Waiting to cut out the deadwood

Waiting to clean up the city

Waiting to weed out the weaklings

Waiting for the final solution

To strengthen the strain

Waiting to follow the worms – Floyd

Now comes the fun part of the week!

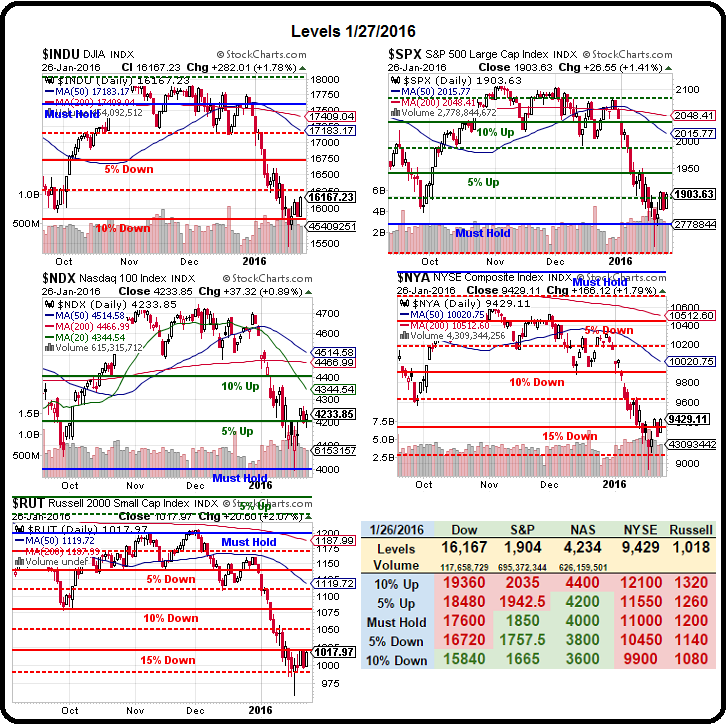

I told you Monday's drop would be meaningless and we had a full reversal yesterday and now we're right back where we finished on Friday, which isn't really such a good place, barely holding that weak-bounce 1,900 line on the S&P but at least it is holding and our Futures plays from yesterday morning put us in fantastic shape for today as my morning note to our Members was:

Futures – I like TF on a cross over 1,000 with tight stops but not too excited about anything else.

Oh, sorry, NQ over 4,200 would work too or NKD over 16,900.

/TF is the Russell 2,000 Futures and they popped up to 1,015 which may not seem like much but they pay $100 per point, per contract so +$1,500 on those and this morning we went long at 1,005 (since we didn't think we'd get back to 1,000 pre-market) and we'll see how that goes but already we're up $350 per contract at 1,008.50 and we set a stop at 1,007.50 to lock in $250 and, once again, the Egg McMuffins are paid for!

/TF is the Russell 2,000 Futures and they popped up to 1,015 which may not seem like much but they pay $100 per point, per contract so +$1,500 on those and this morning we went long at 1,005 (since we didn't think we'd get back to 1,000 pre-market) and we'll see how that goes but already we're up $350 per contract at 1,008.50 and we set a stop at 1,007.50 to lock in $250 and, once again, the Egg McMuffins are paid for!

The Nasdaq (/NQ) made it to 4,240 but that's a dull $400 per contract gain while the real show was the Nikkei (/NKD), which jumped to 17,200 for a lovely $1,500 per contract gain. All in a day's work at Philstockworld and today we will have a LIVE Trading Webinar at 1pm (Members only – join HERE) – right into the Fed Release at 2pm so we'll hopefully be able to make some intelligent trades to take advantage of whatever comes our way this afternoon.

In last week's Webinar (replay available here), at 00:48:15, we went over the trade idea similar to the one in the Options Opportunity Portfolio at Seeking Alpha which was:

- SELLING: 10 UCO July $5 puts for $1

- BUYING: 10 UCO July $6/10 bull call spreads for $1.10

The net on that trade idea was just 0.10 in cash ($10 per contract) and the margin is about $1.90 ($190 per contract) and the payoff, if oil bounces into July would be $3.90 ($390 per contract) for a ridiculous 39x return on cash and 100% return on cash and margin in 6 months. We caught the dead bottom on oil last week and already the net on the spread has gone from $10 to $1,200 for a $1,100 gain in just the first week (1,100% on cash). Sure it's boring compared to the Futures trading techniques we teach our Members but still a pretty nice profit for 7 days, right?

We also made a great bottom call on 5 REITs that we follow along with VNQ, IBM, IRBT and TWTR, which is the only one that isn't up significantly (yet). If there was a more profitable way to spend 90 minutes last week than listening to our Webinar – I'd like to know what it was! The week before, on Jan 14th, I had posted "Fearful Thursday – Are the Markets DOOMED? Breaking Down the Dow", which we discussed in the Webinar and the key takeaway that's relevant this morning is that we called $97 the bottom for Apple (AAPL) – and that's where we are this morning.

BA was also a concern and AAPL and BA are costing the Dow about 95 points this morning and that's the only thing keeping us from going higher (Russell is unaffected and now (8:42) back at 1,012 for a $700 per contract gain and now our stop is 1,011 to lock in $600). Anyway, the main point of my Dow analysis was that we only see about 700 points of upside into earnings (16,700), so we're not expecting any great recovery. 700 Dow points is just 4.4% over the 16,000 line so those of you starting at the market and praying your stocks will reclaim their highs are PLAYING THEM WRONG!

I already discussed our strategy for playing a flat market in that post, so I won't re-hash it here and, as you can see from last week's Webinar, picking winners is like shooting fish in a barrel when you concentrate on the VALUE of the things you are trading and ignore those squiggly lines and the PRICE of the stock of the company you are supposed to be INVESTING in. This is what we teach you at PSW, if you just want picks – go somewhere else!

We had an extensive discussion of AAPL earnings (we're still bullish at $97) in this morning's Live Member Chat Room and, frankly, I'd hoped it would spike lower so we could load up. Boeing (BA) was not surprisingly weak in their Cargo Jet Division, which should not surprise anyone who's been paying attention to global freight numbers. As they are still early in the cycle for deliveries of new planes and as they, like AAPL, were clobbered by exchange rates this year but they have $500,000,000,000 in backlogged plane orders so this sell-off is STUPID and we'll be very happy to bottom-fish Boeing, hopefully around $115.

Ahead of the Fed this afternoon, we have oil inventories at 10:30 and, last night, the API Report showed an 11.4Mb build in inventories. If the EIA report matches that number – oil will likely slide back below $30 (now $30.82, down from $32.50 yesterday) and the markets will not like that one bit. Then it will all be up to the Fed to fix the mess they made at the last meeting. The best thing they can do is simply reverse their decision and say they made a mistake and the recovery was a bit more fragile than they thought and not ready for rate hikes but they are not likely to admit that so expect VERY DOVEISH LANGUAGE in their statement and, much more importantly, in Jon Hilsenrath (the Fed Whisperer)'s interpretation of their statement.

Either way, we're looking for 16,000 to hold on the Dow and 1,900 on the S&P and 4,200 on the Nasdaq and 1,000 on the Russell or else we are DOOMED!!! If you don't believe me – go back to when I told you we were DOOMED if the Russell didn't hold 1,050 and think how much better off you would have been to heed that warning.

Be careful out there!