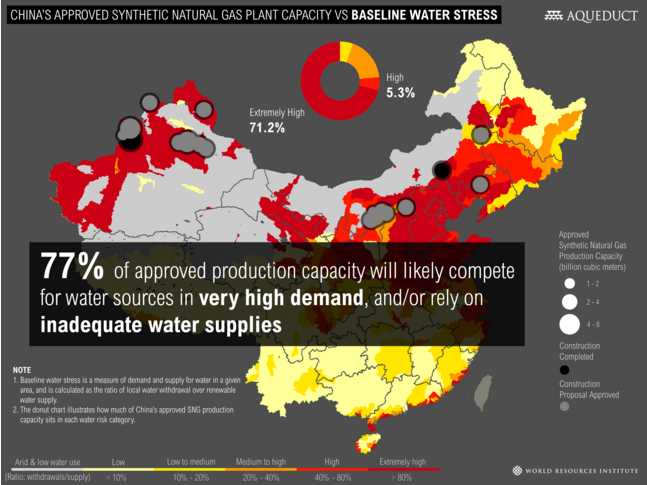

Even as it's being done to China, China is doing it to Africa and I suppose Africa will eventually find someone to pick on as well but we can't take the media's word for China's growth prospects. Take power, for example. Although China has approved massive expansion of 18 major natural gas plants – it turns out that 14 of them (77%) don't actually have enough water to function. So China now has to choose between water or energy shortages in 14 regions.

Even as it's being done to China, China is doing it to Africa and I suppose Africa will eventually find someone to pick on as well but we can't take the media's word for China's growth prospects. Take power, for example. Although China has approved massive expansion of 18 major natural gas plants – it turns out that 14 of them (77%) don't actually have enough water to function. So China now has to choose between water or energy shortages in 14 regions.

These are HARD STOPS on economic growth and they aren't the kind of problems that can be fixed by lowering interest rates and THAT is why we are bearish on China. There's no "recovery" to 5,200 in the cards – the reality is that 5,200 never should have happened and neither, most likely, should 4,000 or anything over 3,500 (where we are now) given a realistic outlook for China's economy for the next year or so.

The Nasdaq went crazy in the summer of 1998 and shot up from below 2,000 to over 5,000 in March of 2,000 (20 months) but then it crashed to 1,172 (Aug '02) and did not make it back to 3,000 until March of 2012 – ten years later. THAT is how long it can take to regain the highs in a well-established, developed market with very good financial controls in a relatively stable economy.

What are you betting on?