Get ready for not much.

Get ready for not much.

All is relatively calm this morning as traders try to digest last week's exciting events. The S&P has lost 120 points (5.8%) to start the year and it's a pretty light data week with the Fed's Beige Book tomorrow and that's about it until Friday, when we suddenly get busy with Retail Sales, PPI, Industrial Production, Empire State Manufacturing, Consumer Sentiment and Business Inventories. Until then, we can pretty much twiddle our thumbs…

Until then, anything not down is good as we have had some UGLY market action and it will be bullish to simply not re-test the August lows. Unfortunately, it's too late for the Russell, which already blew through that line and is back at 1,050, where it MUST HOLD or we are DOOMED!!!

That's right, DOOMED!!!, and I'm not afraid to say it. Panic is in the air and the VIX hit 27 on Friday, just shy of the August high and that means people are FREAKING OUT and the markets can be very dangerous when that happens.

That's right, DOOMED!!!, and I'm not afraid to say it. Panic is in the air and the VIX hit 27 on Friday, just shy of the August high and that means people are FREAKING OUT and the markets can be very dangerous when that happens.

As you know, our Members are safely in CASH!!! because I annoyed them for the entire 4th quarter warning them not to buy into the BS rally but, as a trading exercise, we took our virtual Long-Term and Short-Term Portfolios and BALANCED them out, so they have been unaffected by the market sell-off.

Our Short-Term Portfolio finished the week at $377,002 (from a $100,000 start on 11/26/13) and our Long-Term Portfolio dropped to $649,779 (from a $500,000 start on 11/26/13) for a total of $1,026,781, which is UP $22,619 on our paired portfolios since our Dec 13th Review. Not bad for a market that's off to the worst start in history in 2016, right?

BALANCE is the key to our strategy. The primary function of our Short-Term Portfolio is to protect and hedge the Long-Term Portfolio, so that we make money in down markets that we can use to turn around and buy more stocks that have gotten cheaper. And we have been buying more for our Long-Term Portfolio though, as I mentioned on Friday, we're still being very cautious until we see the market on firmer footing.

Not overly cautious though. There's no point in gaining $22,000 (net) on your hedges if you're not going to take some profits off the table and last Thursday I outlined the changes we were making to flip ourselves more bullish in the STP but today and tomorrow is the acid test and we'll be watching our levels to see if we need to add another round of aggressive hedges.

Not overly cautious though. There's no point in gaining $22,000 (net) on your hedges if you're not going to take some profits off the table and last Thursday I outlined the changes we were making to flip ourselves more bullish in the STP but today and tomorrow is the acid test and we'll be watching our levels to see if we need to add another round of aggressive hedges.

We THINK that we're going to form a bottom here (around 5% down) but, if we're wrong, then it's back to the 10% correction we saw back in August and here are the levels we will be watching:

- S&P 2,100 to 1,925 is 175 points (8.3%) in the longer-term. That means that, even if we hit the -10% line (1,890), we would still expect a bounce back to 1,932, which is where we are now. That means we don't feel we're taking a big chance with a bullish poke here. So 1,932 is the weak bounce line and 1,974 is a strong bounce – that's what we need by Wednesday to get more bullish.

- Dow 18,000 to 16,200 is the 10% correction and we're pretty much there. A weak bounce from there would be the 16,600 line and then 17,000 would be a strong bounce that we want to see to confirm a still-strong market.

- Nasdaq 5,150 to 4,635 would be 10% and we finished the week at 4,643, so that was kind of predictable. I AAPL can avoid collapsing (we're long – see last week's trade idea), then the Nas should be able to turn up here and the 515-point drop means we can expect 100-point pots and we'll call it 4,750 and 4,850 for our bounce lines. Since the Nasdaq is all about AAPL and AAPL dropped 20% from $120 to $96 – that means we'll be looking for AAPL to rise from the near-dead and pop back over $100 and then $105 to stabilize the markets. AAPL, of course, is also a major Dow component and a heavyweight in the S&P – so watch it CLOSELY!

- The NYSE is as bad as the Russell, falling from the July peak of 11,000 (which is only our Must Hold line and kept us bearish way back then) all the way to 9,500 on Friday, a pretty awful 13.6% collapse in the broad market. The August low was 9,700, so we blew that too! In this case, we want to see that -10% line retaken at 9,900 before we are in any way comfortable getting back in the water on the long side – that's a pretty tall order for the week and anything down is bad but, if we break below -15% (9,350) – you have my permission to panic.

- The Russell is our other broad index and should, in theory, be doing better, not worse, than the broader market because Russell 2000 companies get over 80% of their revenues from America and we just put 300,000 more people to work in December and gas prices are as low as they were under Clinton and interest rates are still super-low – so what's the problem? We'll be paying close attention to earnings to try to get a handle on this situation.

- Meanwhile, though the Russell was over in the summer, we'll call 1,200 the realistic top (and it's also our Must Hold line) and that means 1,080 was the 10% line, which failed on Wednesday so step one is taking that back by Wednesday and then we'll be looking for 25-point bounces to 1,105 and 1,130.

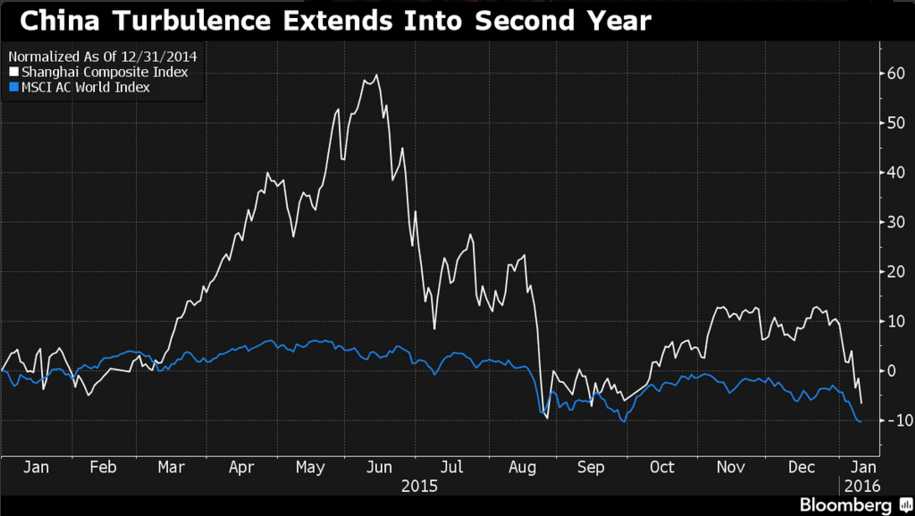

Gosh, now that I've written it down, I'm getting worried that we're expecting too much from our markets – especially with China still in full-on meltdown mode, dropping ANOTHER 5% today over at the Shanghai – all the way back to the 3,000 line BUT, on the whole, that just so happens to be down 10% from where we were in Jan 2014 – before the silly, overblown China rally began. So, ignoring the nonsense, China is simply down 10% with the rest of the World – don't look for it to bounce back more than we do.

Earnings season officially kicks off this evening with Alcoa (AA) but Apollo (APOL) already got people excited this morning with a smaller than expected loss. That's all it takes to pop 5% in this market as sentiment could not be more negative (hence the VIX at 27). It's a great time to sell puts in companies you'd like to buy cheaply. AA, for example, is at $8 but you can sell 2018 7 puts for $1.25 and that nets you in for $5.75, which is 28% lower than today's open. So either you end up owning AA for a 28% discount or you keep the $1.25 against your $5.75 risk (and much less in margin) for a 21.7% gain in two years for NOT buying a stock cheaply.

This is what we do with our CASH!!! when the market is low and the VIX is high – we use the margin on the cash to establish even cheaper positions in stocks we feel are good values going forward. AA will make about $400M this year and is trading for $10Bn at $8 per share, which is a p/e of 25 – not great but our discount drops our entry p/e to less than 20 and we know/hope the economy will turn around one day and get back to $600M in earnings.

Later this week we have CSX, IHS, DRWI, INFY, XSR, SVU, FRC, INTC, JPM, TSM, BLK, C, FAST, PNC, RF, USB and WFC – with most of the bank names on Friday. Moral of the story – don't miss Friday!