Not too exciting so far.

As we predicted on Monday, the 5% Rule™ is in play and we have, so far, held the line at the bottom but now we need to see if our bounces are weak (+1%) or strong (+2%) into Friday's options expirations. It's entirely possible, since it benefits the most Fund Managers, that we pop 2.5% and end up even for the month – right back where we started when they sold all those option contracts on Dec 18th.

Yes, that's right, the markets are a manipulated joke but, as long as you understand and accept that – you can play along with the manipulators and make some good money. Clearly the markets are a bit oversold here and, oddly enough, it's the overwhelming level of doom and gloom coming from the MSM that makes us want to go long now.

Yes, that's right, the markets are a manipulated joke but, as long as you understand and accept that – you can play along with the manipulators and make some good money. Clearly the markets are a bit oversold here and, oddly enough, it's the overwhelming level of doom and gloom coming from the MSM that makes us want to go long now.

After all, what are they telling you to worry about? China, the Fed, Oil, Commodities, Terrorism, North Korea, Junk Bonds, Brazil, Puerto Rico… These are all things we've been talking about all year when we went SHORT at S&P 2,100. Now that we're back to 1,900 (down 10%), I'm a lot more comfortable that the market is now taking into account these risk factors. None of these problems are new folks – the media simply stopped ignoring them this month.

As I mentioned yesterday in our Live Webinar, we KNOW the energy sector's earnings are going to be a disaster – that's a given. How much of that will spill over to bad debt for the banks is something we'll find out this week as JPM, BLK, C, PNC, FRC and RF all give their earnings reports (Thursday night and Friday morning). If they manage to be relatively unscathed by the collapse in commodities and the collapse in China – then the main reason to panic will quickly fade into the background.

For those who watched the Obama's final State of the Union Address last night (and here's the 2 min version) it was starkly apparent that the American people have been hammered with negativity about our economy from a dozen GOP candidates but, in fact, it's very easy to paint a much more positive picture – and that's exactly what Obama did last night. Will it cheer up the markets – that remains to be seen.

For those who watched the Obama's final State of the Union Address last night (and here's the 2 min version) it was starkly apparent that the American people have been hammered with negativity about our economy from a dozen GOP candidates but, in fact, it's very easy to paint a much more positive picture – and that's exactly what Obama did last night. Will it cheer up the markets – that remains to be seen.

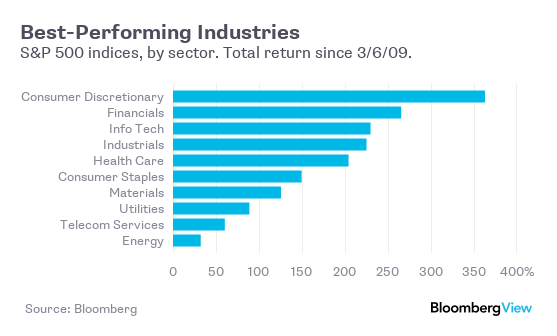

As you can see from this Bloomberg chart, big and small companies, as measured by the Russell 3000 Index, are growing at an annual rate of 15.5% since March, 2009 and outperforming the rest of the world by 7.4%. During the 20 years prior to Obama's presidency, the Russell's yearly gain was 4.5% and it outperformed the rest of the world by 3.9% each year.

What's especially compelling is that U.S. firms are investing in their growth at a record pace. Capital expenditures of the S&P 500 are the most since at least 1990, when Bloomberg began compiling such data, and increased 68 percent since 2010. The only comparable investment spree occurred between 1995 and 2000, when the Internet began transforming U.S. commerce. American companies also are healthier than they have ever been. The ratio of net debt to Ebitda (earnings before interest, taxes, depreciation and amortization) of the S&P 500 — the most widely-used measure of corporate well-being — improved the most during the Obama presidency and hovers at all-time lows, according to Bloomberg data.

The US Auto Industry and their 5M workers, who Obama saved over the strong objections of Republicans, just reported their best year ever and 17.6M more Americans have Health Insurance through Obamacare, which has led to a boom in the health care sector (by covering 10% more people – something we predicted in our 2010 Market Outlook, when Obama first took office).

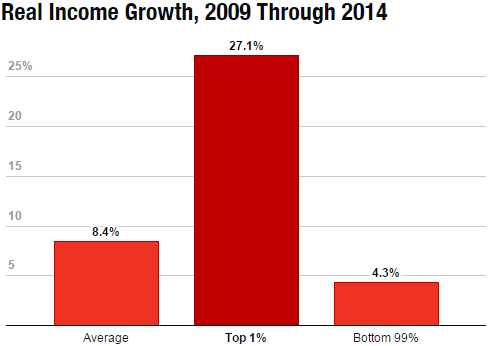

Something else we predicted in our 2010 Outlook has also, sadly played out exactly as we thought. Income disparity has gotten worse and worse and inequality in America has passed the worst excesses of the Roaring 20's – right before the economy collapsed.

Something else we predicted in our 2010 Outlook has also, sadly played out exactly as we thought. Income disparity has gotten worse and worse and inequality in America has passed the worst excesses of the Roaring 20's – right before the economy collapsed.

Notice that, on this chart, the AVERAGE wages, which include the top 1%, seem OK but, once you remove the top 1%, the average for the other 99% drops to less than 1% per year in wage growth and, if you remove the next 9% from that group, the bottom 90%'s share of wages has actually DECLINED over the past 7 years. THAT is the one thing holding down the US economy – our consumers are tapped out and that's put the brakes on our expansion. As the positive effect of job growth slows, we NEED wage increases or this economy will stagnate or worse.

.jpg)

As you can see from the above chart, those record Auto Sales came at a cost of $300Bn in additional debt to the consumers (+$3,500 per family) and Student Loans have cost the Average Family another $5,000 and, if that's not you – think about how awful the debt load must be for the other guy!

Student Loan Debt and Income Inequality is what Bernie Sanders talks about on the campaign trail and he's beginning to take the lead in the polls because these are the biggest problems facing America – not whether or not a Mexican rapist is lurking behind a wall somewhere!

Student Loan Debt and Income Inequality is what Bernie Sanders talks about on the campaign trail and he's beginning to take the lead in the polls because these are the biggest problems facing America – not whether or not a Mexican rapist is lurking behind a wall somewhere!

I will be downright bullish about the economy if Bernie is elected President in November but that's still a long shot and we'll have to settle for Hillary but maybe she'll be smart enough to make Bernie her VP – clearly he's able to strike a chord with the voters that Hillary has never been able to – who would be better to go out and be the spokesman for the President's policies?

Keep in mind though, that you don't know how well Bernie Sanders is doing because it's being actively covered up by the MSM, which is owned by the very same 400 Billionaires that Bernie has in his sights. In recent polls, voters under 45 are favoring Sanders 2:1 over Clinton – if Bernie can energize that voting block in the election (very hard to do but Kennedy and Clinton the 1st pulled it off) – he may end up sitting in the big chair in November – and that is scaring the crap out of the Top 1%!