Financial Markets and Economy

Dollar rise hits commodities as Fed talks of tightening (Reuters)

The dollar was on its best run in almost a year on Thursday, pressuring commodities and shares after yet another Federal Reserve official talked up the chance of more than one hike in U.S interest rates this year.

If the dollar .DXY can keep its footing going into the long Easter weekend it will notch up a near 2 percent, and first weekly gain in a month against the world's other major currencies.

Credit Suisse Confusion on Costly Trades Adds to CEO's Woes (Bloomberg)

Credit Suisse Group AG Chief Executive Officer Tidjane Thiam dropped a bombshell on investors: Caught off guard by a buildup of illiquid trading positions, the CEO said the bank will probably post a second straight quarterly loss as it unwinds the trades and deepens cuts at that business.

'Helicopter Money' Won't Provide Much Extra Lift (Bloomberg View)

'Helicopter Money' Won't Provide Much Extra Lift (Bloomberg View)

Global central bankers' quest for unconventional ways to stimulate weak economies has generated a lot of excitement about "helicopter money," a policy that entails creating money and giving it directly to people or the government to spend.

The excitement seems unwarranted to me and misses the important point: The government has all the borrowing and spending power it needs to boost the economy and get inflation up to the desired level, if only it had the will.

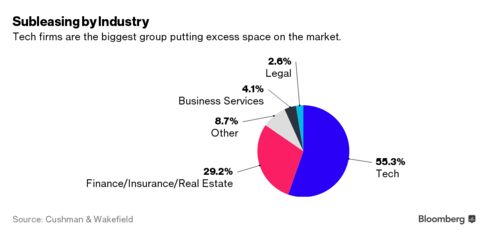

Tech Slowdown Seen in San Francisco's Commercial-Property Market (Bloomberg)

San Francisco’s commercial real estate market may be foretelling a slowdown in the city’s heated technology-driven economy.

Chinese Earnings Estimates Cut Most Among Major Asian Markets (Bloomberg)

Chinese companies listed in Shanghai and Hong Kong had their profit estimates cut the most among major Asian economies as the slowest growth in more than two decades erodes corporate earnings.

Why this stock-market rally is now looking exhausted (Market Watch)

Stocks have slipped for two straight days and look on track for their first weekly drop in six weeks.

Time to throw in the towel? Yes, actually, according to financial blogger Macro Man.

Mounting debts could derail China plans to cut steel, coal glut (Reuters)

China's campaign to slim down its bloated industries could be derailed by more than $1.5 trillion of debt in its steel, coal, cement and non-ferrous metal sectors, which threatens to overwhelm local banks.

Tackling industrial overcapacity has become a priority for Beijing to make its slowing economy more efficient and address a supply glut that has hammered coal and steel prices.

Here come durable goods … (Business Insider)

Here come durable goods … (Business Insider)

The preliminary data on durable goods orders during February are set for release at 8:30 a.m. ET.

Economists estimate that orders fell 3% compared to the prior month, according to Bloomberg.

Treasuries Hold Gains Before Durable Goods, Jobless Claims Data (Bloomberg)

Treasuries held gains from Wednesday before economic data that, based on analysts forecasts, may support the argument that the U.S. recovery is still not robust enough to withstand higher interest rates from the Federal Reserve.

Weaker Commodity Prices Drag Down Stocks (Wall Street Journal)

Global stocks extended losses Thursday ahead of the Easter holiday weekend, as a resurgent dollar and weaker commodities prices dented a recent rally.

3 Long-Term Consequences of Negative Rates (Bloomberg View)

3 Long-Term Consequences of Negative Rates (Bloomberg View)

Most economists are tempted to rely on incremental analysis to explain the spread of negative interest rates and their implications for the global economy and markets. This is understandable, yet the inclination to focus primarily on marginal changes could be overly partial and even misleading — especially for market participants who must navigate the unintended consequences of sub-zero yields, including the possibility of “tipping” events.

Leader of Valeant Investor Sequoia Resigns (Wall Street Journal)

The woes of Valeant Pharmaceuticals International Inc. claimed another casualty Wednesday as investing legend Robert Goldfarb stepped down from a mutual fund with a big stake in the drugmaker.

Futures are lower (Business Insider)

Stock futures are lower on the last trading day of this short week.

An Inside Look at Wall Street's Secret Client List (Bloomberg)

There’s a secret list that Citigroup Inc. keeps on its equity-research desk at its swank new campus in Tribeca.

Japanese Bonds Fall as BOJ Trims Size of Its Purchases Thursday (Bloomberg)

Japan’s long-term bonds fell, sending the 40-year security to it s biggest decline in almost two weeks, after the central bank reduced the size of a buying operation on Thursday.

Investors have bet more than £11 billion on Brexit crushing the pound (Business Insider)

Investors are putting billions of pounds worth of bets on the pound crashing should Britain vote to leave the European Union in June.

According to data compiled by Bloomberg, investors have piled up more than £11 billion ($15.5 billion) in currency options that would profit is the pound falls more than 4% after the UK's EU membership referendum on June 23rd.

Oil’s Decline Takes Toll on Saudi Conglomerate (Wall Street Journal)

A construction conglomerate at the center of Saudi Arabia’s petrodollar-fueled economic boom is teetering under billions of dollars of debt, bankers and financial advisers familiar with the matter said, showing the strain of cheap oil on the kingdom and its companies.

U.S. Futures Slide, Crude Under $39 As Dollar Rallies For Fifth Day (Zero Hedge)

Following yesterday's dollar spike which topped the longest rally in the greenback in one month, the prevailing trade overnight has been more of the same, and in the last session of this holiday shortened week we have seen the USD rise for the fifth consecutive day on concerns the suddenly hawkish Fed (at least as long as the S&P is above 2000) may hike sooner than expected, which in turn has pressured WTI below $39 earlier in the session, and leading to weakness across virtually all global risk assets.

SNB Spent $88 Billion on Interventions in Year of Cap Exit (Bloomberg)

The Swiss National Bank spent 86.1 billion francs ($88 billion) on interventions last year, a measure of its efforts to shield the economy from deflation.

Politics

Trump's tariff plan could boomerang, spark trade wars with China, Mexico (Reuters)

Donald Trump's threats to slap steep tariffs on Chinese and Mexican imports may have won him votes in Republican primaries but they would likely backfire, severely disrupting U.S. manufacturers that increasingly depend on global supply chains.

How Hillary Moved Trans Rights Forward (The Daily Beast)

How Hillary Moved Trans Rights Forward (The Daily Beast)

In 2011, a transgender woman working in the Illinois construction industry wrote an e-mail to then-Secretary of State Hillary Clinton (PDF).

“I have applied at well over 300 job openings since 2007,” she wrote. “I was able to get about a dozen interviews and as soon as they found out I was a transgender person, all bets were off.”

Technology

They said it couldn’t be done: Teaching robots good taste (Quartz)

They said it couldn’t be done: Teaching robots good taste (Quartz)

Can software have good taste?

Until recently, the idea that a few—or even many—lines of code could predict the music you’ll like even before you’ve heard it seemed impossible. You might have said it couldn’t be done. But entire companies, even industries, depend on that proposition, including Spotify, whose preference technology we explore in the season two debut of our podcast, Actuality.

Apple’s Recycling Robot Needs Your Help to Save the World (Wired)

Apple’s Recycling Robot Needs Your Help to Save the World (Wired)

Somewhere in a Cupertino warehouse, a giant labors with robotic precision, its 29 arms singularly focused on one thing: an iPhone. But instead of putting pieces together, this robot is pulling pieces apart. It disassembles iPhones at the rate of one handset every 11 seconds—less time than it takes you to fish your phone out of an overcrowded bag.

Health and Life Sciences

Increase In Older Patients Using Potentially Dangerous Drug Combinations (Forbes)

Increase In Older Patients Using Potentially Dangerous Drug Combinations (Forbes)

New research suggests that there’s been an increase in elderly adults using "potentially deadly combinations" of medications and dietary supplements. Researchers at the University of Illinois at Chicago concluded that one in six older adults now use combinations of both prescription and over-the-counter (OTC) medications, and dietary supplements that could ultimately lead to death, a two-fold increase over a five-year period. Identifying what study participants were actually taking by conducting in-home interviews, the researchers of the report analyzed the changes in medication use in older adults between the ages of 62 and 85.

Running on Vacation (NY Times)

On the second day of a recent two-week road trip, I woke up at a Holiday Inn off Interstate 95 in Santee, S.C., and drove to a nearby state park. I was in my fifth week of marathon training and needed to complete three miles, so why not do so in a new place I might never see again?

Is smoking pot the fix for the painkiller epidemic? (Futurity)

Is smoking pot the fix for the painkiller epidemic? (Futurity)

Patients who use medical marijuana to control chronic pain report a 64 percent reduction in their use of more traditional prescription pain medications known as opioids.

A study of 185 patients from a medical marijuana dispensary in Ann Arbor, Michigan also shows fewer side effects from their medications and a 45-percent improvement in quality of life since using cannabis to manage pain.

Life on the Home Planet

Belgium hunts 'third man' after Islamic State bombings (Reuters)

Belgian police were on Thursday hunting for a third man filmed with two Islamic State suicide bombers at Brussels airport as evidence piled up that the same jihadist network was involved in the deadly Paris attacks last November.

North Korea boasts successful test of new rocket engine (Market Watch)

North Korea boasts successful test of new rocket engine (Market Watch)

North Korea said it successfully tested a powerful new solid-fuel rocket engine, the latest in a series of announcements that appear intended to portray progress in its development of an advanced nuclear-tipped missile that could threaten the U.S. mainland.

Leader Kim Jong Un attended the test and said it would help “strike great horror and terror into the hearts of the enemies,” according to an account published by North Korea’s state news agency on Thursday. North Korea also released photos of Kim at the test but didn’t say when it happened.

Abandoned barges crash into bridge in China after heavy rainfall (The Telegraph)

Abandoned barges crash into bridge in China after heavy rainfall (The Telegraph)

Footage has emerged of two abandoned barges crashing into a bridge in China.

Captured in Shaoguan, Guangdong Province the video showed how water levels had suddenly risen from heavy rainfall.