Financial Markets and Economy

Major Oil Companies Have Half-Trillion Dollars to Fund Takeovers (Bloomberg)

The world’s six largest publicly traded oil producers have more than a half-trillion dollars in stock and cash to snap up rival explorers.

Fidelity has no business investing in startups like Snapchat (Business Insider)

Fidelity has no business investing in startups like Snapchat (Business Insider)

NYU finance professor Aswath Damodaran doesn't think a big, stodgy investor like Fidelity has any business investing in a startup like Snapchat.

In an appearance on Bloomberg TV on Wednesday, Damodaran was asked about recent reports that Fidelity had marked down the value of its investment in Snapchat by 25%.

Indian startups have been handed an incredible opportunity to reach new investors (Quartz)

Indian startups have been handed an incredible opportunity to reach new investors (Quartz)

Some of the world’s leading startup investors—like Tiger Global and Sequoia Capital—have been dabbling in India for several years now. They should probably start preparing for a lot more company.

With China now targeting a minimum growth rate of 6.5% a year until 2020—the lowest growth forecast that the country has had since the late 1970s—India stands to siphon off some of the venture capital that otherwise might have flowed into China.

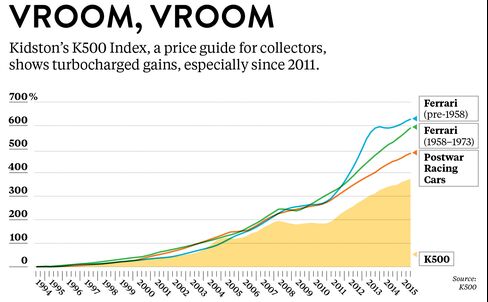

How This Classic Car Broker Is Helping Collectors Gauge the Market (Bloomberg)

Steeped in the romance of classic cars, Simon Kidston arranges the sale of very expensive ones. Now, hes launched an index to give enthusiasts an edge.

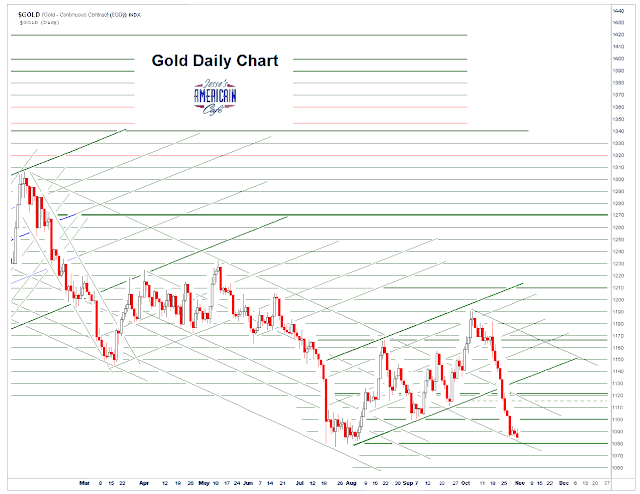

Gold Daily and Silver Weekly Charts – The Road Ahead (Jesse's Cafe Americain)

It was more back and forth with gold and silver today.

Apple in talks with U.S. banks for person-to-person payment service: WSJ (Business Insider)

Apple in talks with U.S. banks for person-to-person payment service: WSJ (Business Insider)

Apple Inc is in talks with U.S. banks to develop a person-to-person mobile payment service, the Wall Street Journal reported.

The talks are ongoing and it is unclear if any of the banks have signed an agreement with Apple, the Journal said, citing people familiar with the matter.

Goldman says U.S. economic recovery has about 4 years before it ends (Market Watch)

Goldman says U.S. economic recovery has about 4 years before it ends (Market Watch)

Investors who worry that the U.S. economy is speeding toward another inevitable recession can relax: the likelihood that the recovery will continue is actually pretty good.

That is according to a team of researchers at Goldman Sachs Group, led by Chief Economist Jan Hatzius. The team analyzed a data set of developed-market business cycles and their findings were pretty interesting.

Japan Stocks Swing Near Highest Level Since August After Rally (Bloomberg)

Japanese stocks fluctuated, with the Topix index near the highest level in more than 11 weeks, as the yen maintained gains and investors weighed profit reports from DeNA Co. and McDonald’s Corp.’s local unit. Energy explorers were dragged lower by a drop in oil prices.

SunEdison is getting obliterated (Business Insider)

Renewable-energy firm SunEdison is down 14% after the company disclosed a number of cash commitments in its quarterly earnings report.

Alibaba stock discounted on record-breaking Singles Day (Market Watch)

Alibaba stock discounted on record-breaking Singles Day (Market Watch)

Alibaba processed a record $14.3 billion in Singles Day sales, but aspiring Alibaba investors may have missed the boat if they were hoping to profit from the e-commerce bonanza.

Shares of Alibaba closed down 2% to $79.85 on Wednesday despite surpassing the 2014 Singles Day record of $9 billion in sales before lunchtime in China, and topping industry tracker IDC’s estimate of $13 billion to $13.8 billion in sales.

Asian Stock View Mixed After U.S. Drop as Crude Weighs on Market (Bloomberg)

The greenback extended losses in Asian trading following its worst day this month, while Australian shares slipped with Japanese index futures as investors mulled the prospect of more divergence in global monetary policy. Oil was near a two-month low.

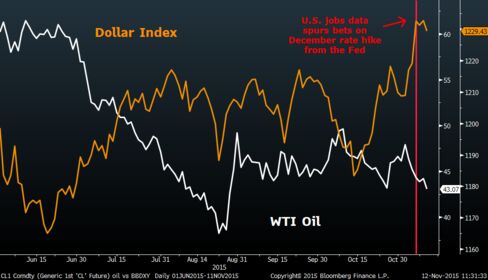

Crude oil is sliding (Business Insider)

Crude oil was down nearly 3% in morning trade on Wednesday.

.png)

How China’s stock market is in both bull and bear territories (Market Watch)

How China’s stock market is in both bull and bear territories (Market Watch)

After an extremely volatile summer, the Chinese stock market is the awkward position of being in both bull- and bear-market territories.

As of Wednesday, the Shanghai stock index SHCOMP, +0.27% is up 24% from its trough on Aug. 26 but down 30% from its June 12 peak, highlighting the crazy mood swings that one of the world’s largest stock exchanges has undergone in the past few months.

Valeant Drug-Price Travails Put Stock at $72 to Damodaran (Bloomberg)

Shares of Valeant Pharmaceuticals International Inc. are approaching fair value after plummeting as much as 72 percent in the past three months, according to Aswath Damodaran, a finance professor at New York University.

Macy's whiffed on sales and lowered its outlook, and now the stock is crashing (Business Insider)

Macy's reported third-quarter sales that missed analysts' expectations on Wednesday, and blamed weaker consumer demand.

Investing in Racehorses, Despite the Long Odds (NY Times)

Investing in Racehorses, Despite the Long Odds (NY Times)

One morning this past summer, Ahmed Zayat was in a stall at Del Mar racetrack in California alongside the 2015 Triple Crown winner American Pharoah.

“I was kind of cuddling with him, lying down on my back, giggling, and he starts licking me … it was hilarious,” he said.

Uruguay's Chinese Car Boom Ends on Cheap Brazil, India Imports (Bloomberg)

Uruguay's Chinese Car Boom Ends on Cheap Brazil, India Imports (Bloomberg)

Uruguayans love their beef, wine and cheap Chinese cars that used to account for almost a quarter of new vehicle sales. But competition from low-cost Brazilian and Indian cars has sent Chinese sales into a tailspin this year.

Politics

Cruz's Criticism Underlines Fed's Politics Problem This Election (Bloomberg)

Cruz's Criticism Underlines Fed's Politics Problem This Election (Bloomberg)

It was open season on the Federal Reserve at Tuesday’s Republican presidential debate. Candidates blamed Fed officials — "philospher kings" in Texas Senator Ted Cruz’s words — for everything from the financial crisis to income inequality.

Their criticism highlights how much the central bank remains a lightning-rod for popular angst toward Washington as the candidates vie for conservative support.

Donald Trump doubles down: 'Our wages are too high' (Business Insider)

Donald Trump doubles down: 'Our wages are too high' (Business Insider)

Real-estate tycoon Donald Trump argued during the Tuesday-night Fox Business Network debate that US wages are "too high" — and he didn't back off the next morning when pressed.

"It's a tough position politically," Trump admitted during an interview on MSNBC's "Morning Joe."

"We have to become competitive with the world. Our taxes are too high, our wages are too high. Everything is too high. We have to compete with other countries."

Technology

Inflatable Solar Lights Illuminate the Darkest of Nights (PSFK)

Inflatable Solar Lights Illuminate the Darkest of Nights (PSFK)

MPOWERD is creating solar lamps which can become a greener light source for the modern home or a life-saving alternative for families in developing nations. The inflatable lamp, which is powered entirely by sunlight, is affordable, sturdy and useful.

Health and Life Sciences

Is Fat Stigma Making Us Miserable? (NY Times)

Is Fat Stigma Making Us Miserable? (NY Times)

Being overweight doesn’t necessarily make a person distraught, researchers are learning. Rather, it’s the teasing, judgment and unsolicited advice directed at overweight people that can cause the greatest psychological harm.

Could wearable 'artificial kidney' change dialysis? (CNN)

Could wearable 'artificial kidney' change dialysis? (CNN)

A small, experimental wearable device has moved a step closer to helping patients who rely on kidney dialysis, according to a report.

For patients with kidney failure, the common treatment is to be hooked up to a dialysis machine at a hospital or clinic several times a week. In addition to the inconvenience, patients develop buildup of fluids and minerals between dialysis sessions, which can result in high blood pressure and breathing problems and require severe dietary restrictions.

Life on the Home Planet

Saving Apes From Ebola: Harms, Benefits and Probabilities (Huffington Post)

Saving Apes From Ebola: Harms, Benefits and Probabilities (Huffington Post)

Recently, in a New York Times Op-Ed, Dr. Peter Walsh made the case that curtailing biomedical research on chimpanzees may negatively impact the ability for conservationists to save that species in the wild. It's a compelling argument on the surface, pitting animal protection groups who have cried victory in helping eliminate the invasive use of chimpanzees for medical research, against those invested in shielding chimpanzees in Africa from a very real threat: the Ebola virus.

Prehistoric farmers were first beekeepers (BBC)

Prehistoric farmers were first beekeepers (BBC)

Humans have been exploiting honeybees for almost 9,000 years, according to archaeological evidence.

Traces of beeswax found on ancient pottery from Europe, the Near East and North Africa suggest the first farmers kept bees.