All fixed!

All fixed!

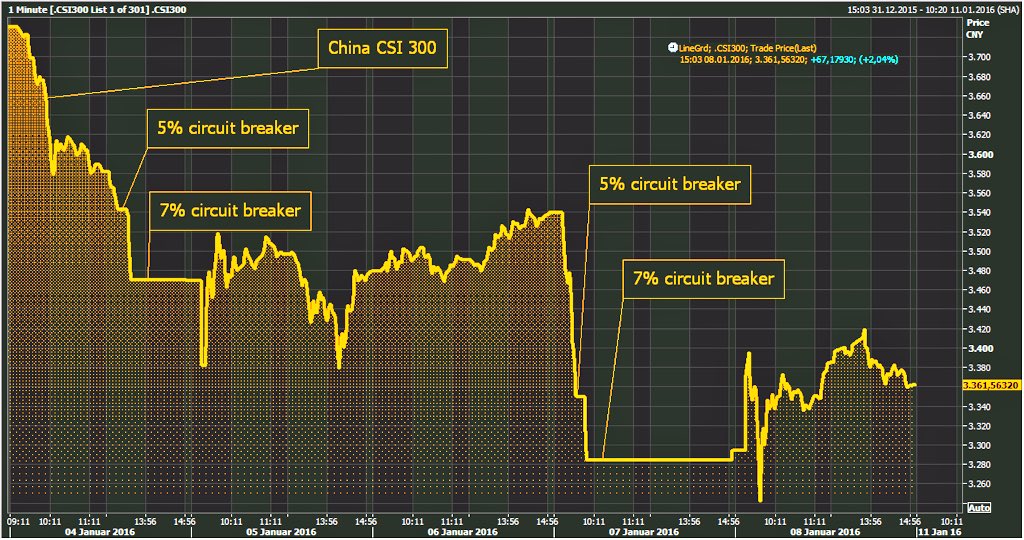

Well, not really. As you can see on this chart of the Shenzhen 300 Chart, we fell 5%, then 2% more, then 5% more, then 2% more – that's 14% and then, this morning, we rose from 3,285, where the market was halted on Thursday, back to close at 3,361, which is only up 2.3% or less than a 20% weak bounce off the 14% drop.

Our 5% Rule™ dictates a 2.8% bounce would be "weak" and that would take us from 3,285 to 3,377 and, since we were rejected there – it's actually a bearish sign! I already sent out an Alert to our Members this morning and I even tweeted it so all can read it HERE as it's a very important warning on not getting sucked into any BS about things being "fixed" into the weekend. Pertinent to this post, I noted:

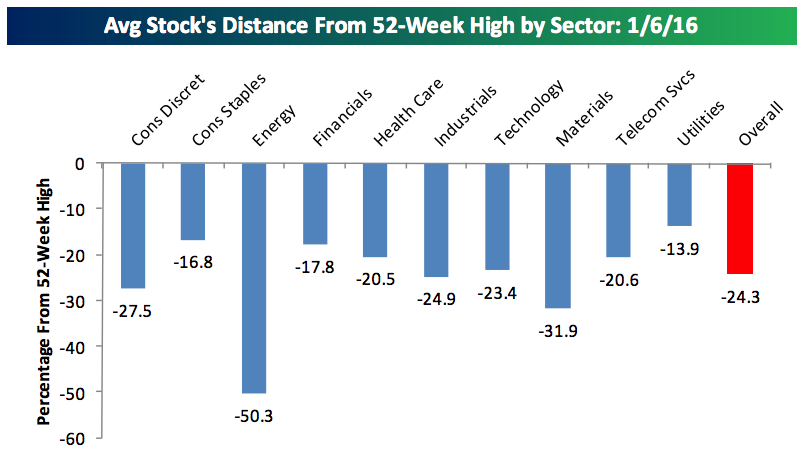

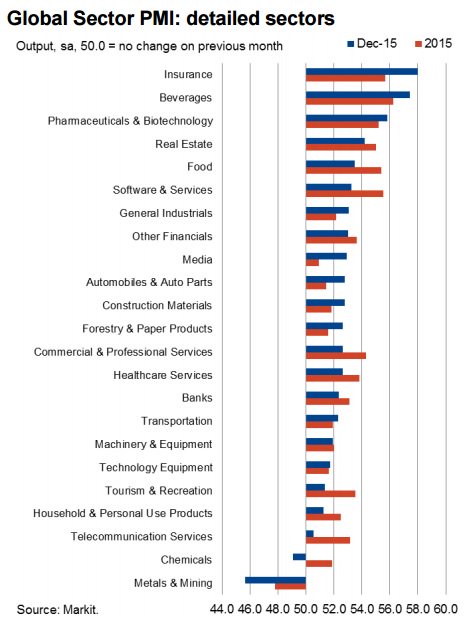

There's nothing here to get excited about technically. Fundamentally, China is a drag until it stops and, after that, it's up to earnings, which are going to be TERRIBLE in the Energy sector and probably not good in the Retail sector and Housing has been lame and Materials have been a catastrophe so what exactly are we hanging our hopes on?

Looks like we have plenty of discounted stocks to shop for but the sale isn't over yet, so no need to rush. This morning we get the Non-Farm Payroll Report for December and that will tell us nothing but we'll see how the markets react – which will tell us something. If NFP doesn't do the trick, then Fed super-dove Williams will regale us his economic outlook at 11:30 and, if that doesn't work, uber-hawk Lacker can turn doveish at 1pm and really confuse people.

So it looks to be an interesting day but it's all about earnings now and that starts in a couple of weeks but already our friends at Goldman Sachs have lowered their S&P earnings forecast by $3 to $106 for 2015. Now, $3 doesn't sound like much out of $106 but we already KNOW what quarters 1, 2 and 3 were so the $3 comes entirely out out the Q4 earnings we're waiting for (about $28) and that's a 10% haircut!

So it looks to be an interesting day but it's all about earnings now and that starts in a couple of weeks but already our friends at Goldman Sachs have lowered their S&P earnings forecast by $3 to $106 for 2015. Now, $3 doesn't sound like much out of $106 but we already KNOW what quarters 1, 2 and 3 were so the $3 comes entirely out out the Q4 earnings we're waiting for (about $28) and that's a 10% haircut!

The revision reflected annual EPS growth of -7% in 2015, +11% in 2016 and +8% in 2018, the note stated, with the strategists expecting that 2015 was "the worst year for S&P 500 earnings since 2008." Let's not forget that GS told us we would have 12% growth in 2015 and they missed by -19%, so we should take their rosy 2016 forecast with a huge grain of salt! Goldman said it expected three topics to dominate the earnings discussion in 2016: Margins having peaked, the path of energy EPS and the risk of further economic slowdown.

8:30 Update: Non-Farm Payrolls are up HUGE – +292,000, blowing away expectations of 230,000 and November has been revised up from 200,000 to 252,000 so that's 114,000 more jobs than expected! That's giving a bit of a lift to our indexes and well-deserved with Construction adding 45,000 jobs in a usually lackluster December. HOWEVER, strong job growth leads to more Fed tightening – and that's what led to this sell-off in the first place, so we'll need to wait and see how this is all taken in next week.

Hourly wages are flat and hours worked are flat and those are good signs for our Corporate Masters and also keeps pressure off the Fed to raise rates as wage inflation is the only kind of inflation they really try to fight. If we're growing jobs without increasing wages – that's Goldilocks for the Fed because our Corporate Masters don't want to pay you more money for doing the same work – they want to give the raise you deserve to a new guy (or robot) who will make more widgets for less benefits.

So all is well and now we wait for Williams and Lacker and then, at 3pm, we get the Consumer Credit Report where it's expected we ran up $19.1Bn in new debt in November (this report is way behind).

So all is well and now we wait for Williams and Lacker and then, at 3pm, we get the Consumer Credit Report where it's expected we ran up $19.1Bn in new debt in November (this report is way behind).

I guess I should point out that, in 2008, when Consumer Credit was considered out of control and led to the Financial Meltdown that year, that American Consumers were, in fact, only 6% of their incomes in debt and now we are well over 8%. The reason we haven't imploded yet is, of course, the very low rates we're paying on that 33% increase in debt and it will be interesting to see where our new breaking point is as both rates and debt continue to rise at a record pace. Maybe we should start an economic "death pool" – I'll take September.

Until then – please be careful out there!

Have a great weekend,

– Phil