Courtesy of Joshua Brown, The Reformed Broker

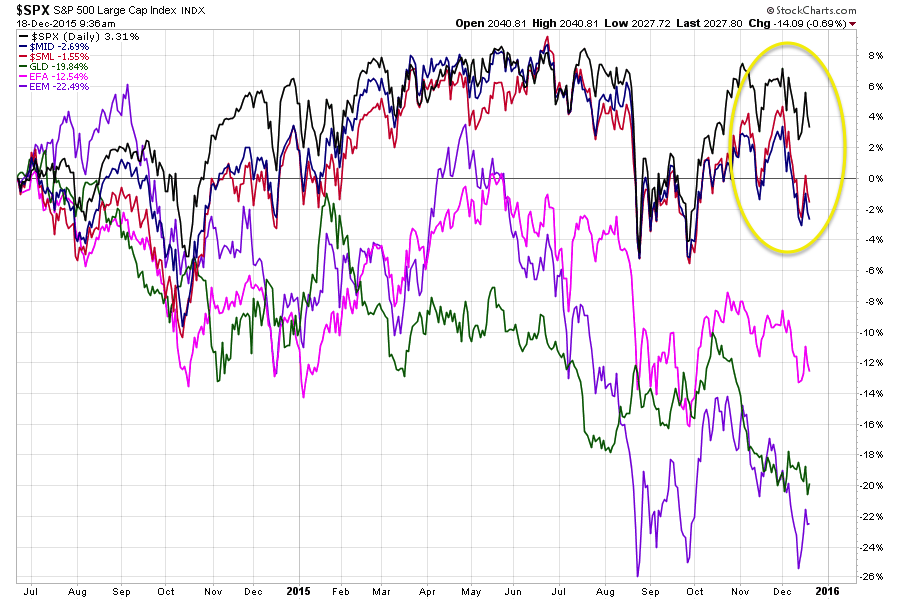

A few ways to look at my chart above…

a) What bull market? No progress for any equity asset class in 18 months, lots of losses.

b) The fact that US stocks (large, mid, small, in the yellow circle) are essentially flat since last summer is just a consolation prize, I suppose.

c) The destruction to foreign equities and gold means lots of frustration.

d) Those saying that “markets” have run too far, too fast, have no idea what they’re talking about.

e) Earnings still matter after all. No earnings growth, no returns.

f) Thank god for buybacks. This would look materially worse without them.

g) During every secular bull market, there are years where stocks take a pause. This would be the charitable way of thinking about things.