Nothing really matters

Anyone can see

Nothing really mattersnothing really matters to me – Queen

Is this the real life?

Is this just fantasy? Caught in a landslide, no escape from reality?

Yes, that's about the tone of the markets this week as we wait on the Central Banksters at the Federal Reserve to once again steer the markets off a cliff or into the stratosphere or whatever the opposite of their stated intentions – as seems to be too often the case. We finished last week right where we began on the S&P, back just over the 1,900 line – but it's nothing to be proud of as we're still down from 2,050 (7.3%) from Jan 1st and 9.5% off our 2,100 high, last visited on the morning of Dec 2nd, when I said:

This is getting tedious.

The S&P gets to 2,100 and we short ES Futures at 2,100 (with tight stops above the line) and Russell (TF) Futures below the 1,200 line and Nikkei (NKD) Futures below the 20,000 line and then, tomorrow or Friday, I'll tell you how much money we made shorting and you'll say "why do I never catch these great trade ideas" and I'll say it's because you're not patient enough to wait for the pattern to reset itself and just make the obvious play.

Also in that 12/2 post (and you can get them by Email every morning for just $2 per day!), we noted our Short-Term Portfolio (STP) was up 213.2% and we were loaded for a bear market with our positions and, as of Friday's close, our STP was up 309.8% – a gain of $996,000 in 7 weeks – which is very good protection against a 10% market drop, even if you don't know how to play the Futures. In fact, we even gave away an options play so our non Futures-playing readers could hedge against the downturn:

- Sell 20 SDS March $19 puts for $1.25 ($2,500 credit)

- Buy 20 SDS Jan $18 calls for $1.20 ($2,400 debit)

- Sell 20 SDS Jan $20 calls for $0.48 ($960 credit)

Those January calls expired in the money ($23.33) on the 15th and paid $4,000 and the short March $19 puts are just 0.05 ($100) but we're done with those for net $3,900 plus the original $1,060 credit is a profit of $4,960 or 467% back on cash in 54 days and THAT, my friends, is how you hedge your positions! And these are just the free samples we give away…

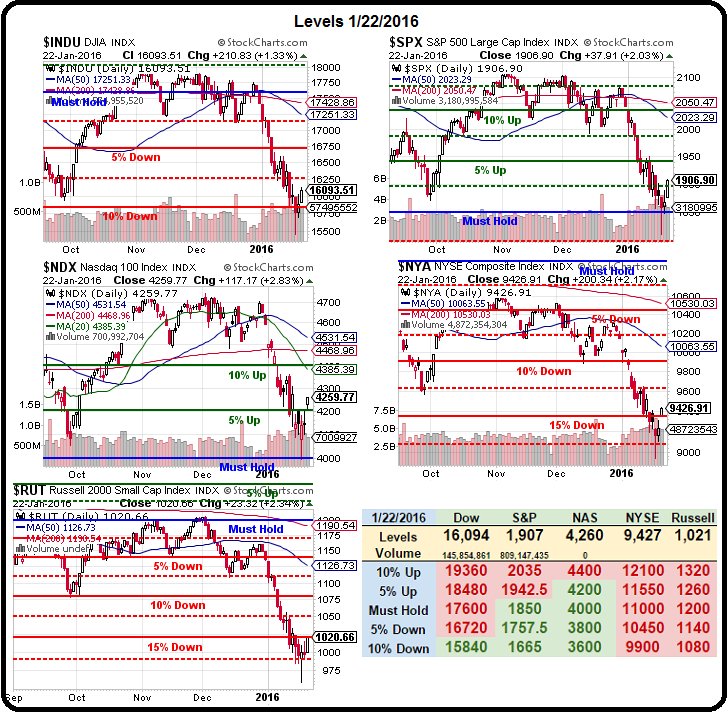

As our Members know, we made a call to go long back at the 1,850 line last week and already the 50-point gain is good for $2,500 per S&P Futures Contract (/ES) and we took that money and ran into the weekend at 1,900 and now we'll see how things hold up here as these are just the weak bounce we predicted for the week last Tuesdsay, which were (and still are):

Keep in mind, however, that we went from 2,100 to 1,850 which is 250 points so 50 points (1,900) is just a weak bounce (where we are now) and it won't be impressive until we get back to 1,950:

Dow 17,750 to 15,750 was down 2,000 so big 400-point bounces to 16,150 (where we are now) and 16,550 is strong:

Nas 4700 to 4,100 is 600 points and that means we expect 120-point bounces to 4,220 (almost there) and 4,340 (strong)

Russell is our lagger at the moment, having fallen from 1,200 to 1,000 is 120 so let's say 25-point bounces to 1,025 and 1,050 before we are impressed:

Dax has to make it's bounce as well. Down from it's must hold line at 11,000 (I'm ignoring the spike up) to 9,500 is 1,500 points so 300-point bounce lines mean we need 9,800 (weak) and 10,100 strong but we don't forget that we did throw out the 500-point spike so they are being spotted 100 points on the bounces – that means the DAX will have to work extra-hard to impress us.

Nikkei is another total disaster with a 3,000-point fall (ignoring Friday) from 20,000 to 17,000 so 600 points just to make a weak bounce at 17,600 is what we will be waiting for. Strong bounce kicks in at 18,200 – which was our old bull line in happier times.

As you can see, for the most part, we're barely at our weak lines. If they fail to hold then we're looking at another leg down with little major support for the S&P until 1,665 – another 10% down from 1,850. That would be super-ugly so check last week's posts for our hedging ideas for the next leg lower. We added the Nasdaq ultra-short (SQQQ) hedge to our Options Opportunity Portfolio on Friday afternoon – taking advantage of the move up in Apple (AAPL) and the Nasdaq (QQQ).

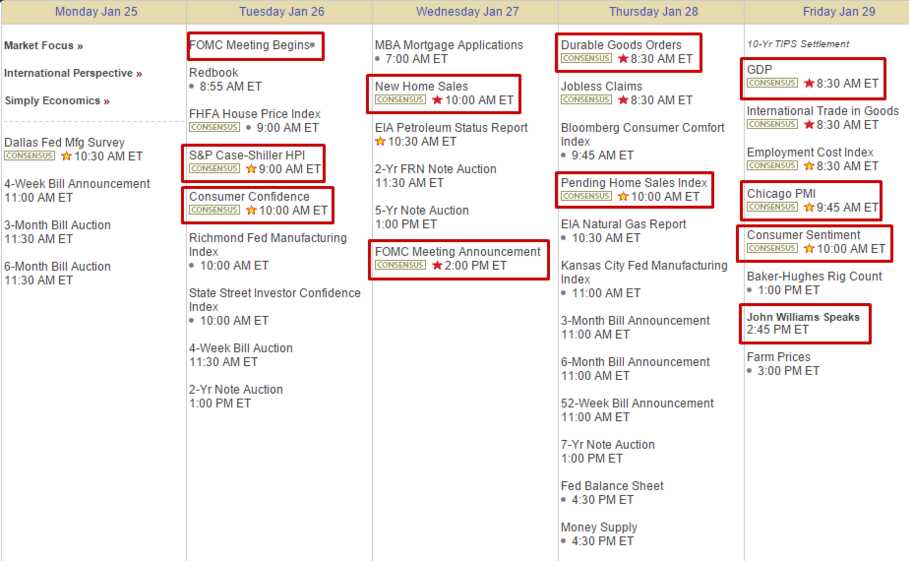

We did not get the new round of Chinese stimulus we hoped for over the weekend and Draghi has already promised (again) to do all he can – which hasn't been enough so far – which leaves it all up to the Fabulous Federal Reserve, who meet tomorrow and Wednesday and make their policy decision Wednesday at 2pm. This will be followed the next morning by the Durable Goods Report and then a revised look at Q4 GDP. If those numbers are looking bad – expect the Fed to be extremely doveish on Wednesday.

John Williams is one of the Fed's super doves and he's getting the last word on Friday so the Fed is already bracing for a market that needs reassurance and, somehow, I don't find that very reassuring – do you?

While we wait, we'll be keeping a close eye on our bounce lines – ready to pull the trigger on our hedges at the first sign of weakness because making $996,000 (99.6% of our original $100,000) in a 10% downturn is fun while standing around like a deer in the headlights while your portfolio melts away on you is not – and we like to have FUN at Philstockworld!