Would it be too early to call the year yet?

Would it be too early to call the year yet?

"As goes January, so goes the market" is something a lot of traders believe and we're off to a rotten start, for sure but mostly we just gave back the gains I thought we never should have gotten last week anyway – so NOW we're back to 2,000 on the S&P (/ES on the Futures), we'll see what's real and what's not.

We went long on /ES at the 2,000 line and /TF (Russell Futures) at 1,100 and we made a big call yesterday in our Live Member Chat Room, to cash in those SQQQ March $15 calls ($5.44), from that spread I mentioned in yesterday's post and that flipped us BULLISH into the close, where we were rewarded by the "stick save" (so far).

That's a really great feature of using spreads to hedge like we do because we can flip our whole portfolio from bearish to bullish by simply taking the profit ($5,220 in this case) of our short leg off the table and now we've gone from slightly bearish to slightly bullish and all we have to do to get bearish again is buy another bear leg. Hopefully, we won't need to and SQQQ will top out at $20 and the short calls will expire worthless and we'll make another $5,550 on that leg.

Of course, as I mentioned yesterday, we have huge short positions on Amazon (AMZN) and Netflix (NFLX) so, to some extent, we were locking in some of our gains by flipping bullish on the Nasdaq to cover a possible bounce in those two. I don't think either one of them are done going down but Apple (AAPL) looks like it's going to hold $100 and AAPL counts WAY more in the Nasdaq than those overpriced jokes.

We were hoping AAPL would go a bit lower as we only have one bull call spread in our Long-Term Portfolio. Our plan was to sell some short 2018 puts when AAPL got down to $100 – preferably the $95 puts for $15, which would give us a very comfortable net $80 entry – another 20% off from here. Those puts maxed out at $12.50 yesterday – too low to trigger our entries.

As we expected, China stepped in and threw $20Bn into the money markets this morning to stop the bleeding as the exchanges re-opened. In a dilemma similar to the U.S. Federal Reserve's recent tapering of its stimulus program, Beijing is trying to orderly unwind a massive and unprecedented stock market rescue last summer, while pressing ahead with reforms to allow markets to have a greater say in determining the Yuan's value.

Mike Lebowitz of 720 Global wrote a GREAT article today on the Fed's "Self-Defeating Monetary Policy," which does a fantastic job of illustrating the macro forces that are currently pushing and pulling on the global economy and has a great illustration of a point I keep hammering on – that you can't draw conclusions from a stimulated economy. In his case – he uses Barry Bonds on steroids to illustrate the point rather well.

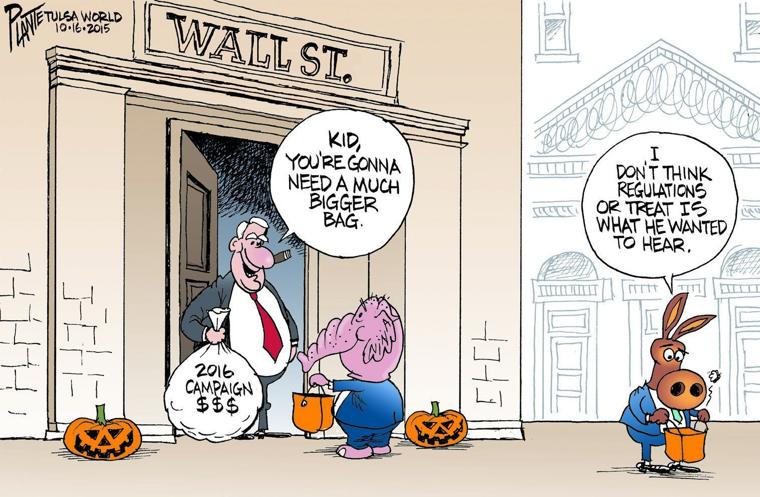

As noted by Zero Hedge, "Governments are Running out of Candy" and, based on yesterday's Manufacturing and Construction Reports, our economy is running out of steam as well.

As noted by Zero Hedge, "Governments are Running out of Candy" and, based on yesterday's Manufacturing and Construction Reports, our economy is running out of steam as well.

According to the WSJ: The Federal Reserve Bank of Atlanta said Monday it now believes fourth-quarter GDP grew at just a 0.7% pace, down from a prior estimate of 1.3% growth. JPM cut its estimate in half to 1% growth from 2%. Forecasting firm Macroeconomic Advisers lowered its estimate by three-tenths of a percentage point to 1.1%.

If those estimates pan out, it would mean the economy ended 2015 in roughly the same precarious state in which it began the year. GDP grew 0.6% in the first quarter of 2015 before rebounding in the spring and summer.

The economy has been getting key support by consumers, who have been snapping up cars, shelling out more at restaurants, and, until recently, stepping up home purchases. But persistent weakness in the global economy and the domestic energy sector have been cutting into demand at American factories. The latest manufacturing numbers are stoking concerns that global weakness could weigh even further on the U.S. economy in 2016.

None of this is unknown. On our Big Chart, we still have 1,850 on the S&P as our "Must Hold" line because that's where we still think the bottom of the channel is and 2,100 remains the top of the channel so we tend to get bearish as we near 2,100 and bullish as we near 1,850 and we've had a great time playing this range since we first plotted it way back in late 2013 and we're going to keep using it until it breaks. After 2 years though, we don't have our hopes up.

Every day the index is below that 50 dma (2,060), it pulls the average lower and, as you can see, it's barely holding flat now. A declining 50-day moving average is bad news – especially on a major index and the broader-based NYSE and Russell indexes have already begun to turn down so, technically, we're not in very good shape at the moment.

If it were not for the expectation of MORE FREE MONEY from our friendly Central Banksters, I'd be very bearish right now but they aren't done trying yet so we'll play the hand we're dealt. That's why we went long yesterday and again this morning – these little sell-offs are usually all we get and, since we're mainly in cash, we can afford to flip-flop and catch these rides in both directions.

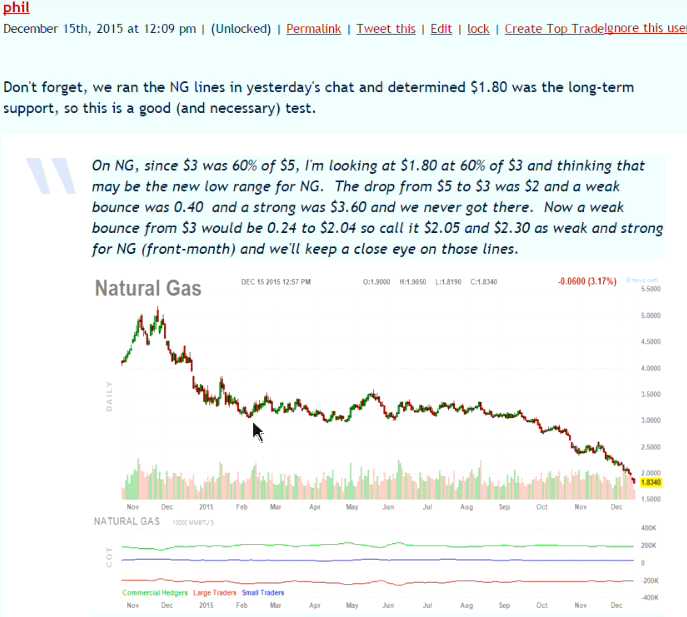

.jpg) Speaking of flip-flopping: It's been 3 weeks since our last Live Webinar on 12/16 and, right out of the gate that afternoon we featured our big call on Natural Gas Futures using 20 /NGJ6 (April, 2016) long contracts which were, at the time, down $11,230 from our $2.10 average entry. That was a FREE Live Webinar and, for those who joined us on that trade (or a portion of it), I'm very happy to report that yesterday we hit +$60,000 – a $71,230 move in 20 days ($3,561.50 per contract) – I told you Futures Trading could be fun (and profitable)!

Speaking of flip-flopping: It's been 3 weeks since our last Live Webinar on 12/16 and, right out of the gate that afternoon we featured our big call on Natural Gas Futures using 20 /NGJ6 (April, 2016) long contracts which were, at the time, down $11,230 from our $2.10 average entry. That was a FREE Live Webinar and, for those who joined us on that trade (or a portion of it), I'm very happy to report that yesterday we hit +$60,000 – a $71,230 move in 20 days ($3,561.50 per contract) – I told you Futures Trading could be fun (and profitable)!

I had laid out my logic for loving the Natural Gas trade with UNG and LNG as well as the /NG Futures in the previous day's post (12/15), as I had been banging the table for Natural Gas all month. That trade isn't over yet but you missed the easy part because we're looking to get 1/2 out at $2.50 and hoping for $3 on the rest as the LNG export terminals kick on over the next few months (see post for details). Surprisingly, most people still don't understand what a profound change this is going to make in the Natural Gas Sector but we think publicity regarding the first tankers going out this month will raise awareness (and prices) over the $2.50 line (was $1.85 on the 15th, now $2.35).

Isn't that fun? That's the best thing in trading when the contracts you are following do EXACTLY what you expect them to! We'll be looking at some more Futures Trading in today's Live Webinar (sorry, Members only this week but join now and don't miss out) but already this morning (8:45) our /TF (Russell) longs are up $500 per contract at 1,105 and our /NKD (Nikkei) longs are up $750 per contract at 18,350 and both going strong – that's how we pay for those Egg McMuffins before serious trading starts!

Have a great day,

– Phil