Financial Markets and Economy

US inflation rears its ugly head as global cycle nears danger zone (Telegraph)

US inflation rears its ugly head as global cycle nears danger zone (Telegraph)

The trigger for the next global recession is at last coming into view after a series of loud distractions and false alarms.

The Atlanta Federal Reserve's gauge of "sticky-price" inflation in the US soared to a post-Lehman peak of 3pc in February. This index is a 'pure' measure of core inflation – the underlying story once the noise is stripped out.

Stock exchanges are devouring each other because no one buys individual stocks anymore (Quartz)

Jack Bogle has won.

Bill Ackman is acting a lot like he did the last time he blew up a hedge fund (Business Insider)

Part of why history repeats itself so often is that it's so rare for grown people to change, especially if they are Masters of the Universe accustomed to being right.

There's Trade, and Then There's Good Trade (Bloomberg View)

There's Trade, and Then There's Good Trade (Bloomberg View)

I find myself in an odd position right now. Having spent years criticizing the elite consensus in favor of free trade, I now am very reluctant to join the backlash.

One simple reason is that the backlash is being led, in part, by Republican presidential candidate Donald Trump and I'm disinclined to sign onto a movement of which he is a prominent leader.

How Americans’ Perceptions of the Economy Have Changed in Just Three Months (Wall Street Journal)

In the broadest strokes, the U.S. economy looks a lot like it did in December. After all, three months isn’t much time to change the outlines of an $18 trillion global powerhouse.

How a Pension Fund Will Fare in a Low-Carbon Economy (Chief Investment Officer)

Reducing emissions won’t be easy on equity-heavy investors like CalSTRS—but it’s still better than the alternative, Mercer reports.

US Industrial Production Collapses Most Since 1952 Outside Of Recession (Zero Hedge)

The current decline in US manufacturing would be the first time since 1952 that Industrial Production has declined for four straight months without the US economy not being in recession. A worse-then-expected 0.5% MoM plunge – near the worst since 2009, led to a 1.0% drop YoY, the 4th monthly decline..

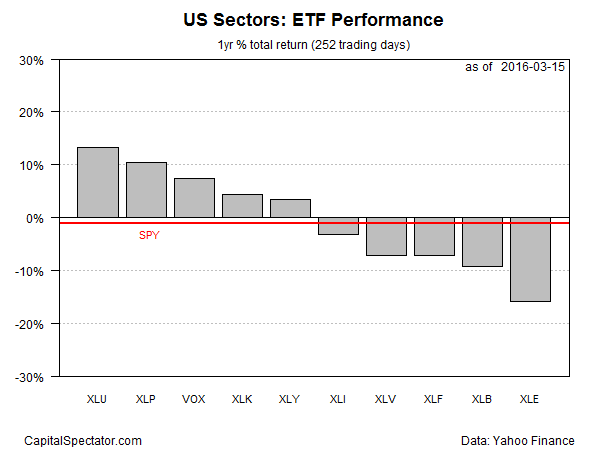

Bullish Momentum Powers US Utility Stocks In 2016 (Capital Spectator)

If the crowd’s worried about the possibility of rising interest rates, the anxiety isn’t showing up in utility stocks. This interest-rate sensitive corner of equities is comfortably in the lead among US sectors, based on a set of ETF proxies.

The rise of the sharing economy (The Economist)

The rise of the sharing economy (The Economist)

Last night 40,000 people rented accommodation from a service that offers 250,000 rooms in 30,000 cities in 192 countries. They chose their rooms and paid for everything online. But their beds were provided by private individuals, rather than a hotel chain. Hosts and guests were matched up by Airbnb, a firm based in San Francisco. Since its launch in 2008 more than 4m people have used it—2.5m of them in 2012 alone. It is the most prominent example of a huge new “sharing economy”, in which people rent beds, cars, boats and other assets directly from each other, co-ordinated via the internet.

The Two-Year Yield Soars Back (Crossing Wall Street)

Perhaps the big story of the investing year so far is that the consensus went from expecting several rate hikes this year, to expecting none, and now back to expecting some.

China Needs a New Commitment to Economic Reform (Bloomberg View)

China's leaders have been struggling with the same essential dilemma for some time: They want steady growth and short-term stability, but they also want far-reaching economic reform. Those aims can't easily be reconciled.

Soft-Drink Makers Plunge on Surprise U.K. Budget Sugar Levy (Bloomberg)

Companies that profit from Britain’s sweet tooth plunged as the U.K. unveiled a sugar tax, a surprise move that adds another burden to food and beverage companies grappling with marketing restrictions and a shift toward healthier fare.

The Golden Corral (Market Anthropology)

Gold took the exit ramp south Monday, meeting expectations that the nearly three month rally was poised to stall.

S&P 500 Performance on Fed Days (Bespoke)

Today is yet another Fed Day, and below we highlight how the S&P 500 has performed on Fed Days over the last three years. As shown, the average change on these 24 days has been +0.16%, and we’ve seen positive days outnumber negative days 13 to 11.

A Cheaper Way to Battle Recession (Bloomberg View)

What should the U.S. government do to fight recessions? What should it do to fight slow growth? This is the eternal question of so-called countercyclical policy. The two mainstream ideas are fiscal and monetary stimulus. The fiscal version works by having the government borrow and spend money, either on useful things like infrastructure, or by simply mailing people checks. The typical monetary variety works by having the Federal Reserve swap money for financial assets, which lowers interest rates.

Politics

How the 'New York Times' Sandbagged Bernie Sanders (The Rolling Stone)

How the 'New York Times' Sandbagged Bernie Sanders (The Rolling Stone)

The New York Times ran a piece about Bernie Sanders Monday, a sort of left-handed compliment of a legislative profile. It was called "Bernie Sanders Scored Victories for Years Via Legislative Side Doors."

I took notice of the piece by Jennifer Steinhauer because I wrote essentially the same article nearly 11 years ago. Mine, called "Four Amendments and a Funeral," was a Rolling Stone feature. Sanders back then was anxious that people know how Congress worked, and also how it didn't work, so he invited me to tag along for weeks to follow the process of a series of amendments he tried (and mostly succeeded) to pass in the House.

Senate Republicans Won’t Hold SCOTUS Confirmation Hearing. They’re Holding These Hearings Instead. (Think Progress)

Senate Republicans Won’t Hold SCOTUS Confirmation Hearing. They’re Holding These Hearings Instead. (Think Progress)

Even before President Obama announced on Wednesday his nominee to fill the Supreme Court seat vacated by the late Antonin Scalia, the leading members of the Republican Party pledged to oppose his pick no matter what. The GOP has made it clear that there are no plans to even hold a hearing to allow a vote on Obama’s nominee.

Confirming court nominees is a central part of the Senate’s responsibilities. In response to intransigent senators who say it’s better to hold off until after an election year, critics have coalesced around a “do your job” rallying cry.

Rest In Peace To The Republican Party (Forbes)

Rest In Peace To The Republican Party (Forbes)

The Republican Party, known by its nickname as the Grand Old Party, died on March 15, 2016. It was 162 years old. The party, born in the strife of the 1850s, succumbed to internal strife, sources said.

The GOP had been suffering from hopeless internal divisiveness brought on by multiple sectors internally all claiming to be the “real conservatives” and no one ready to agree on a unifying theme. The party stopped breathing because of demographics that were stacked against it and its inability to adjust to a different America demographically, culturally, and having a worldview that didn’t recognize new global realities.

Technology

Nike's Self-Lacing Shoes Are Here: Meet The Hyperadapt (Popular Science)

Nike's Self-Lacing Shoes Are Here: Meet The Hyperadapt (Popular Science)

“Have you ever had shoes without shoestrings?” Kanye West intoned in 2009’s “Run This Town” collaboration with Jay-Z and Rihanna. The self-styled genius and fashion auteur maybe forgot that Velcro exists, but his line could almost as easily describe Nike’s new HyperAdapt 1.0 sneakers with "adaptive lacing", debuted by the long-running footwear giant in New York today.

Supercomputer copies body's blood flow (BBC)

Supercomputer copies body's blood flow (BBC)

A new supercomputer simulation of blood moving around the entire human body compares extremely well with real-world flow measurements, researchers say.

Its accuracy passed a first key test when physicists compared blood flow in the virtual aorta with the that of real fluid in a 3D-printed replica.

Health and Life Sciences

Scientists Grow Full-Sized, Beating Human Hearts From Stem Cells (Popular Science)

Scientists Grow Full-Sized, Beating Human Hearts From Stem Cells (Popular Science)

It’s the closest we've come to growing transplantable hearts in the lab

A team of scientists from Massachusetts General Hospital and Harvard Medical School has gotten one step closer, using adult skin cells to regenerate functional heart tissue from stable scaffolding.

Life on the Home Planet

The Complete History of Monsanto, "The World's Most Evil Corporation" (The Last American Vagabond)

The Complete History of Monsanto, "The World's Most Evil Corporation" (The Last American Vagabond)

Of all the mega-corps running amok, Monsanto has consistently outperformed its rivals, earning the crown as “most evil corporation on Earth!” Not content to simply rest upon its throne of destruction, it remains focused on newer, more scientifically innovative ways to harm the planet and its people.

As true champions of evil, they won’t stop until…well, until they’re stopped!

Is religion in the U.S. doing a vanishing act? (Futurity)

Is religion in the U.S. doing a vanishing act? (Futurity)

For generations, the United States has been considered a religious outlier—its citizens more dedicated to their faith and houses of worship than the rest of the developed world.