Like those about to die miserably in Les Miserables, our fearless Fed leader sang the same old song with a few new lines (well, that's The Who, actually) and, as Lincoln predicted – you CAN fool some of the people all of the time and what a rally we had yesterday, as the Dow popped 200 points on "news" that the Fed would not raise rates more than twice this year. We took quick advantage of it in our Live Trading Webinar (replay available here) and went long on the Russell Futures (/TF) and made a very quick (15 mins) $390 per contract for our Members but, since the whole thing was BS – we took the money and ran!

How much BS? Janet's fake, Fake, FAKE!!! enthusiasm for our economy was nicely summed up by Dave Fry, who said:

"There’s a lot of spin (um, lying?) going on with the Fed’s announcement Wednesday. It’s consistent with past comments and runs as follows:

- Consumer Confidence has improved—no it hasn’t.

- Economic Growth is growing at “moderate” pace—not really unless you consider 1% moderate.

- The strong dollar has restricted economic growth—this has been the mantra for past two years, Retail Sales, Industrial Production and so forth remain weak.

- Oil prices are rebounding has prices increased—that’s possibly true but the category is still weak.

- Employment is expanding as is participation—most new jobs part-time or in the low paying services sectors, this is BS.

- Overseas Economic weakness has little effect on our projections—seriously?

- Financial market (stock markets) are doing well fanning the flames to heat up investor confidence—markets are still rallying based on corporate buybacks. One thing to keep in mind is that this creates a lot of debt.

And, so the psychological manipulation goes."

That "psychological manipulation" was enough to buy us that one more day before reality hit this morning as Japan's February Trade Data was yet another disaster and, when push comes to shove, you can blame a slump in exports to US (down 3.2%) as the source of new woes in addition to a continuing 15.6% decrease in export volume to China.

“The tailwind from the weak yen has gone. We can’t help but hold a pessimistic view on the outlook for exports,” said Atsushi Takeda, an economist at Itochu Corp. in Tokyo, said before the figures were released. “Domestic demand won’t be dependable at all, and the same goes for exports. I can’t deny the possibility of another economic contraction this quarter.”

“The lack of a boost from exports raises a risk of Japan’s contraction this quarter,” said Nobuyasu Atago, the chief economist at Okasan Securities Co. and a former Bank of Japan official. “It’s becoming clearer that the weakness of the global economy is taking a toll on Japan’s economy.”

Interestingly enough, going long on the Nikkei Futures (/NKD) was our last trade idea of the day in our Live Member Chat Room, where I said (3:51): "/NKD is the best way to go long overnight above 16,900. Figure either Asia likes the Fed and rallies or the Dollar comes back and the Nikkei likes that – two ways to win!" As you can see on the chart, by 9pm we were back to 17,200 but those who were greedy were punished at the Nikkei pulled a full reversal overnight (we don't hold Futures positions overnight, in general, so no worries).

Interestingly enough, going long on the Nikkei Futures (/NKD) was our last trade idea of the day in our Live Member Chat Room, where I said (3:51): "/NKD is the best way to go long overnight above 16,900. Figure either Asia likes the Fed and rallies or the Dollar comes back and the Nikkei likes that – two ways to win!" As you can see on the chart, by 9pm we were back to 17,200 but those who were greedy were punished at the Nikkei pulled a full reversal overnight (we don't hold Futures positions overnight, in general, so no worries).

Though the Nikkei is back down, the very lousy data has us hesitating to go long again unless the Dollar (95 on /DX Futures) heads back up and /NKD crosses 16,700 – then we can play it long again with tight stops IF the US Index Futures are improving (Dow over 17,200, S&P over 2,120, Nasdaq over 4,375 & Russell over 1,070). It hasn't been a whole day yet and tomorrow is options expiration day so anything is possible.

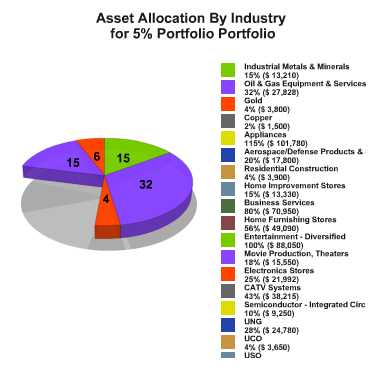

On the whole, our tracking portfolios are all parked in neutral except our Butterfly Portfolio, where our spreads got downright aggressive in last month's adjustments and that will be changed today as we get ready for a flat to down period between now and April expirations. Yesterday's rally added 3% to our Options Opportunity Portfolio since last week's review, now up 25.2% in month 7 and 10% below our 5% per month target gains. We'll want to get more aggressive with our hedges into the weekend uncertainty to protect our still cooking long positions.

On the whole, our tracking portfolios are all parked in neutral except our Butterfly Portfolio, where our spreads got downright aggressive in last month's adjustments and that will be changed today as we get ready for a flat to down period between now and April expirations. Yesterday's rally added 3% to our Options Opportunity Portfolio since last week's review, now up 25.2% in month 7 and 10% below our 5% per month target gains. We'll want to get more aggressive with our hedges into the weekend uncertainty to protect our still cooking long positions.

CAUTION is the watchword for today and tomorrow. While the Fed did not disappoint and tank the markets yesterday, it might be even worse that they drastically lowered the rate outlook and it barely got a reaction (in the grand scheme of things) from the markets. If we fully reverse the Fed move into the weekend – next week can be very scary indeed!

Beware the ides of March!