Historical trends suggest that the stock market should be doing well this year, but that's not the case. There are still four trading days left, so the final numbers on the indexes are yet not decided, but we do know that the major indexes have had the help of the FANGs which covers up a more bearish picture.

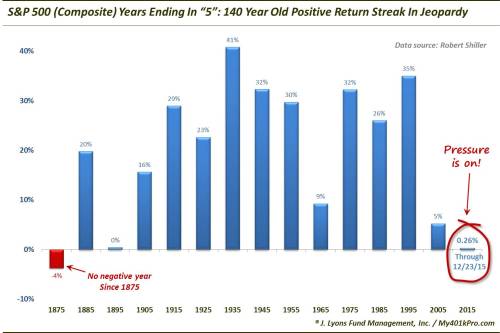

140 Year Old Stock Streak In Jeopardy

Courtesy of Dana Lyons

The U.S. stock market has not been lower for any year ending in a “5″ since 1875…that streak is in jeopardy.

Just a fun one today: A year ago, we posted a chart showing the returns of the S&P 500 (S&P Composite before 1950) for years ending in “5″. As it turns out, the index has been positive the last 13 times during such years. The last negative year was 1875. Well, that streak is in jeopardy. Through yesterday, December 23, the S&P 500 was up 0.25%.

So with a week to go in 2015, the pressure is on for this 140 year old streak. For those curious, the number to watch is 2058.90, i.e., last year’s closing price on the S&P 500.

What is the takeaway? Nothing.

More from Dana Lyons, JLFMI and My401kPro.

See also:

The Dow is on the verge of doing something it hasn't done since 1939 — and it's not good

By Myles Udland at Business Insider

Excerpt:

And while stocks usually go up, the decline in the blue-chip index this year has been particularly surprising given that it's the year before an election.

Even more bullish for stocks heading into 2015 was data showing that years ending in "5" following a mid-term election have been uniformly positive for stocks.

Alas, 2015 has not been that kind of year…

Source: Bespoke