Financial Markets and Economy

Dividend Cuts Show Pain of Cheap Oil for Emerging Companies (Bloomberg)

Energy producers in emerging markets are cutting dividend payments faster than peers in developed countries after a slump in crude prices and slackening demand in China forces them to preserve capital.

Wall Street is ditching experienced traders, and it could backfire when markets go haywire (Business Insider)

Finance Insider is Business Insider's midday summary of the top stories of the past 24 hours.

How to make money from Brexit: get ahead of the freaked-out foreigners (Business Insider)

The analysts at Liberum, a London-based investment bank, think that British voters are very unlikely to choose to leave the EU in the referendum to be held on June 23. They put the odds of a British exit—aka “Brexit”—at just 25%.

Is the U.S. economy $3 trillion stronger than we think? (Washington Post)

Is the U.S. economy stronger than we think? Perhaps. A persisting puzzle about its recent performance is the stark contrast between growth of jobs (which has been unexpectedly robust) and the growth of the economy’s output (which has been unexpectedly weak). How could a struggling economy produce so many jobs? The puzzle would disappear if the economy’s output is consistently undercounted.

Markets are going haywire after the ECB fires a 'bazooka' (Business Insider)

The euro is ripping higher after a big drop that followed the European Central Bank's announcement that it was cutting interest rates.

Oil's technicals and fundamentals are predicting different things (Business Insider)

A few weeks ago everyone was talking about the death of oil with one infamous pundit possibly referring to his own death. How much sentiment for oil prices has changed in a few weeks…

Eight Story Lines Explain the Global Economic Crisis (Bloomberg View)

Something weird is going on with the global economy. It’s been going on since at least 2007. Economic growth has been slow, financial markets have been volatile and economic policy makers have often been at a loss.

Bank Of Japan May Fire Bazooka To Lift All Stocks (Forbes)

Among all of the moves in markets yesterday, the biggest by far was the plunge in Japanese yields. Japanese 10-year yields are already negative and, with today’s moves, the 20, 30 and 40-year bond yields traded like they have a date with zero. If you gave the Japanese government your money for 40 years today, you would earn a whopping interest rate of 1/2 percent a year.

Asia stocks gain as oil bounce improves sentiment, ECB awaited (Reuters)

Asian stocks edged up on Thursday, encouraged by a rally in crude oil prices and expectations that the European Central Bank will ease policy later in the day, emulating policymakers elsewhere seeking to bolster their struggling economies.

The epic collapse of American soda consumption in one chart (Business Insider)

American soda consumption has plunged.

The Fed Shouldn't Watch the Calendar (Bloomberg View)

The U.S. Federal Reserve faces a daunting task as it moves away from near-zero interest rates: communicating its plans without unduly shaking up financial markets. The job would be easier if everyone involved recognized that the central bank's actions must depend on the state of the economy, not on the calendar.

Wall St. Rises on Strong Earnings Data (NY Times)

United States markets were higher in early trading on Thursday after more positive earnings reports. Most European stock markets rose after the European Central Bank unveiled a bigger-than-anticipated stimulus for the 19-country eurozone economy.

Why This Sucker Is Going Down – The Case Of Japan's Busted Bond Market (Zero Hedge)

The world financial system is booby-trapped with unprecedented anomalies, deformations and contradictions. It’s not remotely stable or safe at any speed, and most certainly not at the rate at which today’s robo-machines and fast money traders pivot, whirl, reverse and retrace.

Here's Why Apple's Shares Are Rebounding (Fortune)

After months of declines in Apple‘s stock, sentiment appears to be mending as investors focus on steady earnings expectations and bet that the expected launch of a new iPhone will add badly-needed fuel to sputtering sales.

China isn't the reason for the commodities crash (Business Insider)

I regularly read Niels Jensen’s monthly letter, and this month’s edition is exceptional.

The S&P 500 beat 66% of stock pickers last year (Market Watch)

The track record of stock pickers has improved a little, but it’s still not great, according to the latest data from S&P Dow Jones Indices.

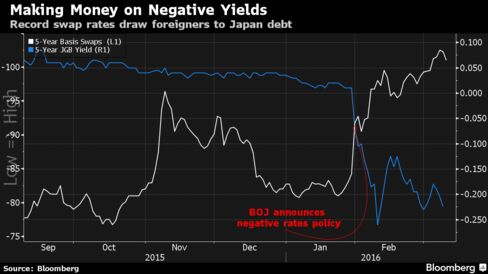

How Global Investors Turn Negative Japan Yields Into Big Returns (Bloomberg)

Record-low negative yields are no deterrent to overseas demand for Japanese government bonds. In fact, they’re an incentive.

These Are the Options Left in the ECB’s Stimulus Arsenal (Wall Street Journal)

The European Central Bank is widely expected to announce a substantial package of stimulus measures on Thursday, combining rate cuts, additional asset purchases and possibly more. Here are some options, and how they might affect markets.

Goldman Turns Bearish: "Relief Rally Was Too Fast, We Do Not Feel Comfortable Taking More Risk" (Zero Hedge)

The market's volatile swing are clearly too much for the central banker-incubating hedge fund known as Goldman Sachs, because just three days after Goldman said there has "never been a better time to buy S&P calls", when it said that "our GS-EQMOVE model estimates there is a 21% probability of a 5% up-move over the next month based on the current levels of S&P 500 Free Cash Flow yield, Return on Equity, ISM new orders and US Capacity Utilization"…

Men's Wearhouse Store-Closing Plan Sends Company's Stock Soaring (Bloomberg)

Tailored Brands Inc. jumped the most in more than two years after announcing plans to close hundreds of stores, part of a cost-cutting push for the owner of Men’s Wearhouse and Jos. A. Bank.

Politics

Ohio's 'dirty little secret': blue-collar Democrats for Trump (Reuters)

If Donald Trump wins the Republican Party nomination, his path to the White House will run through this working-class city with a knack for picking presidents.

No Republican has ever won the White House without Ohio.

Obama on the World (The Atlantic)

Over the course of extended conversations with The Atlantic’s Jeffrey Goldberg, President Barack Obama laid out his views on foreign policy.

Four Republicans, Four Big Myths (Bloomberg View)

Four Republicans, Four Big Myths (Bloomberg View)

In Donald Trump's telling, Mexico, Japan and especially China are fleecing the U.S. because past presidents were inept negotiators and too timid to muscle America's trading partners.

But even if a President Trump could stop companies from offshoring or countries from manipulating currencies — possibly by strong-arming Congress into imposing 35 percent tariffs on imports — those jobs aren't coming back. This is the big myth propelling Trump's surprisingly successful candidacy.

Technology

The Human-Robot Trust Paradox (The Atlantic)

We never found elephants on the moon, or invented working mind-reading machines, or figured out how to use telephones to commune with the dead.

But we do have robots! Ancient automata notwithstanding, the modern robot came straight out of the annals of science fiction, as if realized by sheer imagination. People have been infatuated with them ever since.

Robots are coming for your job, and most of you don’t even know it (Market Watch)

Robots are coming for your job, and most of you don’t even know it (Market Watch)

Robots may soon take your job and, most likely, you won’t see it coming.

While two in three Americans expect that, within 50 years, robots and computers will do much of the work that humans currently do, when it comes to their own jobs, most workers think they’re in the clear, according to a survey of more than 2,000 adults released Thursday by Washington, D.C.-based think tank Pew Research Center.

Health and Life Sciences

Is It Safe to Exercise During Pregnancy? (NY Times)

The recommendation to limit heart rate to 140 during pregnancy was made in 1985, at a time when “the scientific data on strenuous exercise in pregnancy was very scarce,” said Dr. Raul Artal, the obstetrician and exercise physiologist who developed the guideline for the American College of Obstetricians and Gynecologists (ACOG). But the recommendation was later withdrawn. “It has no scientific value,” Dr. Artal said

First U.S. Uterus Transplant Fails Due to Complications (Scientific American)

First U.S. Uterus Transplant Fails Due to Complications (Scientific American)

The first uterus transplant in the United States has failed and the Ohio hospital that performed the procedure said on Wednesday the organ was removed due to an unspecified complication.

"We are saddened to share that our patient, Lindsey, recently experienced a sudden complication that led to the removal of her transplanted uterus," Cleveland Clinic said in a statement.

Life on the Home Planet

Revolutionary Guards commander says Iran's missile work will not stop: state TV (Reuters)

A senior Revolutionary Guards commander has said that Iran's ballistic missile program will not stop under any circumstances and that Tehran has missiles ready to be fired, according to Iranian state television.

Fukushima exclusion worse than radiation? (BBC)

Fukushima exclusion worse than radiation? (BBC)

The exclusion zone around the Fukushima nuclear plant has a strange beauty to it. The small town of Okuma, just two kilometres from the plant, looks unreal to my human eyes – so conditioned to the bustle of urban life.

There are houses and shops, cars parked neatly in driveways, a traffic light flashing orange in the distance. But, apart from me, there is not a single human.

American Workers Rank Last In Problem-Solving Skills With Technology (Fast Company)

American Workers Rank Last In Problem-Solving Skills With Technology (Fast Company)

A new report issued by the National Center for Education Statistics has found that American workers rank "dead last" out of 18 industrial nations when it comes to problem-solving skills using technology, the Wall Street Journal says. The report is based on Program for the International Assessment for Adult Competency (PIACC) data that tested thousands of adults aged 16 to 74 on literacy, numeracy, and digital problem-solving.