Financial Markets and Economy

U.S. income inequality highest since the Great Depression (Journalist's Resource)

Income inequality in the United States has been a major flashpoint during the 2016 presidential election, with much debate focused on whether America is divided between “the 1 percent” who make up the wealthy elite and the lagging middle and working classes.

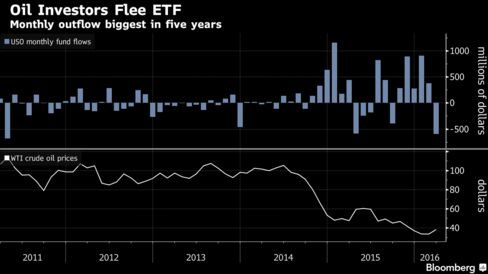

Oil Investors Pull Most Money Out of ETF in Five Years: Chart (Bloomberg)

Oil investors withdrew most money from the United States Oil Fund last month in almost five years, helping stall a rebound that pushed crude prices up by the most since April 2015. The biggest exchange-traded fund that tracks U.S.

Iceland's prime minister has resigned over secret investments revealed in the Panama Papers (Business Insider)

Iceland's prime minister, Sigmundur David Gunnlaugsson, has reportedly resigned over revelations contained in the Panama Papers that he and his wife hid millions of dollars worth of investments in an offshore shell company.

These 7 Stocks Prevented The Dow From Setting A New All-Time High (Forbes)

The Dow Jones Industrial Average began April at a new 2016 high of 17,792.75 with a day’s high of 17,811.48. The strong upward momentum since trading as low as 15,450.56 on Jan. 20 has the benchmark average up 2.1% year-to-date and up 15.2% from the low. This puts the Dow within 3% of its all-time high of 18,351.36 set on May 19.

Two US Labor Market Indexes Predict Slower Employment Growth (The Capital Spectator)

Job growth in March posted a solid gain, inspiring a new round of upbeatcomments on the outlook for US payrolls and the economy generally. But newly minted numbers for two multi-factor measures of the labor market hint at a weakening trend. In contrast with the upbeat message in the latest data for payrolls, broadly defined benchmarks of the labor market published yesterday by the Federal Reserve and the Conference Board (CB) reveal a worrisome round of deceleration unfolding in the first quarter.

U.S. Moves to Thwart Use of Foreign Inversions as Tax Dodge (NY Times)

The Treasury Department took new steps on Monday to further curtail a popular type of merger in which an American company buys a foreign counterpart, then moves abroad to lower its tax bill.

Three Investment Firms Downgraded This Gunmaker and Its Shares Are in Freefall (Fortune)

Consumers bought so many guns in past quarters that Smith and Wesson will see demand slow in this quarter.

Fund Chief Survives Oil’s Swings (Wall Street Journal)

A day after oil prices plunged to a 13-year low in January, Pierre Andurand, a French hedge-fund manager who made millions betting against crude, started buying.

Europe's major economies mark disappointing end to first quarter (Reuters)

Europe's major economies ended the first quarter on a sour note, with lackluster growth in nearly all key business surveys, as jitters about a global slowdown and fears Britons may vote to leave the European Union weighed on demand.

Kuwait Says Oil Producers Can Reach Output Freeze Without Iran (Business Insider)

The Organization of Petroleum Exporting Countries and other major oil producing countries can reach an agreement for a production freeze, even if Iran doesn’t join the action meant to help shore up prices, according to Kuwait’s OPEC governor.

What Do Share Buybacks Really Tell Us About the Stock Market (A Wealth of Common Sense)

Chief executive officers, who just announced the biggest round of monthly repurchases ever, executed about $550 billion of buybacks last year, according to data compiled by S&P Dow Jones Indices. That compares with a net $85 billion of deposits by customers of mutual and exchange-traded funds, the biggest gap since 2012, data compiled by Bloomberg and Investment Company Institute show.

Puerto Rico Bonds Plunge After Senate Passes Debt Moratorium Bill (Zero Hedge)

The ongoing feud between Puerto Rico and its mostly hedge fund creditors is promptly shaping up as the next "Argentina", where "vulture investors" may well end up holding the island commonwealth hostage for years, during which time, however, they won't get paid.

Simple vs Complex (The Reformed Broker)

It’s been said that everyone has the right to have that one topic that they are utterly unreasonable about. That one subject where no matter what anyone says, they are so sure they’re right that it’s a waste of time even trying to talk them out of it.

The Future of Money (Of Two Minds)

The cartels and state organs are frantically trying to co-opt, outlaw, corral or control this disruptive technology.

S&P Erases "Great" Jobs Bounce As Bonds Surge (Zero Hedge)

What goes up (for no good reason) must come down (for fundamental and earnings-driven reality)…]

The Surging Yen (Crossing Wall Street)

After being week for a long time, the Japanese yen is rallying. It just hit a 17-month high.

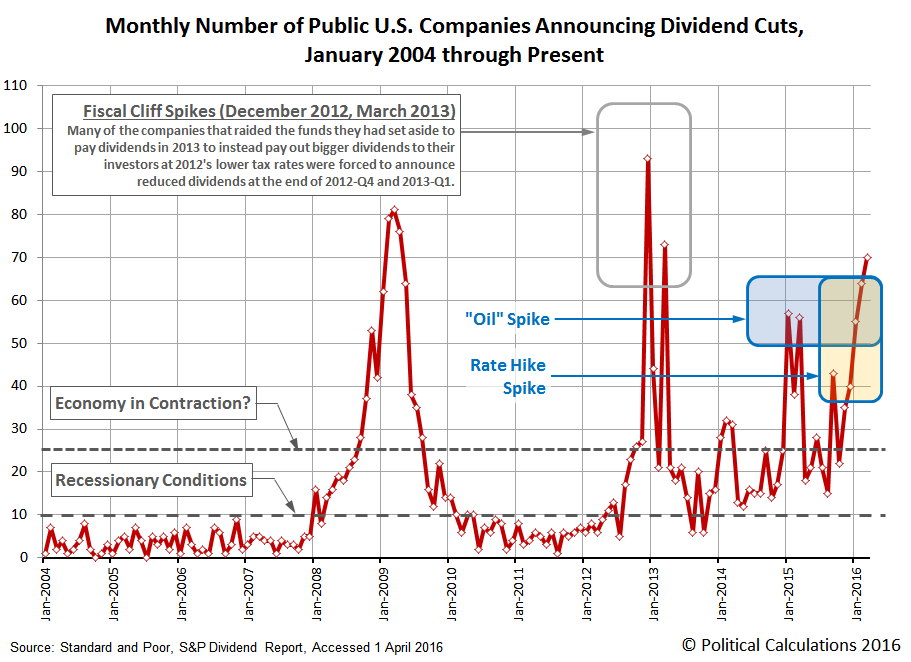

The Worst Quarter for Dividends Since the Great Recession (Political Calculation)

In the first quarter of 2016, 189 U.S. firms announced that they would be cutting their dividend payments to their shareholders, making it the worst quarter for dividend cuts since the first quarter of 2009, which saw 222 firms reduce their dividends as the U.S. stock market reached its bottom during the Great Recession.

Ackman's Horror Week Gets Worse as Valeant Fall Threatens Rating (Bloomberg)

Bill Ackman’s bad week just keeps getting worse.

Politics

“This is the day we take our country back.” – Donald Trump, February 1, 2016

The “take our country back” slogan first emerged with the Tea Party movement in 2009. It was never quite clear what that meant. Where did the country go? Who took it there? How do we take it back? These questions were never asked. The slogan itself implied the answers.

Democrats Are Much More Confident In The Economy Than Republicans (Wall Street Journal)

A deep partisan gap divides Americans when it comes to the economy.

Hillary Clinton is fundamentally honest (The Guardian)

Hillary Clinton is fundamentally honest (The Guardian)

It’s impossible to miss the “Hillary for Prison” signs at Trump rallies. At one of the Democratic debates, the moderator asked Hillary Clinton whether she would drop out of the race if she were indicted over her private email server. “Oh for goodness – that is not going to happen,” she said. “I’m not even going to answer that question.”

Technology

Samsung patents smart contact lenses with a built-in camera (Mashable)

Samsung patents smart contact lenses with a built-in camera (Mashable)

In the future, we could all be wearing smart contact lenses, like the ones secret agents use in movies.

Samsung has been granted a patent in South Korea for contact lenses with a display that projects images directly into wearer's eyes, according to the Samsung-focused blogSamMobile. A built-in camera and sensors are controlled by blinking.

5.jpg) This 351-foot concept superyacht has a waterfall, 360-degree glass elevator, and two pools (Business Insider)

This 351-foot concept superyacht has a waterfall, 360-degree glass elevator, and two pools (Business Insider)

The Stiletto is not your average superyacht.

Instead, it's a 351-foot floating slice of paradise. Right now, it's just a concept design by Netherlands-based yacht buildersOceanco, but if built, it would rank among the largest yachts in the world.

Health and Life Sciences

New Study Shows Chocolate Improves Brain Function (Eater)

New Study Shows Chocolate Improves Brain Function (Eater)

It may only be Tuesday but the good news is already rolling in — at least for chocolate lovers. According to data gathered from the sixth part of the Maine-Syracuse Longitudinal Study earlier this month, consumption of chocolate is positively associated with cognitive brain function.

Artificial Heart Muscles One Step Closer With Cheap, Robust Silicone Elastomer And Carbon Nanotubes (Forbes)

Batman v Superman: Dawn of Justice’ is one of the most hotly anticipated movies of 2016. While I am yet to see it, I am hoping that the movie stays true to the Frank Miller comics that I have seen in my quest for Superhero Science – superpowers that can become a reality with a little materials science and engineering. In The Dark Knight Returns, Batman wears an exoframe that gives him more power and strength than his body could normally allow. This could well be down to artificial muscles – materials that can be embedded into the fabric of the suit that rapidly contract on the application of a current or heat, potentially allowing the wearer to jump higher and run faster.

Neuroscience Learns What Buddhism Has Known for Ages: There Is No Constant Self (The Daily Good)

Proving that science and religion can, in fact, overlap, University of British Columbia researcher Evan Thompson has confirmed the Buddhist teaching of the not-self, or “anatta,” is more than just a theory.

Life on the Home Planet

Climate Change Could Wipe Out Up To $25 Trillion Worldwide (Forbes)

Climate Change Could Wipe Out Up To $25 Trillion Worldwide (Forbes)

For years now, concern has been growing among investors that the regulatory response to climate change poses a threat to some of the world’s biggest companies and their assets, particularly fossil fuels that have yet to be pulled from the ground. But a new study suggests that the impacts of climate change put up to $25 trillion worth of other assets at risk.