This guy (who writes for the WSJ) has WAY too much influence over the market due to his supposedly tight relationship with the Fed. At this point, it no longer matters what the Fed actually says – what matters is what Jon Hilsenrath tells you the Fed said. In this case, we had a nice uptick on reading the very doveish 2pm Fed minutes that lasted all the way until 2:03, when Hilsenrath opined in the article pictured here.

I had to use this screenshot (which, fortunately we captured during our Live Webinar) because, after I called him out for being totally WRONG in his snap interpretation of the Fed Statement (and we went long on the Dow Futures (/YM) into the sell-off) – his article has been DRASTICALLY altered. Now it reads:

Federal Reserve officials expressed renewed worry about financial-market turbulence and slow economic growth abroad, leaving doubts about whether the central bank will raise interest rates as early as March.

…the policy statement, released Wednesday after a two-day meeting, raised questions about whether the Fed would follow through with a rate move when it gathers again on March 15-16. Futures markets place just a 25% probability on rate increase by then.

Raised questions? I was the one raising the questions!!! If you want to hear me screaming about this live, you can check out our Webinar Replay later today (not ready yet) but, as far as investors who were not lucky enough to have me calling shenanigans on Hilsenrath and the Wall Street Journal – the damage was already done. The WSJ didn't even point out that the article was corrected – they just shoved their tail between their legs and tried to pretend they didn't make a mistake that cost the Dow 300 points.

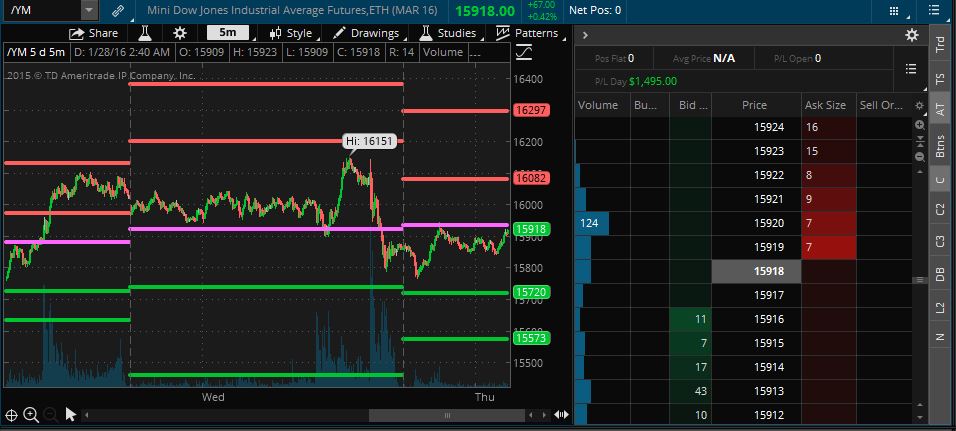

Of course, the great thing about participating in one of our Live Webinars (see yesterday's post for your invite) is that we know how to trade this kind of market BS and what we did was take a long position on the Dow Futures (/YM), averaging into a position at 15,879 and exiting early this morning at 15,914 for a nice $700 gain on 4 contracts. The Dow is back down to 15,889 at the moment and we'll be liking them long again at 15,900 with tight stops below along with 1,000 on the Russell (/TF), 4,150 on the Nasdaq (/NQ) and 17,100 on the Nikkei (/NKD). Tune in tomorrow and we'll see how well those do.

We also decided to pick up the March gasoline contracts (/RBH6) at $1.0335 as we felt it was the contract rollover from Feb (/RBG6) that was holding it back. Those contracts are already over $1.085 this morning and a stop at $1.08335 locks in a gain of $2,100 per contract in less than 24 hours but it could go well over $1.10 into the weekend at $420 per penny, per contract.

In addition to the WSJ scaring away investors, Goldman Sachs dropped the D (Depression) bomb on Brazil yesterday in an afternoon spot on Bloomberg and no, I'm not tryng to see how many corporations that are controlled by multi-Billionaires I can name-drop in one sentence – that's just the way our markets are manipulated! Brazil is the World's 7th largest economy at $2.4Tn in GDP so a Depression there can drag the World down with it.

“Brazil is a mess,” Alberto Ramos, the chief Latin America economist at Goldman Sachs, said at an event organized by the Brazilian-American Chamber of Commerce in New York on Wednesday. “Number 10 used to mean Pele. Now it’s inflation rate, unemployment rate and the popularity rate of the president."

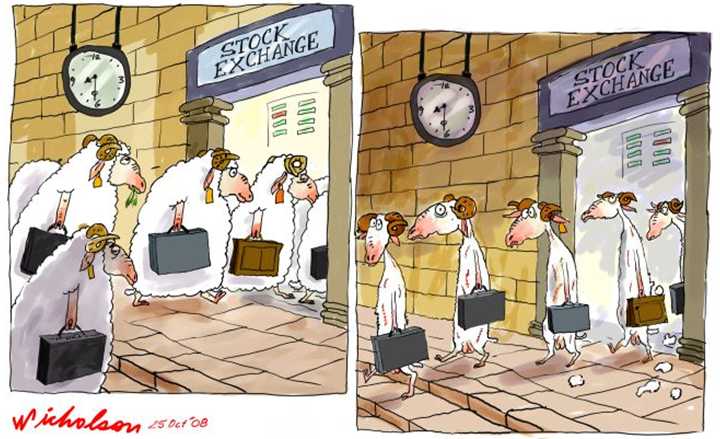

Wow, call Jimmy Fallon – one of his gag writers has escaped! While nothing is funnier than a major economy in crisis – this kind of scare talk depresses commodity prices and, more importantly, scares retail investors (maybe you) away from buying at the bottom which, conveniently, gives the owners of the media more time to accumulate their own positions before their employees are directed to change their tune and give the "all clear" signal to the masses, who are then shoved into the top of the price range like passengers on a Japanese subway.

Wow, call Jimmy Fallon – one of his gag writers has escaped! While nothing is funnier than a major economy in crisis – this kind of scare talk depresses commodity prices and, more importantly, scares retail investors (maybe you) away from buying at the bottom which, conveniently, gives the owners of the media more time to accumulate their own positions before their employees are directed to change their tune and give the "all clear" signal to the masses, who are then shoved into the top of the price range like passengers on a Japanese subway.

That's right, the Japanese government hires people whose job it is to stuff commuters into trains to maximize their capacity – so why would Billionaires who control the Media and the Financial Corporations not employ analysts, writers and "news" people to stuff investors into whatever makes them the most money as well as chasing investors out of whatever they want to buy.

Today's case in point is Apple (AAPL) and I refuse to get into a valuation discussion on a $517Bn company with $220Bn in cash, no debt and $55Bn in annual net profits. What I will say, however, is that Facebook (FB) yesterday reported $1Bn in quarterly profit, which is what AAPL makes in a week and the stock jumped from $95 to $107 – up 15%, which is $40Bn in market cap, putting them over $305Bn vs AAPL's $517Bn even though, as I said, AAPL makes 25% more EACH MONTH than FB makes all year.

So why then, are people being stuffed into FB, which will take 100 years to earn enough to cover a $110 investment at the current rate, while being chased out of AAPL, which returns over 10% per share in profits at the current rate – a factor of 10 better than FB. The reason is because "THEY" are accumulating AAPL below $100 and dumping FB over $100 and they need to make FB seem hot, so people will buy the shares – hopefully with the money from the AAPL stock they just dumped.

That's the game and we love to play it. As I often say to our Members: "We don't care IF the game is rigged as long as we understand HOW it is rigged and are able to place our bets accordingly." Knowing it's a scam enables us to see through the BS and make much better investing decisions than the general public and, even as I am writing this (9:05), our Futures are taking off – exactly as we bet them to.

That means it's time for me to go back to work and join the Live Chat with our Members!