Mid-Week Update

Courtesy of Urban Carmel

Below are a few mid-week thoughts.

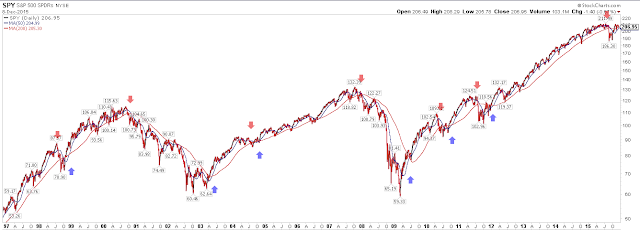

Trend: Tomorrow, SPY will have a golden cross, where its 50-dma will cross above its 200-dma at about $205 (blue arrows). Holding above that level would obviously be positive. SPY continues to follow NDX, which had its golden cross November 17 and is now sitting very near a 15-year high.

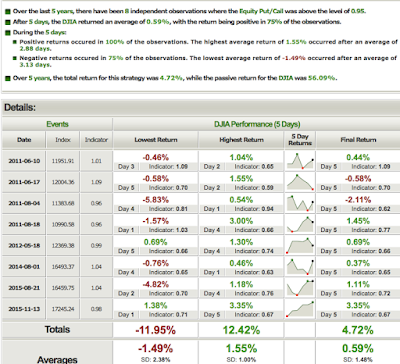

Sentiment: The equity-only put/call ratio closed at 0.96 today. It has only closed this high 12 other times in the past 5 years; in all cases, SPY closed higher at least once within 5 days. Excluding overlapping observations, 6 of 8 (75%) also closed higher at the end of 5 days. In two cases there was a significant drawdown before the higher close, something to watch out for tomorrow on weakness. A third day lower tomorrow would add further weight to near term upside (from index Indicators).

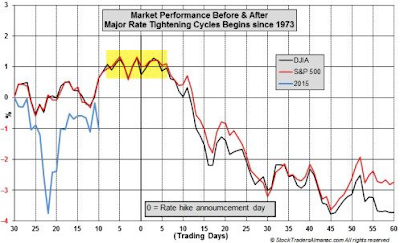

Recall that the dominant pattern in the period before (and after) the initiation of higher rates by the Fed is for up and down chop in a small range. That might be the case now as well, in which case fading the edges is the appropriate strategy (data from Stock Almanac).

Breadth: There is a great of consternation about market breadth. The picture is a more nuanced than the dialog in the market would have you believe.

Only last week, the cumulative advance-decline (A-D) line for the S&P hit an all-time high. What is notably absent from the discussion is that the market has sold off since that new high in A-D, a pattern we have seen often in the past as well (a post on thishere).

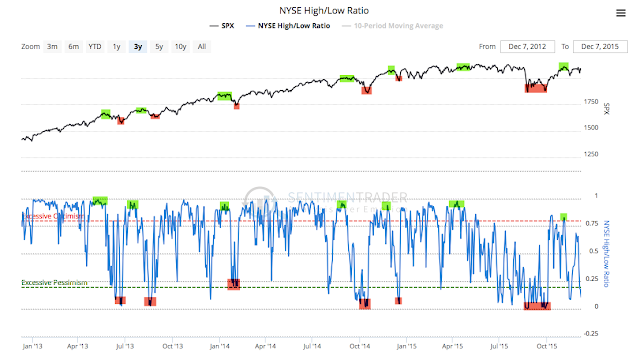

The discussion has now turned to weakness in new 52-week highs versus new 52-week lows (known as the high-low ratio). It is weak, but as the chart below shows, index lows correspond to lows in the high-low ratio (red shading) and market peaks correspond to highs in the high-low ratio (green). This is exactly opposite to what many market commentators imply, but it fits the same breadth pattern that we see in A-D. This is a different way of thinking about breadth which we find has value (data from Sentimentrader).

Macro: Here is a link to worthwhile article from Bill McBride (Calculated Risk) on the state of the economy (post). Bill was one a handful of analysts who was on top of the housing bubble prior the financial crisis. He remains very optimistic about housing and commercial development now, and also sees little signs of excess in debt. As he concludes, the economy is poised for more growth. This has been our view as well.

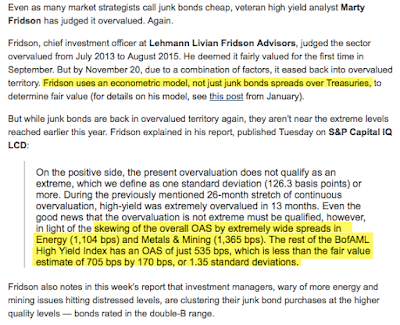

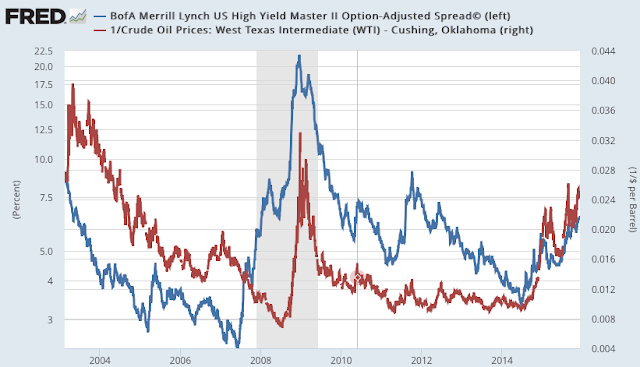

Given this backdrop, the worry over high yield as a barometer on the broader economy seems unwarranted. Indeed, most of the blow out in spreads is in the beleagured energy and materials sectors.

This is not a new paradigm, but a relationship we have seen in the past as spreads (blue) blow out when oil prices drop (inverted; red), and vice versa.

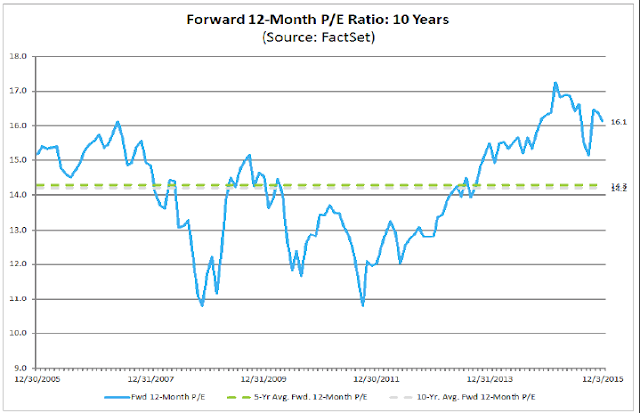

Valuation: Maybe the biggest headwind for the market next year is valuation. Forward P/Es are 16x, above the norm over the past 10 years. Moreover, this ratio assumes earnings growth of 8-10% which is probably a stretch given economic growth of 3-4% and margins that are already at highs (data from FactSet).

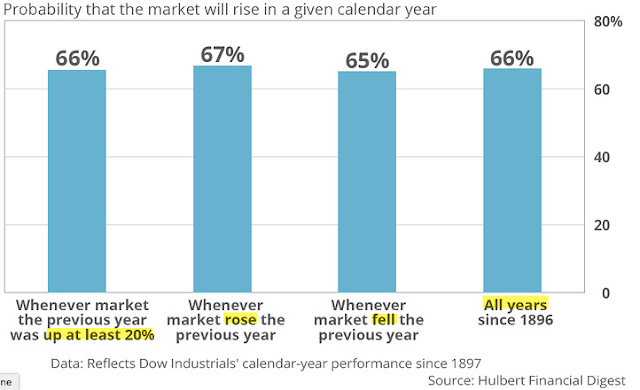

Will the indices go higher next year? According Mark Hulbert, the odds of a gain next year are always about 2/3, whether the prior year was up a lot, up a little or down. The natural tendency for the market is to rise over time.