Financial Markets and Economy

2015 Was the First Time Since the Recession That More Hedge Funds Closed Than Opened (Fortune)

2015 Was the First Time Since the Recession That More Hedge Funds Closed Than Opened (Fortune)

2015 was a train wreck for many hedge fund managers.

It was a punishing year for hedge funds, with brutal losses and several high-profile closures, including that of $1.5 billion SAB Capital Management and $1.5 billion Nevsky management, unhinging the industry.

BOJ Minutes Show No Talk of More QQE Before Minus Rate Vote (Bloomberg)

At the January meeting where the Bank of Japan surprised markets by adopting a negative rate, the bank’s staff offered another option – expanding record asset purchases, but the minutes show no discussion of that.

PBOC Steps Up Injections as Money Rate Rises to Three-Week High (Bloomberg)

China’s central bank used its open-market operations to increase the supply of cash in the financial system as demand driven by tax payments and convertible bond sales pushed the overnight money-market rate to a three-week high.

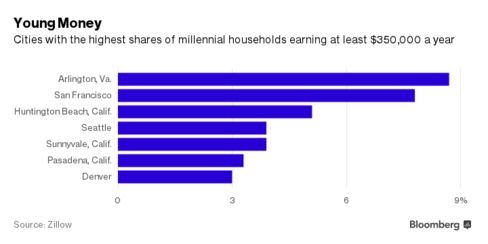

These Are the Cities Where Rich Millennials Live (Bloomberg)

Millennials are giving up on getting rich and more likely to identify as working classthan other generations, according to recent research.

No one knows how the Air Force is going to pay for its $100 billion nuclear aircraft plan (Business Insider)

A top Air Force official on Wednesday floated a potentially controversial scheme to pay for the service’s pricey next-generation bomber, one that could see the entire Defense Department fund the expensive effort.

Strategists Now See Virtually No Europe Stock Gains in 2016 (Bloomberg)

Strategists have slashed expectations for European stocks, painting the gloomiest annual outlook in five years.

Property prices in China's largest cities are forming what looks like a dangerous bubble (Business Insider)

Chinese new home prices continued to accelerate in February, heightening fears that a new property bubble is forming in some larger Chinese centres.

No One Knows Where These 800,000 Barrels of Oil Have Gone (Fortune)

No One Knows Where These 800,000 Barrels of Oil Have Gone (Fortune)

Just two months ago, the International Energy Agencywarned that the global oil market could “drown in oversupply.” But according to a Wall Street Journal report, a large portion of the problematic oversupply that is worrying traders and potentially holding down oil prices is also nowhere to be found.

The IEA was unable to account for 800,000 barrels of crude per day last year—the highest level of missing crude in 17 years.

The Fed's Easing Is A Green Light To Buy Stocks (Forbes)

When the end of this year arrives, and we look back on what transpired for 2016, it may very well be yesterday’s Fed event that proves the big turning point for global markets and economies.

Is Fitbit a Value Stock Or a Sinking Ship (Fox Business)

Fitbit has become a major conundrum for investors looking to find high potential tech stocks today. The company has the largest market share in wearables according to IDC, but it's losing share, and has some built in hurdles compared to emerging rivals likeApple , Samsung, and even Garmin .

Negative interest rates are having an unintended consequence in Switzerland (Business Insider)

Remember back in December when we highlighted that one of the responses to central banks' introduction of negative interest rates might actually be a raising of interest rates by banks to borrowers?

Silver Soars Post-Fed As Gold Ratio Tumbles Most In 5 Months (Zero Hedge)

Two weeks ago we hinted at the flashing red warning coming from 'a 4,000 year old' financial indicator. The Gold/Silver ratio had reached extremely high levels, which at the time we explained…

UBS thinks stocks are at a top (Business Insider)

Is a stock market top near? As the U.S. presidential race appears to be taking shape, technical analysis from UBS indicates a coincidental numeric oddity: trend indicators that speak to stock market internals “are reaching overbought extremes,” the report said as the S&P 500 index traded near 2018 today. The outlook for stocks, furthermore, isn’t much different than the outlook for the recent bull rally in commodities.

How to tell if your investments are too risky (Business Insider)

After you make the decision to invest, you must then decide how much risk you can take. The further you step out on the risk spectrum, the better you expect your returns to be. But that better return can be a desert mirage if you don't understand the behavioral aspects of that decision.

Sea of oil in storage threatens to extend slump (Houston Chronicle)

Oil producers have brought so much crude to the surface that one Houston company is trying to put some back underground.

Oil is hovering around 3-month highs and traders are getting nervous (Business Insider)

US oil futures flirted with new highs for 2016 on Friday, adding to strong gains from the previous session as optimism grew that major producers would strike a deal to freeze output, while a more benign interest-rate environment also supported prices.

Monkeys, Sun and Fish & Chips: The Rock That Fears a `Brexit' (Bloomberg)

From the sun-scorched tip of Spain, Charles Catania has a message for British voters as they make up their minds whether to remain in the European Union.

Revisiting GDP Growth Projections (Barry Ritholtz)

Gross domestic product (GDP) contracted signifi-cantly during the Great Recession and has grownat a considerably slower pace than its historicalaverage during the subsequent recovery. Both GDP andGDP per capita have diverged noticeably from their pre-recession trends: As of 2015:Q4, they are 19 percent and16 percent below their 1955-2007 trends, respectively. Inthis essay, I use the most recent data to review the per-formance of a previous GDP forecast and present new projections up to 2024.

European Shares Advance as Automakers Jump, Miners Rebound (Bloomberg)

European stocks advanced as automakers jumped amid a weaker euro, and mining companies reversed earlier declines.

New York's famed Plaza Hotel is going up for auction (Business Insider)

New York's famed Plaza Hotel is going up for auction (Business Insider)

Billionaire brothers David and Simon Reuben are reportedly foreclosing on the Plaza Hotel, with plans to hold an auction for the legendary property next month.

The Monaco-based Reubens paid $800 million for debt on three properties, which included the five-star hotel in Midtown, from Bank of China last year after the hotel’s current majority owner, Subrata Roy’s Sahara India Pariwar, defaulted. Sahara also owns the Dream Downtown in Chelsea and the Grosvenor House in London.

Need an Airport for the Jet? Atlantic City Is Selling One Cheap (Bloomberg)

Aviation enthusiasts, developers and anyone looking for a parking spot for the private jet, take note: Atlantic City is selling a century-old former airport for a fraction of what it could have received eight years ago.

Valeant CEO sends memo to staff assuring them the company isn't on the verge of bankruptcy (Business Insider)

Valeant CEO Mike Pearson sent a memo to company staff on Wednesday assuring them that, among other things, the company isn't on the verge of filing for bankruptcy, according to a report from Bloomberg News.

Here’s Who’s Really Behind the $2 Trillion Stock Buyback Scam (Wall Street Examiner)

So far in the first quarter of 2016, companies have spent a combined $146 billion buying back their own shares, already surpassing the total for the entire first quarter a year ago. According to research from Bloomberg, that number could hit $165 billion.

America’s problem isn’t free trade — it’s the demise of an entire economic system? (Salon)

Both Bernie Sanders and Donald Trump are blaming free-trade deals for the decline of working-class jobs and incomes. Are they right?

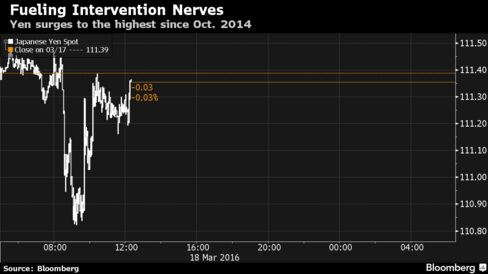

Yen's Surge to Highest Since BOJ's 2014 Bazooka Unnerves Traders (Bloomberg)

The yen trimmed its advance toward the highest level since October 2014 amid speculation the Bank of Japan may intervene to arrest gains that threaten to undermine almost three years of monetary stimulus.

Politics

Bernie Sanders says he has a 'path toward victory' against Hillary (Business Insider)

Bernie Sanders says he has a 'path toward victory' against Hillary (Business Insider)

Vermont Sen. Bernie Sanders said Thursday he still maintains a "path toward victory" in his Democratic presidential bid against Hillary Clinton, rejecting suggestions that she has all but sewn up the party's nomination.

Republican Elite’s Reign of Disdain (NY Times)

It’s an old joke, but it seems highly relevant to the current situation within the Republican Party. As an angry base rejects establishment candidates in favor of you-know-who, a significant part of the party’s elite blames not itself, but the moral and character failings of the voters.

A Trump Presidency Would Be As Bad For The World’s Economy As Islamist Militancy, Analysts Say (Think Progress)

A Trump Presidency Would Be As Bad For The World’s Economy As Islamist Militancy, Analysts Say (Think Progress)

The negative economic impact of a Donald Trump presidency would be on par with the threat of rising global Islamist terrorism, according to a global forecast from a leading economic analysis group announced on Thursday.

The Economist Intelligence Unit warned of a “trade war” with China and Mexico and said that the election of Trump “would be a potent recruitment tool for jihadi groups,” although its analysts made clear that they do not expect Trump to win the presidency.

Technology

Domino's is getting robots to deliver its pizza (Business Insider)

Domino's is getting robots to deliver its pizza (Business Insider)

Fast food giant Domino's is to trial pizza delivery robots in New Zealand, it said Friday, describing the hi-tech, driverless units as a world first.

Would you let a robot invest your hard-earned cash? (BBC)

The floors of the New York and London Stock Exchanges now exist mostly for show. The real trading is done automatically by robots.

About three-quarters of trades on the New York Stock Exchange and Nasdaq are done by algorithms – computer programs following complex sets of rules.

Hybrid Drone-Blimps May Be Flying Billboards of the Future (Fortune)

Hybrid Drone-Blimps May Be Flying Billboards of the Future (Fortune)

A Swiss company is tackling one of the key challenges to drone-based advertising by using a new kind of unmanned aerial vehicle that’s part blimp, part quadcopter. Known as Skye, the bulbous, spherical aircraft is soft and slow-moving, making it safe to fly near crowds.

Health and Life Sciences

Humans Interbred With Hominins on Multiple Occasions, Study Finds (NY Times)

Humans Interbred With Hominins on Multiple Occasions, Study Finds (NY Times)

The ancestors of modern humans interbred with Neanderthals and another extinct line of humans known as the Denisovans at least four times in the course of prehistory, according to an analysis of global genomes published on Thursday in the journal Science.

The Next Generation Of Wearables: Sensors Under Your Skin (Forbes)

The Next Generation Of Wearables: Sensors Under Your Skin (Forbes)

Whether they are done by drawing blood, taking blood pressure or conducting other diagnostic tests, many routine medical assessments haven’t evolved much in recent years. Patients still rely on care providers to perform them, and they still wait days or weeks for results.

Sure, wearable devices such as FitBits have made it easier to track simple physiological activities, such as heart rate and sleep patterns.

Life on the Home Planet

All Eyes on Flint, but Drinking Water Crisis Stretches Nationwide (Common Dreams)

All Eyes on Flint, but Drinking Water Crisis Stretches Nationwide (Common Dreams)

While a congressional hearing Thursday focused attention on the drinking water crisis in Flint, Michigan, news reporting from around the country reveals that the problem of lead-contamination afflicts communities nationwide.

Hottest Winter On Record By Far Drives Devastating Weather Disasters Globally (Think Progress)

Hottest Winter On Record By Far Drives Devastating Weather Disasters Globally (Think Progress)

December to February was the hottest meteorological winter ever by far, topping the previous record by a jaw-dropping half a degree Fahrenheit. The National Oceanic and Atmospheric Administration (NOAA) reports that this winter was a remarkable 2.03°F above the 20th century average.

Radar scans reveal hidden chamber in King Tut's tomb (CNet)

Radar scans reveal hidden chamber in King Tut's tomb (CNet)

The first radar scans of the tomb of Tutankhamun in Egypt's Valley of the Kings have been completed, strongly indicating the presence of hidden chambers, Egyptian Antiquities Minister Mamdouh el-Damatyannounced in a press conference Thursday.